North Dakota Sample Letter for Explanation of Bankruptcy

Description

How to fill out Sample Letter For Explanation Of Bankruptcy?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a broad selection of legal template formats that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, categorized by sections, states, or keywords. You can find the latest iterations of forms such as the North Dakota Sample Letter for Explanation of Bankruptcy in mere minutes.

If you possess a membership, Log In and download the North Dakota Sample Letter for Explanation of Bankruptcy from the US Legal Forms repository. The Download button will appear on every form you view. You are entitled to access all previously saved forms within the My documents section of your account.

Process the transaction. Use your credit or debit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded North Dakota Sample Letter for Explanation of Bankruptcy. Each template you added to your account does not have an expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the North Dakota Sample Letter for Explanation of Bankruptcy with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- In order to access US Legal Forms for the first time, here are straightforward steps to get you started.

- Confirm you have selected the correct form for the city/region.

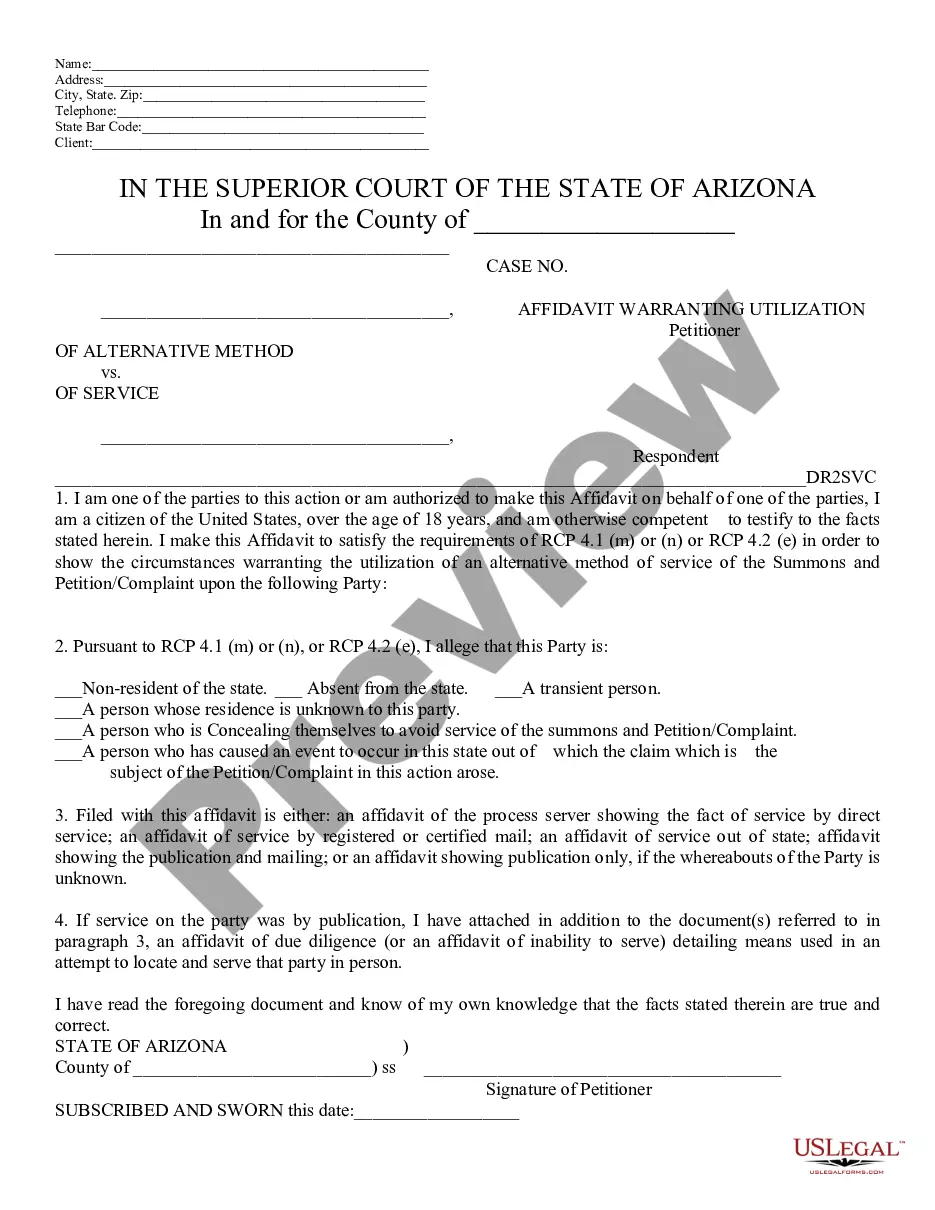

- Click the Preview button to examine the form's details.

- Review the form details to ensure you have selected the right form.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your choice by clicking on the Buy now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

When drafting a Letter of Explanation for Bankruptcy, you need to state the reason you are submitting this explanation, record the type of bankruptcy you filed for, the timeline of the bankruptcy proceedings, and a brief description of the circumstances that led to the bankruptcy.

Begin the letter with the date, a salutation, and an introduction of the incident or issue. Provide a short but detailed description without having to add unnecessary terms and phrases. Provide an explanation of the steps you've taken to rectify the error or to complete the missing information.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

The letter should include an explanation regarding the negative event, the date it happened, the name of the creditor and your account number. It should also include an explanation of why you don't see this problem happening again.

In other words, a letter of explanation is exactly what it sounds like. The lender and their underwriter are asking the borrower to explain something. That could be a change in jobs, a gap in employment, a large deposit into their bank account, a source of self-employed income, or just about anything else.

Try to be as concise as possible yet give a clear picture of the situation. Next, focus on your role in the mistake. Even if you're embarrassed or feel someone else should share the blame, it's important you let your boss know you understand you should have done something different to avoid the situation.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.