North Dakota LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

It is feasible to spend hours online searching for the legal document template that complies with the state and federal stipulations you require.

US Legal Forms offers a vast array of legal forms that are evaluated by experts.

You can effortlessly download or print the North Dakota LLC Operating Agreement for Husband and Wife through my service.

If you would like to find another version of the form, make use of the Search field to locate the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you can complete, amend, print, or sign the North Dakota LLC Operating Agreement for Husband and Wife.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the state/city of your choice. Review the document outline to confirm you have chosen the appropriate form.

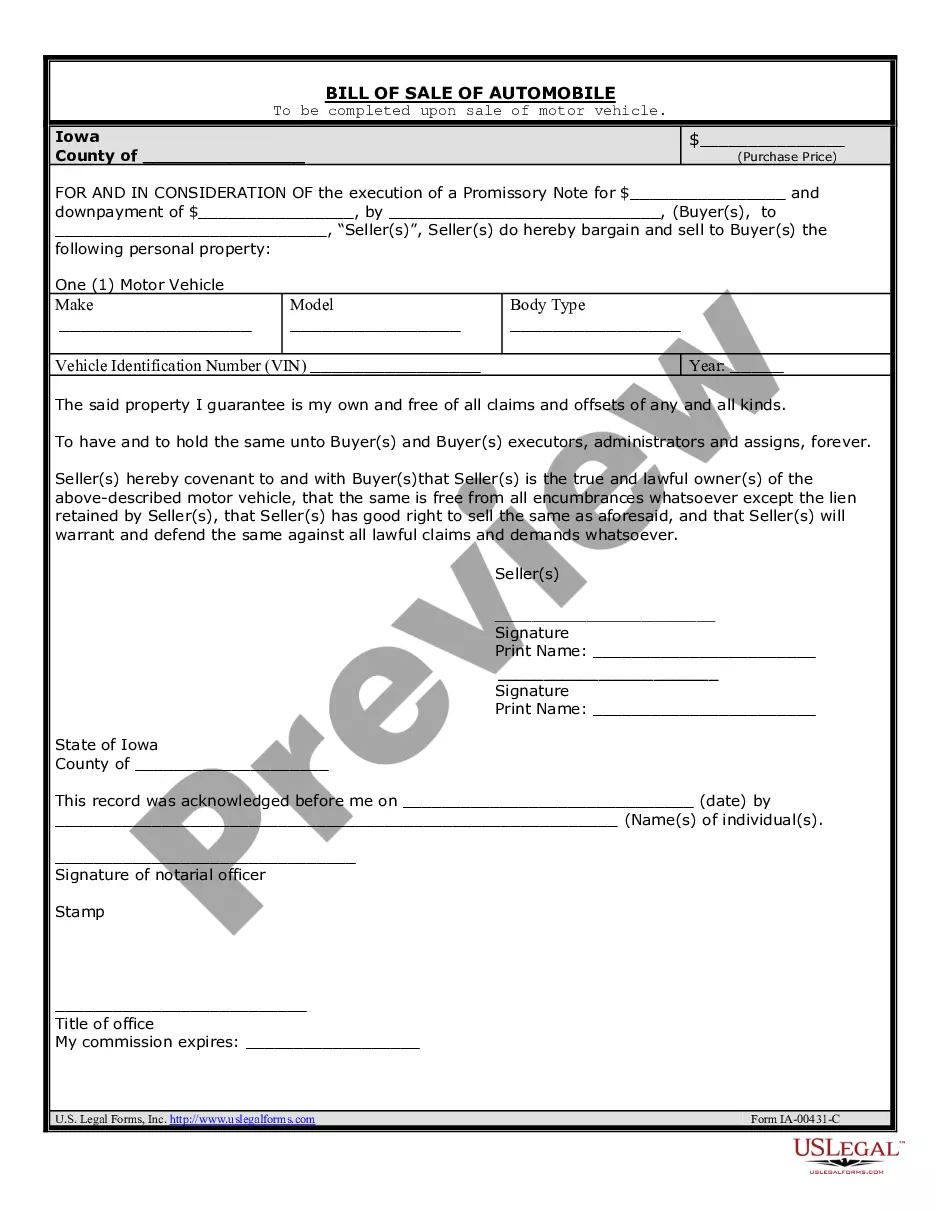

- If available, utilize the Review option to examine the document template as well.

Form popularity

FAQ

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

Percentages of Ownership In return, each LLC member gets a percentage of ownership in the assets of the LLC. Members usually receive ownership percentages in proportion to their contributions of capital, but LLC members are free to divide up ownership in any way they wish.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

10 Must Haves in an LLC Operating Agreement Member Financial Interest. What percentage ownership does each member have? Corporate Governance. Corporate Officer's Power and Compensation. Non-Compete. Books and Records Audit. Arbitration/Forum Selection. Departure of Members. Fiduciary duties.More items...

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.