North Dakota Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

If you wish to compile, acquire, or generate sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the site’s user-friendly and efficient search feature to find the paperwork you need.

A selection of templates for commercial and personal purposes are categorized by type and jurisdiction, or keywords. Utilize US Legal Forms to locate the North Dakota Agreement to Sell Real Property Owned by Partnership to One of the Partners with just a few clicks.

Step 6. Choose the format of your legal document and download it to your device.

Be proactive and download, and print the North Dakota Agreement to Sell Real Property Owned by Partnership to One of the Partners using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the North Dakota Agreement to Sell Real Property Owned by Partnership to One of the Partners.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following steps.

- Step 1. Ensure you have selected the document for your specific city/state.

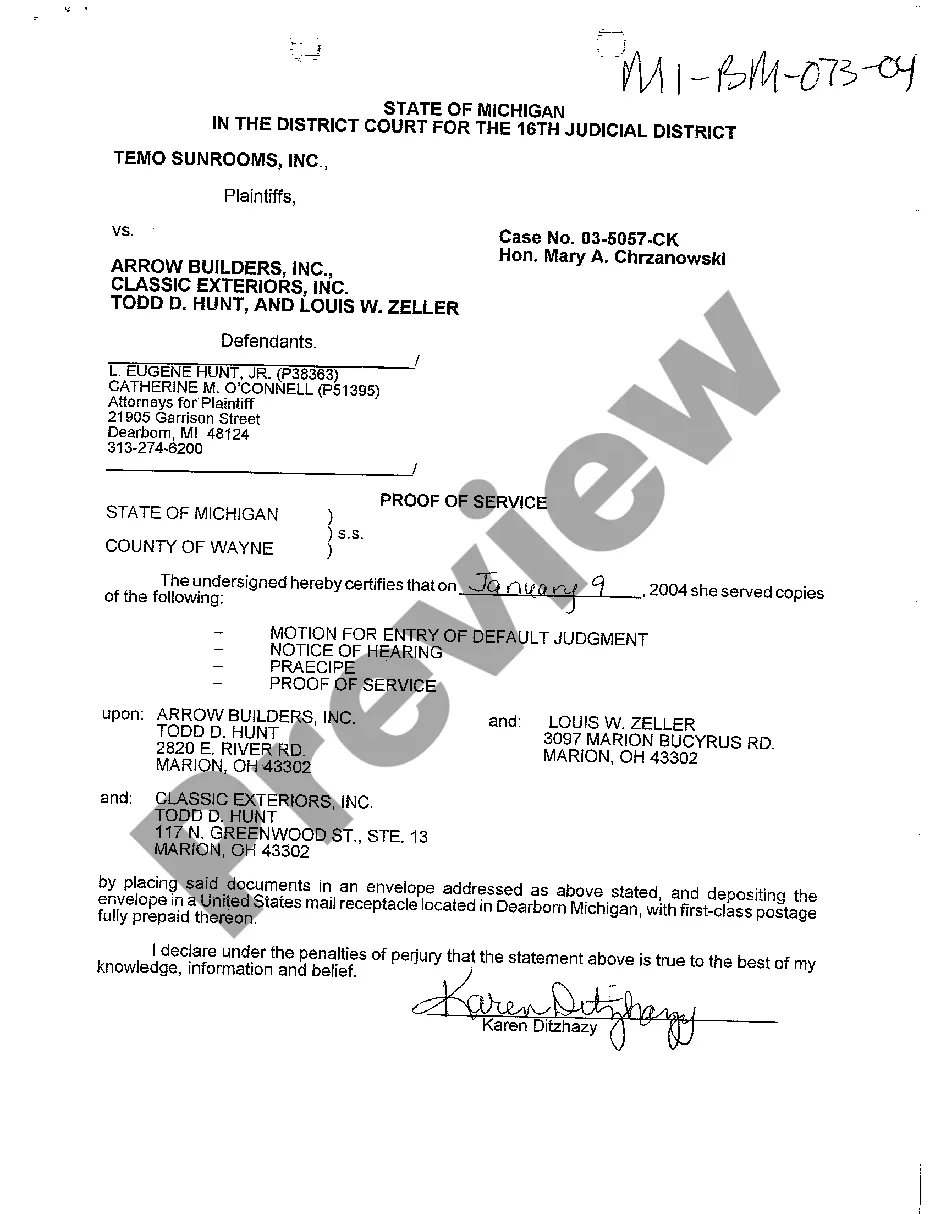

- Step 2. Use the Review option to examine the document's content. Do not forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find other versions of the legal document template.

- Step 4. Once you have located the form you need, click the Purchase now option. Choose the pricing plan you prefer and provide your details to create an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

In North Dakota, non-resident partners face withholding tax on income derived from partnerships operating in the state. The current withholding rate is typically based on the income share allocated to the non-resident partner. Establishing clear terms in a North Dakota Agreement to Sell Real Property Owned by Partnership to One of the Partners can help address these withholding requirements proactively.

A partnership agreement is a contract between all parties involved in starting a partnership structured business. The contract covers the rights & responsibilities of each partner.

In general, a partnership can be described as a type of business structure wherein two or more individuals contribute their skills, resources, property, and/or money to establish a business for profit. Despite being a business entity, a partnership is permitted to own property as if it were an individual person.

A partnership agreement is an internal business contract that outlines specific business practices for the partners of a company. This document helps establish rules for how the partners will manage business responsibilities, ownership and investments, profits and losses, and company management.

Partnership a contract whereby two or more persons bind themselves to contribute money, property or industry to a common fund, with the intention of dividing the profits among themselves, or in order to exercise profession.

In general, partnership property consists of all the property contributed by the partners or acquired for the partnership with its funds. A partnership may own real property as well as personal property. Partners hold title to partnership property by tenancy in partnership or tenants in common.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

Yes, assets can be acquired by the partnership.

Every state has variations regarding the Uniform Partnership Act. A partnership constitution allows your business tailors its standards and operations fit the company. Your agreement should cover areas like business control and investment liability to be considered valid and legal.

According to section 15, the partnership property should be held and used exclusively for the purpose of the firm. While all partners have a community of interest in the property, during the subsistence of the partnership no partner has a proprietary interest in the assets of the firm.