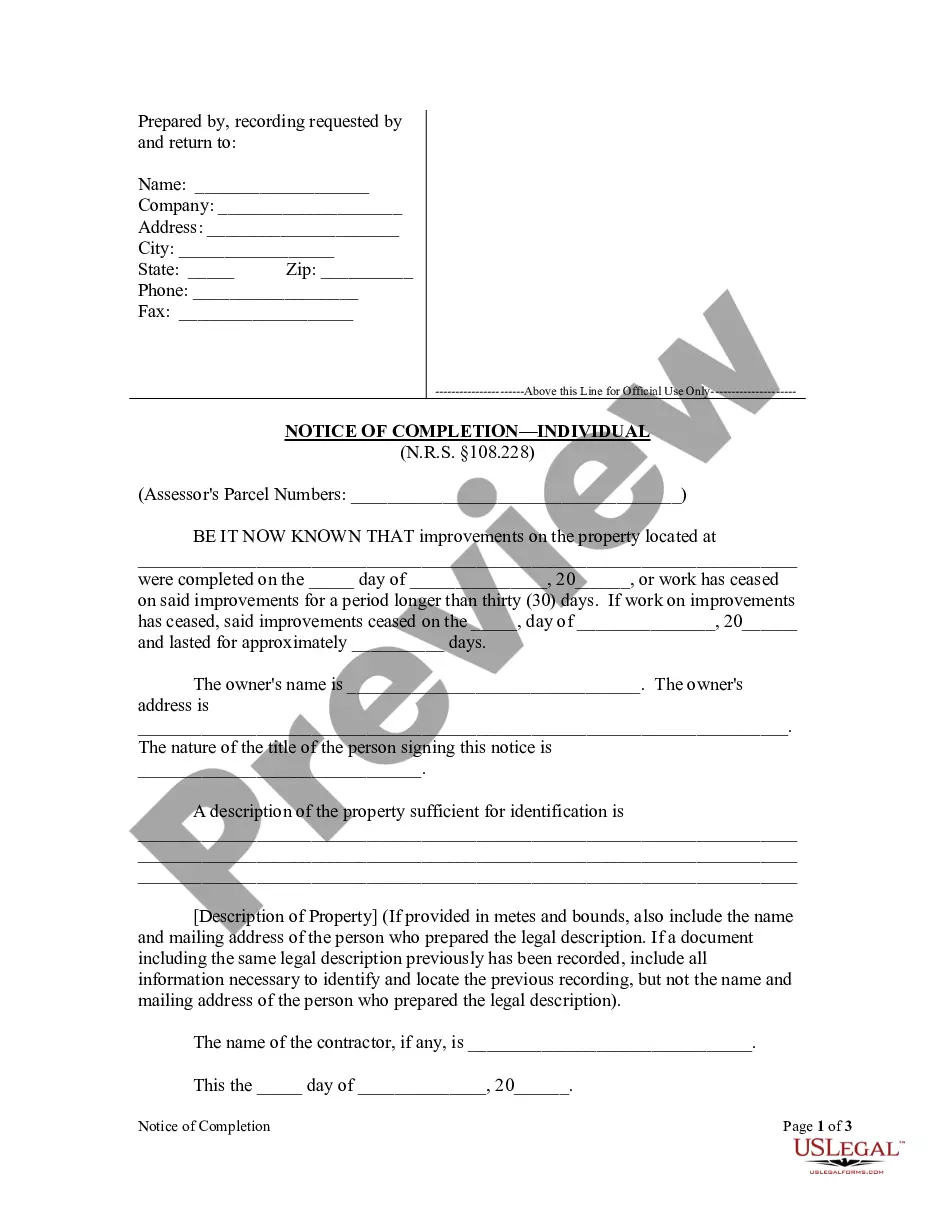

This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can obtain or print. By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes. If you have a subscription, Log In and obtain the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate from your US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have chosen the correct form for your city/region. Click the Review button to examine the form’s content. Check the form description to confirm that you have selected the correct form. If the form does not fulfill your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, select the pricing plan you prefer and provide your credentials to sign up for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate. Every template you add to your account does not have an expiration date and is yours to keep indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

The legal requirements for a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate include the names of both the borrower and lender, the principal amount, the interest rate, the repayment schedule, and signatures of both parties. Additionally, the note should be written clearly to avoid any misunderstandings. Using uslegalforms provides access to templates that outline these requirements, helping you create a legally compliant document with ease.

Yes, you can create your own promissory note for a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate, but you must ensure it meets all legal requirements. Using a template from a reputable source, such as uslegalforms, can simplify this process significantly. However, it is wise to have your document reviewed by a legal professional to prevent any potential issues down the line.

You can easily obtain a promissory note form for a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate from various online platforms, including uslegalforms. This platform offers a comprehensive library of customizable templates that you can download and use, ensuring you have the correct format and legal language. By using a trusted resource like uslegalforms, you can save time and ensure your document meets all legal requirements.

A reasonable interest rate for a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate typically falls between 5% and 15%, depending on various factors such as the creditworthiness of the borrower and prevailing market conditions. It's important to ensure that the rate complies with state laws to avoid any legal issues. Always consider consulting a financial advisor or legal expert to determine the most suitable rate for your specific situation.

Filing a promissory note in the District of Columbia typically involves submitting the document to the appropriate court if you seek legal enforcement. Ensure that the note is properly signed and contains all necessary details. You may also need to file additional forms depending on your case. For assistance, consider using US Legal Forms to ensure your District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate is correctly prepared and filed.

To legally enforce a promissory note in the District of Columbia, you must first gather all relevant documentation, including the signed note and any correspondence with the borrower. If the borrower fails to fulfill their obligations, you can file a lawsuit to seek repayment. The process may involve mediation or court proceedings, depending on the situation. Using US Legal Forms can simplify the preparation of your legal documents.

Generally, an unsigned promissory note is not enforceable in the District of Columbia. The signature of the maker serves as a critical element of acceptance and acknowledgment of the debt. Without a signature, you may face challenges in proving the validity of the note. Therefore, it is advisable to always ensure that your District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate is properly signed.

To enforce a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate, you must first review the terms outlined in the note. If the borrower defaults, you can initiate legal action to recover the owed amount. Typically, this involves filing a lawsuit in the appropriate court. Utilizing platforms like US Legal Forms can help you draft the necessary documents for this process.

Unsecured promissory notes are financial instruments that promise repayment without the backing of collateral. They are based on the borrower's trustworthiness and financial history. Utilizing the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate can streamline the borrowing process while offering both lenders and borrowers clear terms.

Secured promissory notes involve collateral to protect the lender's investment. In contrast, unsecured promissory notes, like the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate, do not require backing by an asset. This makes unsecured notes riskier for lenders, but they provide borrowers with more flexibility.