North Carolina Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act

Description

How to fill out Designation Of Successor Custodian By Donor Pursuant To The Uniform Transfers To Minors Act?

US Legal Forms - one of the most important collections of legal templates in the USA - offers a range of legal document formats you can download or print. By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest forms like the North Carolina Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act in just a few minutes.

If you already have a subscription, Log In and retrieve North Carolina Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get you started: Ensure you have selected the correct form for the city/area. Click on the Review button to examine the form’s details. Read the form description to ensure you have chosen the right form. If the form does not meet your requirements, use the Lookup field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select your preferred pricing plan and provide your credentials to register for an account. Complete the transaction. Use a credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded North Carolina Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the North Carolina Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act with US Legal Forms, one of the largest collections of legal document formats.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

Form popularity

FAQ

If appointing a new custodian, the signature of the previous custodian, a death certificate, or an official court document must be provided. If the former minor's legal name has changed, please provide the previous and new names where indicated.

If a donor acting as the custodian dies before the account terminates, the account value will be included in the donor's estate for estate tax purposes. If a minor dies before the age of majority, a custodial account is considered part of the minor's estate and is distributed ing to state law.

A custodian must open the account and manage the assets on behalf of the minor, but the assets in the account are the property of the minor. Custodians are typically parents, but technically can be anyone. Only one custodian and minor are allowed per custodial account.

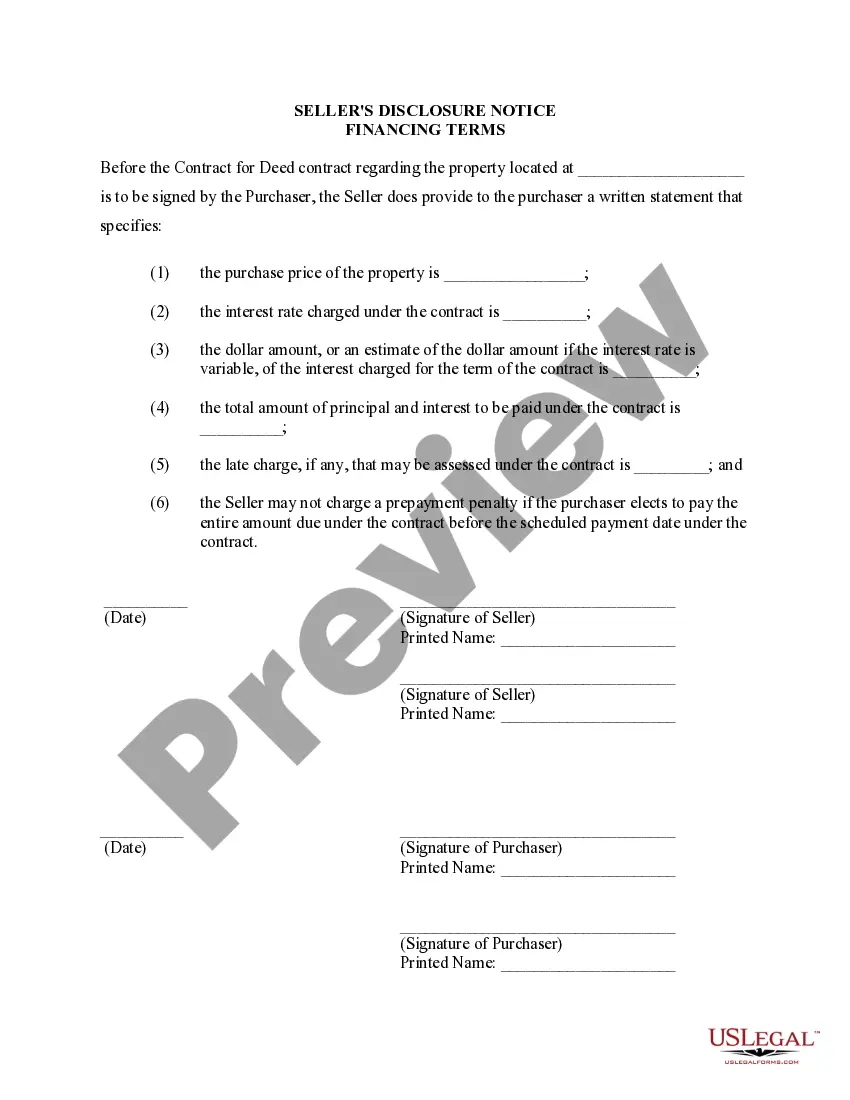

Form used to designate a successor custodian for either an UGMA or UTMA account in the event that the original custodian resigns, dies, is incapacitated or is removed as custodian.

Only one custodian, one beneficiary (i.e., minor) and one successor custodian* can be assigned to an account. *A successor custodian is highly recommended in case of custodian's death.

The custodian is responsible for managing the UTMA account and any of its investments, similar to how a trustee manages a trust. The custodian can be the donor (the person who opened or donated to the account), another adult (like a grandparent), or a financial institution.

Multiple custodians provide firms with more opportunities and allow them to serve a larger share of the market. Because custodians' focus varies from institution to institution, RIA firms can offer more flexibility for their clients and thereby better meet the client's specific needs.

If a donor acting as the custodian dies before the account terminates, the account value will be included in the donor's estate for estate tax purposes. If a minor dies before the age of majority, a custodial account is considered part of the minor's estate and is distributed ing to state law.

Under the laws that govern custodial accounts, including the Uniform Transfers to Minors Act (UTMA), account custodianship ends and the beneficiary becomes eligible to assume control of the account at a specified age?typically 18 or 21, depending on the state.

Anyone can contribute to a UTMA account, but their contribution is considered an irrevocable gift. This means only the custodian has the right to withdraw funds, and it has to be for the child's benefit. The custodian has a fiduciary duty to act in the child's best interest.