North Dakota Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

If you aim to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and convenient search function to locate the documents you need.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have located the necessary form, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the North Dakota Agreement to Sell Partnership Interest to Third Party with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Obtain option to find the North Dakota Agreement to Sell Partnership Interest to Third Party.

- Additionally, you can access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

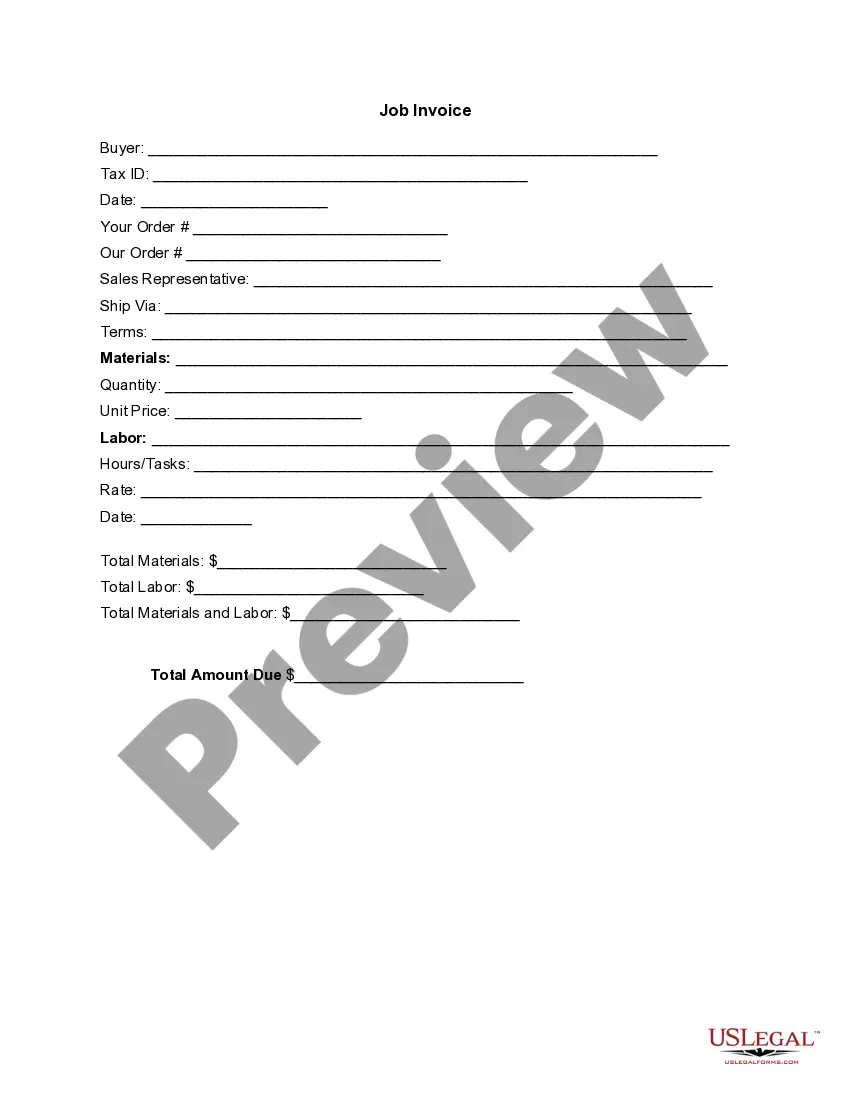

- Step 2. Use the Preview option to review the form's content. Remember to check the description.

- Step 3. If you are unsatisfied with the template, utilize the Search box at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

To account for the sale of partnership interest, you should record the transaction in the partnership's financial statements. This includes adjusting the capital accounts for both the selling and purchasing partners based on the sale terms. Using a North Dakota Agreement to Sell Partnership Interest to Third Party ensures the transaction is properly documented and compliant with legal standards.

Generally, the limited partners receive an ownership interest in exchange for providing capital (either funds or physical resources) to the limited partnership; while the general partner generally receives an ownership interest for either capital or labor provided to the limited partnership.

The gift of a partnership interest generally does not result in the recognition of gain or loss by the donor or the donee. A gift is, however, subject to gift tax unless the gift qualifies for the annual gift tax exclusion or reduces the donor's lifetime gift tax applicable exclusion amount.

Yes, you can have a partner with 0% interest. There are no federal guidelines for the establishment of partnerships and therefore no minimum interest amount that a partner can have in a company.

The percentage of ownership usually determines how partners agree to split profits and debts, which should also be included in the agreement. A partner must have an interest that is greater than zero to be included in the company, but beyond that, there are no minimum restrictions.

(a) A limited partner's interest in the partnership is personal property and is assignable. (b) A substituted limited partner is a person admitted to all the rights of a limited partner who has died or has assigned his interest in a partnership.

A partner can transfer his interest so as to substitute the transferee in his place as the partner, without the consent of all the other partners; a member of company cannot transfer his share to any one he likes.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

To have a general partnership, two conditions must be true: The company must have two or more owners. All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

A general partner is a part-owner of a partnership business and is involved with its operations and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.