North Dakota Job Invoice - Short

Description

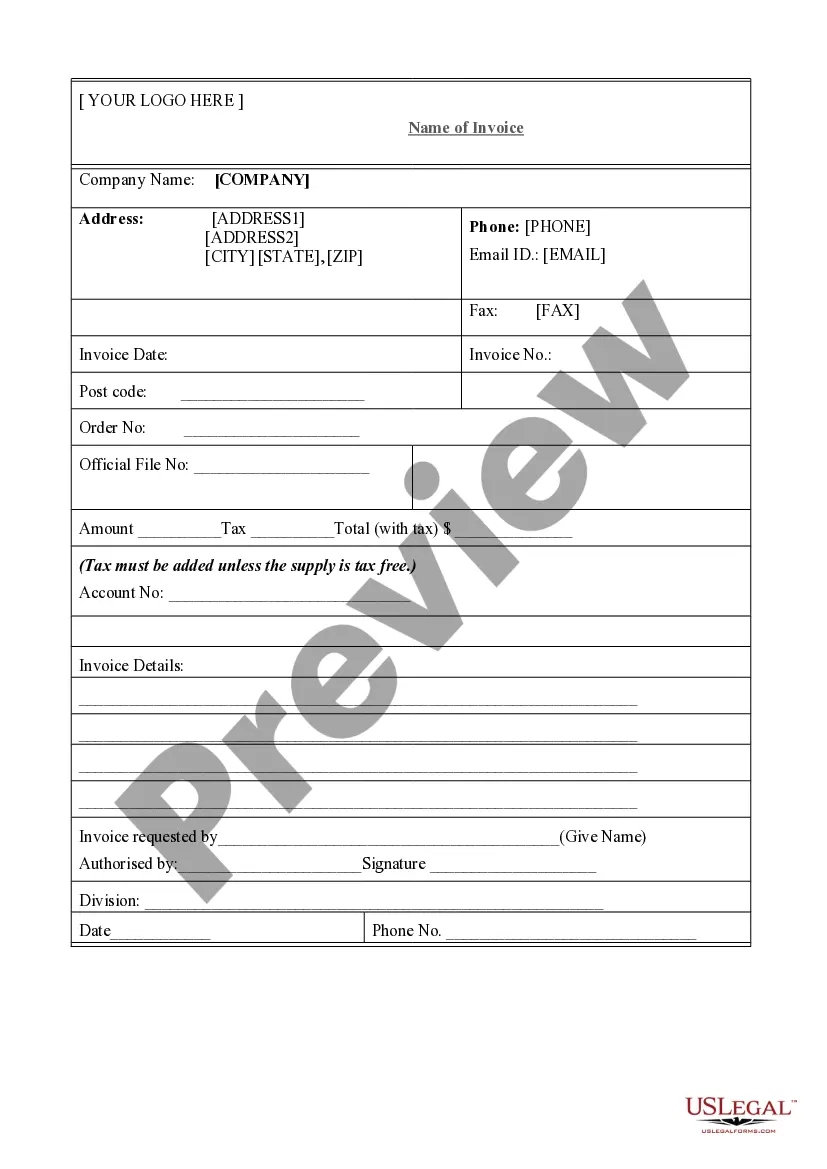

How to fill out Job Invoice - Short?

Are you in a situation where you may require documents for potential organizational or personal purposes almost every time.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms provides thousands of form templates, such as the North Dakota Job Invoice - Short, designed to comply with federal and state regulations.

Once you find the correct form, click on Buy now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and finalize the purchase using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Dakota Job Invoice - Short template.

- If you do not have an account yet and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct town/area.

- Use the Preview button to examine the form.

- Check the description to verify that you have selected the correct form.

- If the form isn't what you're searching for, utilize the Research field to find the form that suits your needs.

Form popularity

FAQ

In North Dakota, the amount of tax deducted from your paycheck depends on your income level and withholding allowances. State income tax rates range from 1.10% to 2.90%. Federal taxes and social security also contribute to the total deductions. Using a North Dakota Job Invoice - Short can help you keep track of how much tax has been deducted from your earnings over time.

The self-employment tax in North Dakota is generally the same as the federal rate, which is currently 15.3%. This tax covers Social Security and Medicare contributions. Self-employed individuals must report their income accurately to ensure they remit the correct amounts. You can rely on the North Dakota Job Invoice - Short to document your earnings efficiently.

To create an invoice for free, build your own invoice using Microsoft Word, Microsoft Excel or Google Docs. You can use a premade invoice template offered by the program you choose, or you can create your own invoice from scratch.

In basic terms, an invoice is a bill sent to your customers after you complete a job or visit. The invoice establishes what services you or your company provided, how much is due and when, and how your customer can pay. Legally speaking, an invoice creates an account receivable.

Main steps to follow when preparing an invoiceOpen your invoice template.Add the date.Enter the invoice number.Fill out the customer name, address, reference and/or order number.Enter a description of the goods or services you provided.Total the costs and double-check your math.More items...

How to Fill out an Invoice Professional Invoicing ChecklistThe name and contact details of your business.The client's contact information.A unique invoice number.An itemized summary of the services provided.Specific payment terms.The invoice due date.The total amount owing on the invoice.

5 ideas for your invoice thank you messageAdd a thank you note and give a discount in your invoice footer message.Ensure your invoice thank you message is prominent.Offer a freebie as a gesture of gratitude.Invite customers to provide feedback.Show the value they're getting from your business.

Your invoices should always include your name and/or your company name. Also, don't forget to include your business address, and preferably your business email and phone number. Make it easy for the recipient of the invoice to get in touch with you just in case they have questions or need clarification.

How to Write a ReceiptAdd in your company details (name, address) in From section.Fill out client details (name, email, address) in For section.Write out line items with description, rate and quantity.Finish with the date, invoice number and your personalized brand.More items...

What should be included in an invoice?1. ' Invoice'A unique invoice number.Your company name and address.The company name and address of the customer.A description of the goods/services.The date of supply.The date of the invoice.The amount of the individual goods or services to be paid.More items...?02-Nov-2020