West Virginia Demand for Account - Individual

About this form

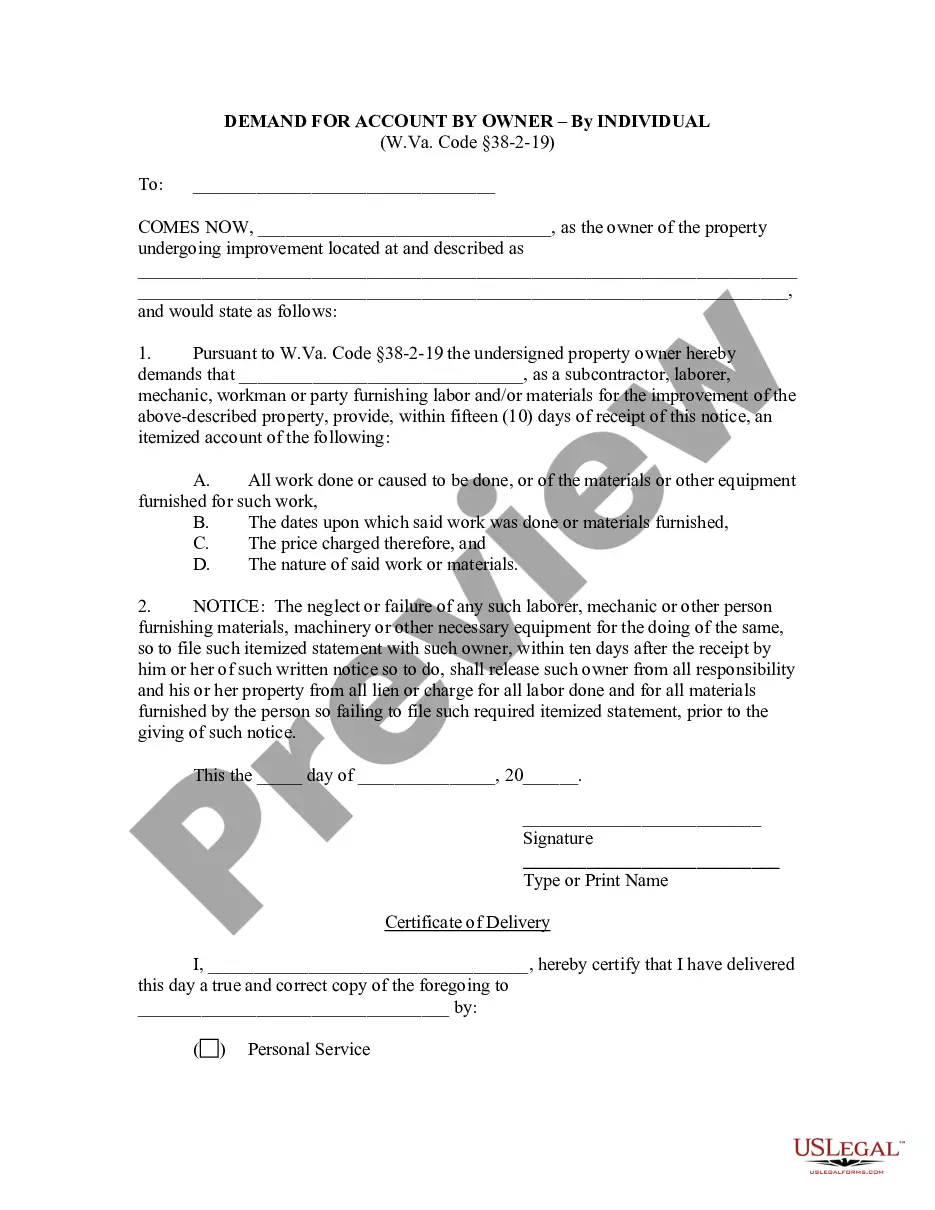

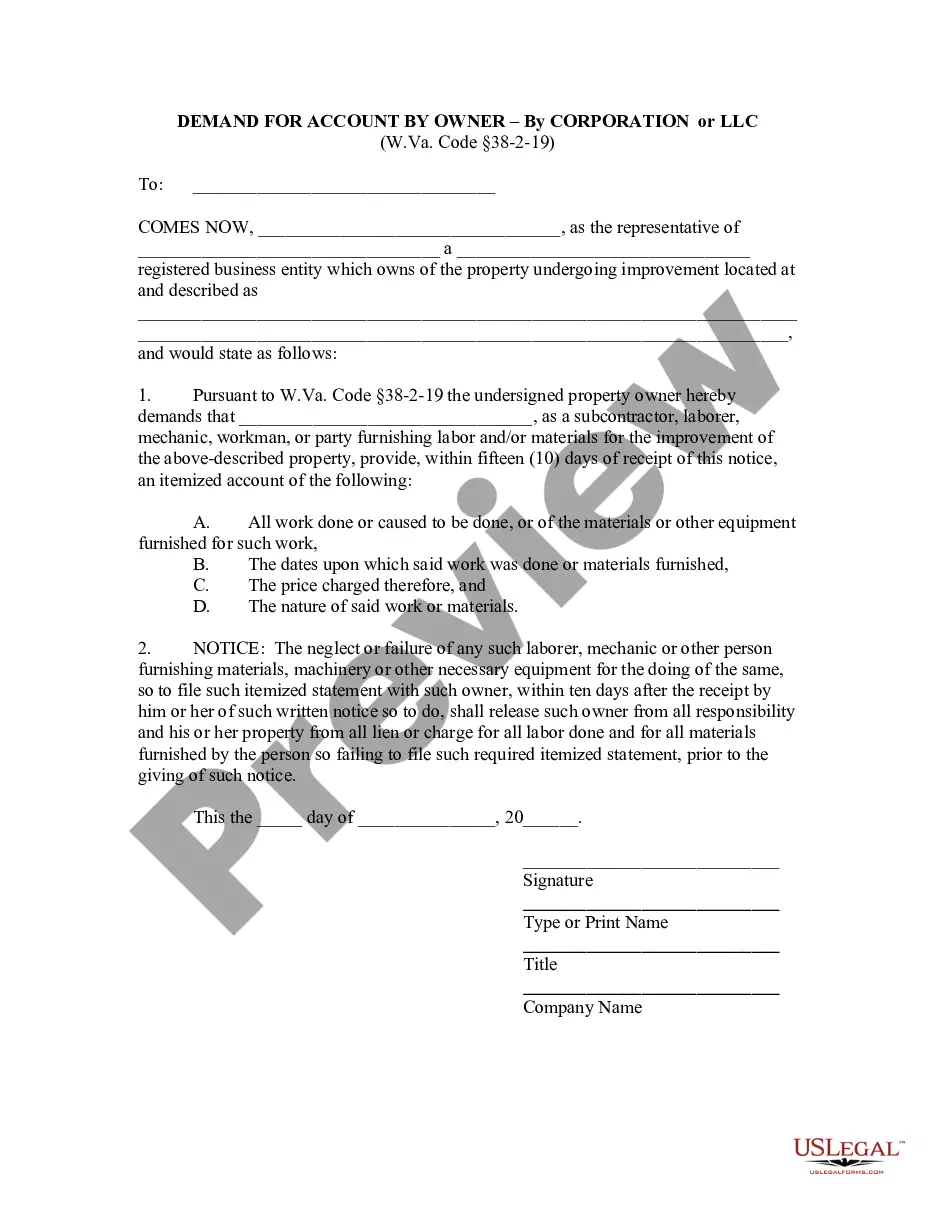

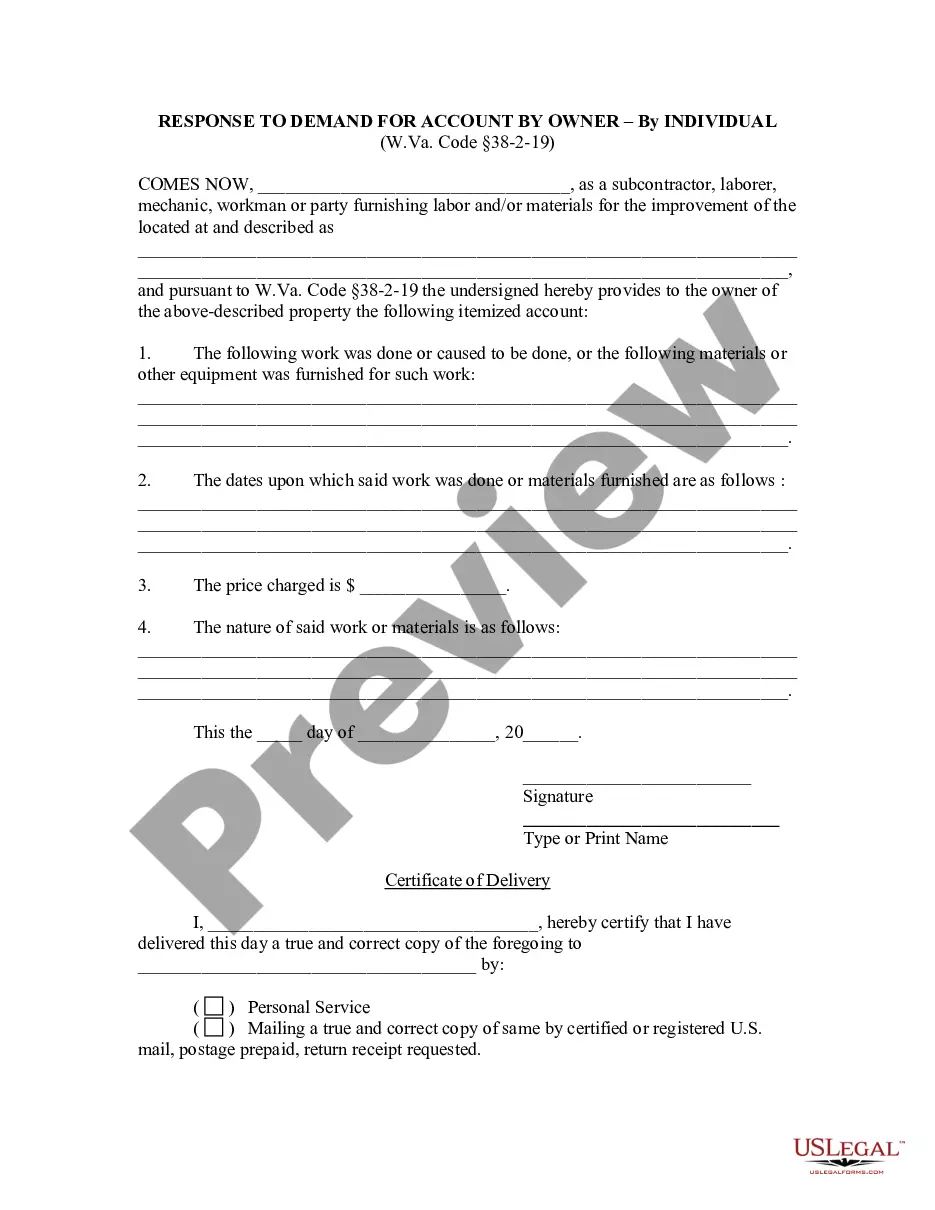

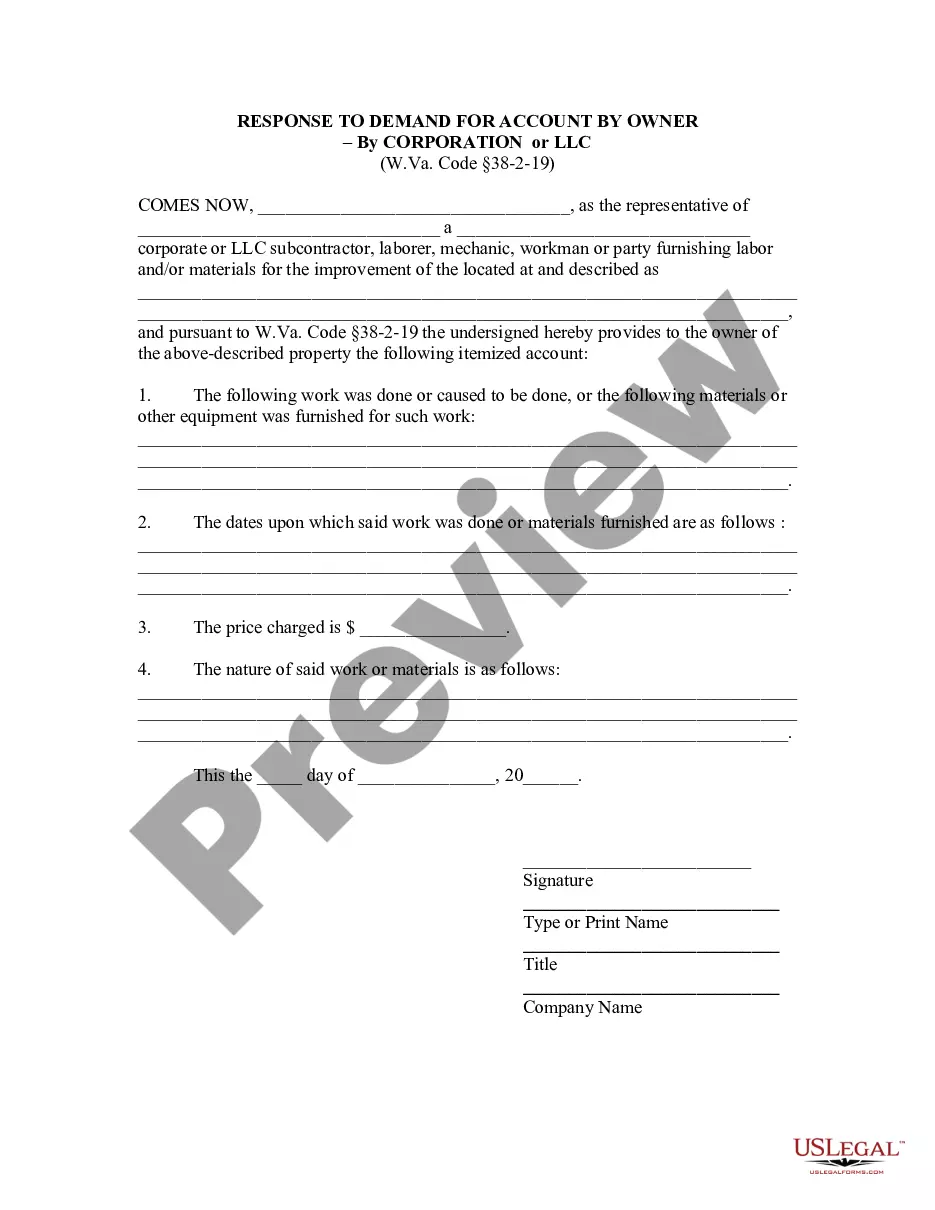

This Demand for Account - Individual form is a legal document that allows property owners to formally request an itemized account from subcontractors, laborers, or others who have provided labor and materials for improvements to their property. This document is specifically designed to ensure that property owners can obtain clear and detailed information about work performed and materials used, delineating costs and remaining work. It differs from other demand forms by focusing on the detailed accounting of services rendered rather than a general request for payment.

What’s included in this form

- Identification of the property owner and the property undergoing improvement.

- Request for an itemized account of work done and materials furnished.

- Specification of deadlines for response (within fifteen days of notice receipt).

- Consequences of non-compliance, including potential release from lien responsibilities.

- Signature section for the property owner and a certificate of delivery.

Common use cases

