District of Columbia Promissory Note with Installment Payments

Description

How to fill out Promissory Note With Installment Payments?

Are you currently in the location where you need documents for either business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, such as the District of Columbia Promissory Note with Installment Payments, designed to meet state and federal regulations.

Once you obtain the correct form, click Purchase now.

Select the pricing plan you prefer, enter the required details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia Promissory Note with Installment Payments template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

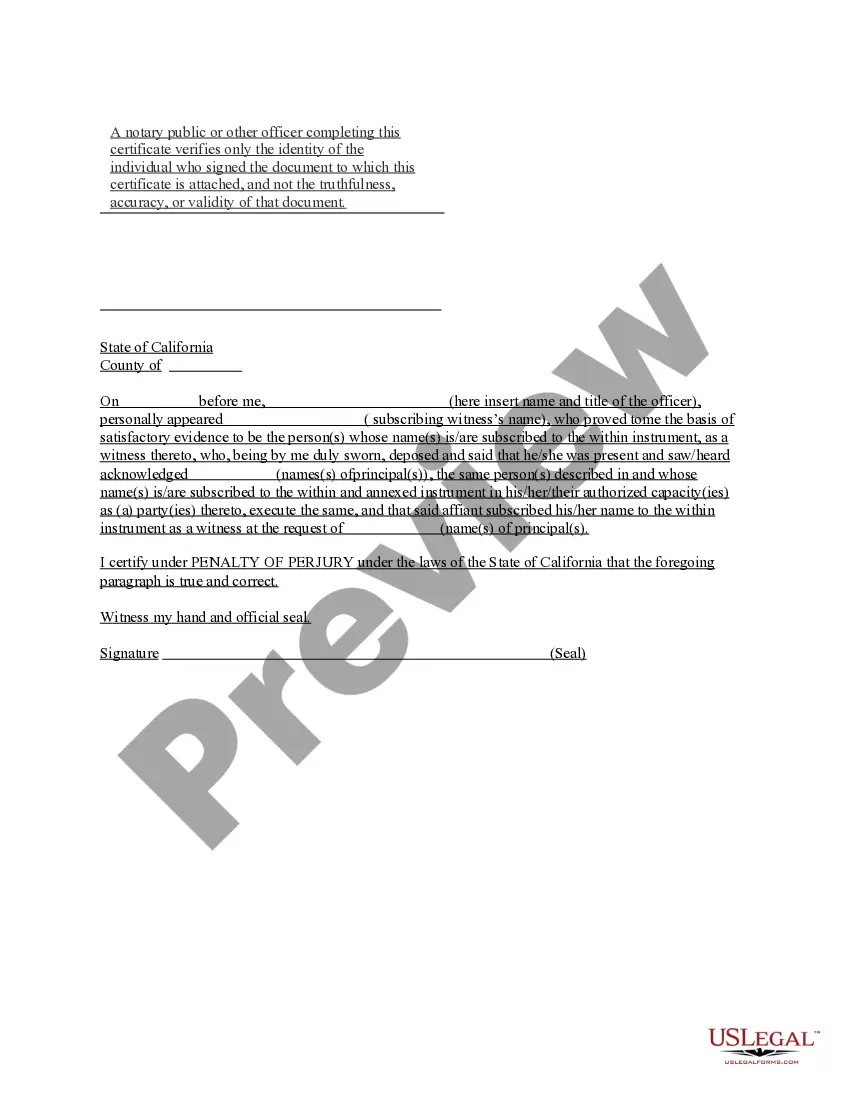

- Utilize the Review button to verify the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

Creating a promissory note for payment is a straightforward process that involves outlining specific terms. Begin by defining the total amount borrowed, the interest rate, and a repayment schedule in your District of Columbia Promissory Note with Installment Payments. Include signatures from both parties to confirm agreement, and consider using an online service like USLegalForms for templates and legal support. This way, you can ensure that you have all necessary components in place for valid documentation.

To record a promissory note payment, you need to maintain accurate and detailed records of each transaction. First, note the payment date, amount, and any applicable interest on your District of Columbia Promissory Note with Installment Payments. It is also wise to keep copies of receipts or bank statements for reference. Using a reliable platform like USLegalForms can simplify this process, ensuring you stay organized and compliant.

Filling out a District of Columbia Promissory Note with Installment Payments involves several crucial steps. First, clearly state the names of the borrower and lender, including their addresses. Next, specify the amount borrowed, the interest rate, and the terms of repayment, including the installment schedule. Finally, complete the document by signing and dating it to make it legally binding, ensuring that both parties have copies for their records.

To obtain your District of Columbia Promissory Note with Installment Payments, you can utilize uslegalforms, where you will find a user-friendly platform designed to simplify the process. Start by selecting the appropriate template that fits your needs, and fill in the required information. Once you complete the form, you can download and print your promissory note, ensuring it meets all legal standards. This straightforward approach helps you secure your agreement easily and effectively.

Promissory notes can vary in type, including secured, unsecured, demand, and installment notes. A secured note is backed by collateral, while unsecured notes rely solely on the borrower's promise to repay. The District of Columbia Promissory Note with Installment Payments falls under the category of installment notes, providing a specific framework for payment schedules and terms.

This type of promissory note is specifically designed for borrowers to repay the borrowed amount in predetermined installments over time. These installments usually include both principal and interest, providing a structured repayment method. The District of Columbia Promissory Note with Installment Payments is an excellent example of such a note, offering clarity and security for both parties.

A Promissory Note with Installment Payments is a lending contract that sets terms for a loan to be repaid in installments. This Promissory Note specifies that the loan will be paid back with consistent, equal, payments. Whether you're the lender or the borrower, you know exactly what each payment will be.

Types of Promissory NotesSimple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note includes a specific promise to pay, and the steps required to do so (like the repayment schedule), while an IOU merely acknowledges that a debt exists, and the amount one party owes another.