North Dakota Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

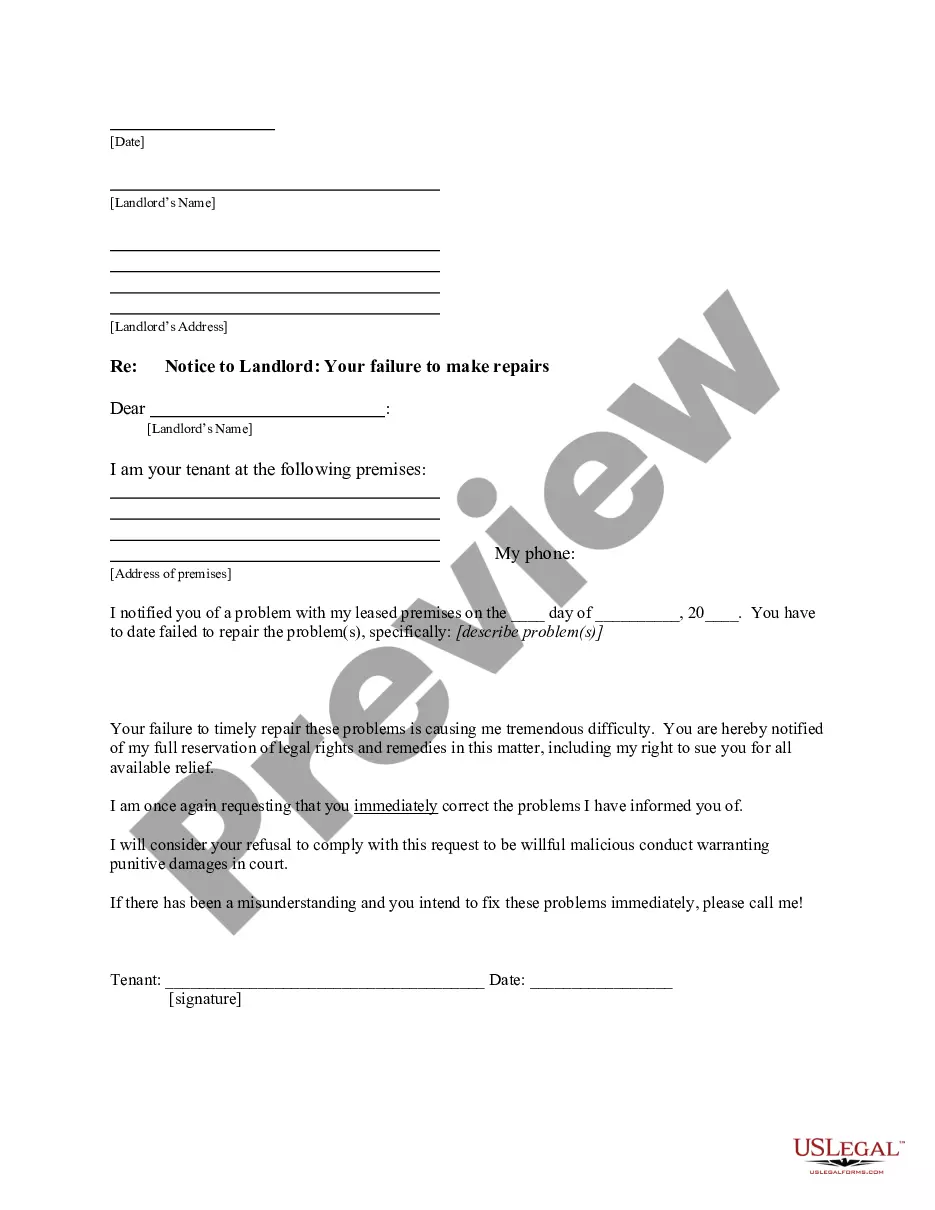

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Have you been within a position the place you require papers for sometimes business or person reasons almost every working day? There are tons of authorized papers web templates available on the Internet, but locating versions you can rely on isn`t simple. US Legal Forms provides 1000s of form web templates, like the North Dakota Sample Letter regarding Information for Foreclosures and Bankruptcies, that are composed to satisfy state and federal needs.

In case you are already knowledgeable about US Legal Forms website and also have your account, basically log in. Next, you may obtain the North Dakota Sample Letter regarding Information for Foreclosures and Bankruptcies web template.

Should you not provide an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for the right metropolis/region.

- Use the Preview option to check the form.

- Look at the outline to ensure that you have selected the right form.

- In case the form isn`t what you`re looking for, make use of the Lookup discipline to find the form that suits you and needs.

- If you find the right form, just click Acquire now.

- Pick the prices plan you want, fill in the desired details to create your bank account, and pay money for the order using your PayPal or credit card.

- Decide on a convenient data file file format and obtain your backup.

Get all the papers web templates you might have purchased in the My Forms menus. You can obtain a additional backup of North Dakota Sample Letter regarding Information for Foreclosures and Bankruptcies anytime, if necessary. Just select the needed form to obtain or print out the papers web template.

Use US Legal Forms, the most extensive collection of authorized kinds, to save lots of efforts and stay away from faults. The service provides skillfully made authorized papers web templates which can be used for a variety of reasons. Generate your account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Security instrument, is the document that creates the lien on the property. The mortgage exposes the real estate to claim by the mortgagee and is the document that gives the creditor the right to sue for foreclosure.

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

Redeeming the Property In some states, the borrower can redeem (repurchase) the property within a specific period after the foreclosure. In North Dakota, the borrower generally gets the right to redeem the property within 60 days after the sale except for property that's abandoned or agricultural.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

Redeeming the Property In some states, the borrower can redeem (repurchase) the property within a specific period after the foreclosure. In North Dakota, the borrower generally gets the right to redeem the property within 60 days after the sale except for property that's abandoned or agricultural.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

When available, the redemption period generally ranges from 30 days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.

Which state has the longest foreclosure process? The state with the longest foreclosure process is Hawaii, followed by Louisiana, Kentucky, Nevada, and Connecticut.