Florida Promissory Note with Installment Payments

Description

How to fill out Promissory Note With Installment Payments?

If you intend to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the biggest assortment of authentic forms available online.

Use the site's user-friendly and efficient search to locate the documents you require.

Different templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

Step 6. Retrieve the format of the authentic form and download it onto your device. Step 7. Complete, modify, and print or sign the Florida Promissory Note with Installment Payments. Every authentic document template you download is yours indefinitely. You can access every form you acquired in your account. Click the My documents section and choose a form to print or download again. Finalize and download, and print the Florida Promissory Note with Installment Payments with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to secure the Florida Promissory Note with Installment Payments in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and then click the Obtain button to access the Florida Promissory Note with Installment Payments.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, please refer to the steps below.

- Step 1. Ensure you have selected the form suitable for your specific city/state.

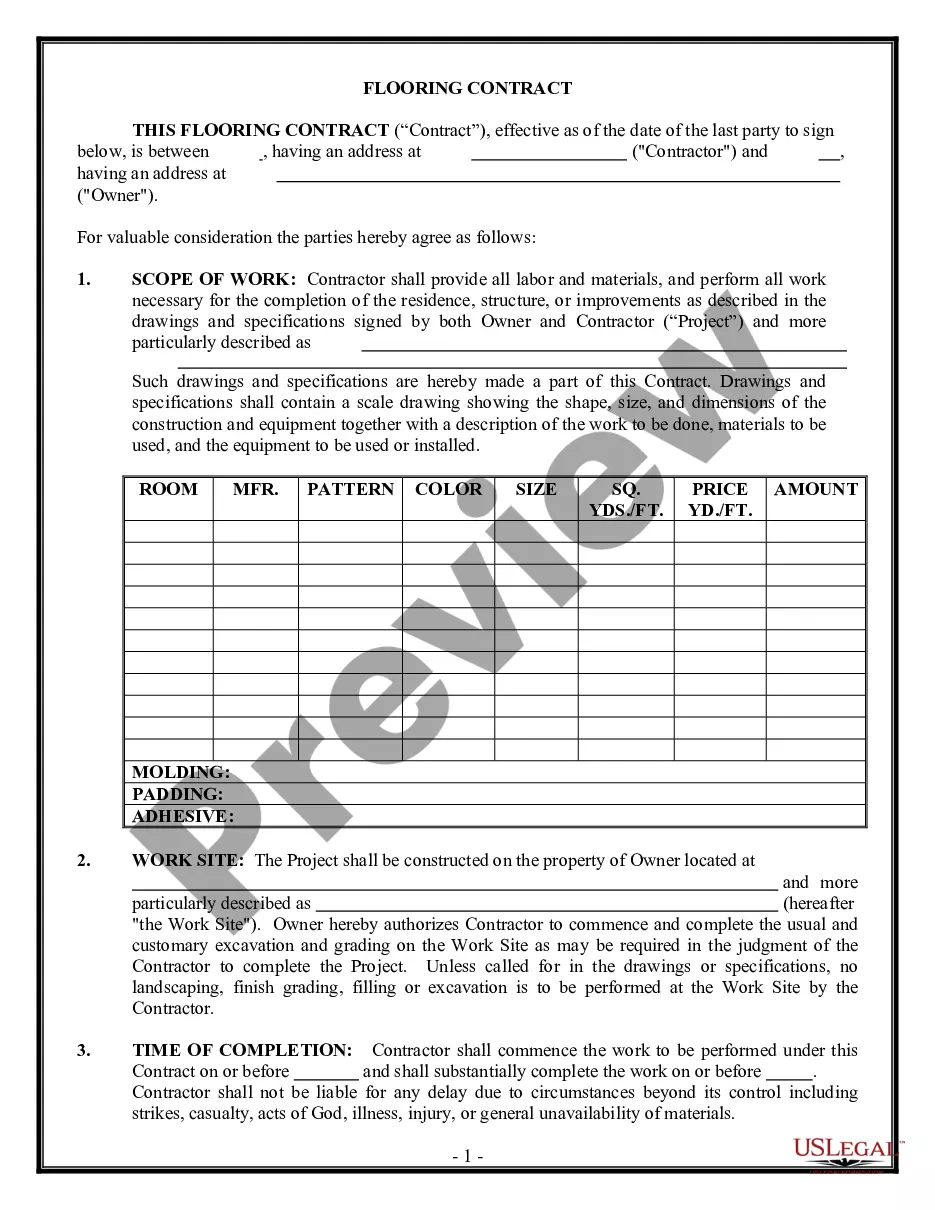

- Step 2. Utilize the Review option to examine the form's content. Remember to read through the summary.

- Step 3. If you are unsatisfied with the form, make use of the Search field at the top of the screen to find other versions of the authentic form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

The primary purpose of a promissory note is to establish a legal obligation for the borrower to repay the lender. By using a Florida Promissory Note with Installment Payments, you create a structured plan for repayment, which can benefit both parties by providing clear terms. This document serves as a record and can be enforced in court if necessary, offering peace of mind for both sides.

Yes, a promissory note is enforceable in Florida as long as it meets specific criteria. The Florida Promissory Note with Installment Payments must include clear terms, such as the amount borrowed, the payment schedule, and the interest rate if applicable. Additionally, it should be signed by both parties to establish a legally binding agreement. For assistance in drafting a promissory note, consider using the US Legal Forms platform, which offers templates tailored to Florida's laws.

A promissory note in Florida is valid when it contains clear terms, includes both parties' signatures, and defines the repayment plan. Additionally, the note must not involve illegal activities and should meet all state legal requirements. By following these guidelines, you can ensure your Florida Promissory Note with Installment Payments stands up in court.

In Florida, a promissory note can be invalid if it does not meet state requirements, such as missing essential information or signatures. Moreover, if the terms are ambiguous or the agreement involves illegal activities, it can be ruled invalid. Therefore, clarity and compliance with legal standards are vital for a Florida Promissory Note with Installment Payments.

A note may be considered invalid if it lacks necessary components such as clarity, signatures, or defined terms. Additionally, if the note is created under coercion or without legal capacity, it can be deemed invalid. Ensuring that your Florida Promissory Note with Installment Payments includes all required elements is essential for enforceability.

An invalid promissory note lacks essential elements required for it to be legally enforceable. Reasons for invalidity can include missing signatures, unclear terms, or an unattainable repayment structure. It's important to ensure all parts are present and clear if you want to draft a successful Florida Promissory Note with Installment Payments.

To write a promissory note for payment, start with the date and the names of both the borrower and lender. Clearly state the amount being borrowed, the interest rate, and the repayment schedule. Include any terms related to late payments and ensure that both parties sign the document. This approach will help you create a solid foundation for your Florida Promissory Note with Installment Payments.