This form is typically used when a property owner needs to formally demand a detailed account from any subcontractor, mechanic, or laborer who has contributed to a property improvement. It is relevant in situations where there may be disputes about work quality, terms of agreement, or if the owner requires clarity before making any remaining payments. Using this form helps protect the owner's rights regarding liens on the property.

Who needs this form

- Property owners seeking clarity and accountability from contractors or laborers.

- Individuals involved in property improvements, renovations, or repairs.

- Homeowners concerned about potential lien claims from unpaid labor or materials.

How to complete this form

- Identify the parties involved, including your name and the name of the subcontractor or laborer.

- Specify the property location, including a physical address and a brief description of the property.

- Fill in the date the demand is being made.

- Clearly articulate the work done and materials used by filling in the required details as specified in the form.

- Sign and date the document, and ensure that you have a method for delivering it to the designated party.

Notarization requirements for this form

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to deliver the demand within the stipulated time period (fifteen days).

- Not including all necessary details about the work performed or materials supplied.

- Neglecting to sign and date the document before submission.

- Assuming verbal communication suffices instead of delivering the formal written demand.

Benefits of completing this form online

- Convenient access to a legally valid template that can be easily filled out and customized.

- Editable format allows for quick adjustments or updates as needed.

- Reliable, attorney-drafted content ensures compliance with current legal standards.

Looking for another form?

Form popularity

FAQ

You are considered a resident of West Virginia if you spend more than 30 days in West Virginia with the intent of West Virginia becoming your permanent residence, or if you are a domiciliary resident of Pennsylvania or Virginia and you maintain a physical presence in West Virginia for more than 183 days of the taxable

Payments may be submitted electronically at https://mytaxes.wvtax.gov/. No tax lien will be filed on a payment plan of six months or less, unless there is a default on the plan. What if I can't pay the full amount of personal income tax due in just six months?

Business Licenses The state of West Virginia doesn't have a general business license; however, many cities require a business license to operate.Zoning Before starting to operate a business (even if it's home-based), be sure to check local zoning regulations before starting to operate out of a location.

Resident -- A person who lives in Virginia, or maintains a place of abode here, for more than 183 days during the year, or who is a legal (domiciliary) resident of the Commonwealth, is considered a Virginia resident for income tax purposes.

Many states require that residents spend at least 183 days or more in a state to claim they live there for income tax purposes. In other words, simply changing your driver's license and opening a bank account in another state isn't enough. You'll need to actually live there to claim residency come tax season.

Business Licenses The state of West Virginia doesn't have a general business license; however, many cities require a business license to operate.While this isn't a license on the business, licensing is required in order to operate.

New Applicants, Transfers, and Expired License Applicants are required to provide one proof of identity, one proof of Social Security number, two proofs of WV residency with name and physical address, and proof of legal name change document(s) if your name has ever changed.

You are considered a resident of West Virginia if you spend more than 30 days in West Virginia with the intent of West Virginia becoming your permanent residence, or if you are a domiciliary resident of Pennsylvania or Virginia and you maintain a physical presence in West Virginia for more than 183 days of the taxable

West Virginia domicile may be established upon the completion of at least twelve (12) months of continued presence within the state prior to the date of registration: Provided, That such twelve (12) months' presence is not primarily for the purpose of attendance at any institution of higher education in West Virginia.