North Dakota Notice of Returned Check

Description

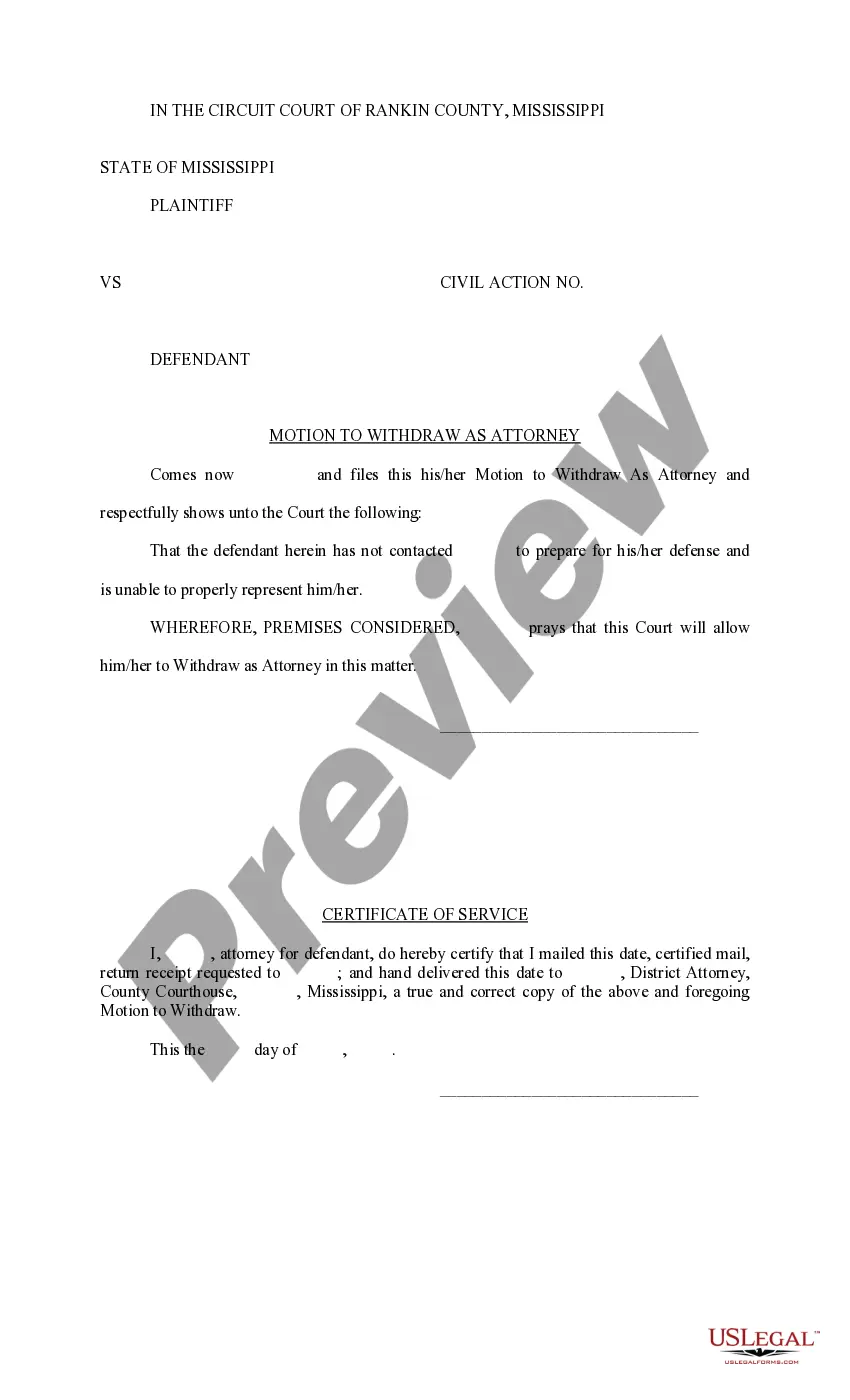

How to fill out Notice Of Returned Check?

You can invest hours online searching for the legal document template that meets the federal and state criteria you need.

US Legal Forms offers thousands of legal documents that are reviewed by experts. You can easily download or print the North Dakota Notice of Returned Check from my service.

If you already possess a US Legal Forms account, you can Log In and click the Acquire button. After that, you can complete, edit, print, or sign the North Dakota Notice of Returned Check. Every legal document template you acquire is your property permanently.

Select the pricing plan you need, enter your details, and sign up for an account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make adjustments to your document if possible. You can complete, modify, sign, and print the North Dakota Notice of Returned Check. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Use professional and state-specific templates to manage your business or personal needs.

- To get an additional copy of the downloaded document, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the document outline to confirm you have chosen the appropriate document.

- If available, use the Review button to look through the document template as well.

- If you wish to obtain another version of the document, utilize the Search field to find the template that fulfills your requirements and specifications.

- Once you have found the template you need, click Get now to proceed.

Form popularity

FAQ

In most cases, banks do not automatically redeposit a returned check. Instead, the check will be marked as returned and the receiver will receive a North Dakota Notice of Returned Check. It’s essential for the check writer to address the issue directly and, if necessary, issue a new check. Always communicate with your bank to understand their specific policies regarding redepositing checks.

To fix a returned check, first contact your bank to understand why it was returned. You can often resolve the issue by addressing the reason, such as insufficient funds or an incorrect account number. Once you've corrected the problem, you may need to issue a new check or settle the debt directly. If you received a North Dakota Notice of Returned Check, it’s crucial to act quickly to avoid additional fees.

A returned check notice is a formal document sent to the person who issued the bounced check. This notice outlines the details of the transaction and informs the issuer about the failure to process their payment. In North Dakota, using a North Dakota Notice of Returned Check can help clarify the situation and prompt the payer to take action. It serves as an essential tool for both parties to resolve the issue amicably.

To collect on a returned check, you should first contact the issuer to discuss the matter directly. You can send a polite reminder or a North Dakota Notice of Returned Check, which formally states the issue and requests payment. If the issuer fails to respond or make payment, you may explore legal avenues to collect your funds, and having documentation can strengthen your case.

A check can be returned to the sender for various reasons, including insufficient funds or an invalid account number. Sometimes, the payee may have closed their account, leading to the check being unprocessed. In North Dakota, receiving a Notice of Returned Check can provide clarity regarding the reason for the return, helping both parties address the matter efficiently.

If you receive a bounced check, you will need to notify the issuer to resolve the payment. A bounced check indicates that the issuer does not have enough funds in their account, which can cause inconvenience for you. In North Dakota, you can issue a North Dakota Notice of Returned Check to formally inform the payer of the bounced check and request payment. This notice serves as documentation that can be useful for any further action you may decide to take.

When you receive a returned check, it means that the bank could not process the payment. Typically, this happens due to insufficient funds in the payer's account. You may also incur fees from your bank for the returned check. It's essential to act quickly by contacting the issuer to resolve the issue and consider documenting your communications.

Writing a bad check exceeding $500 can lead to severe consequences in North Dakota. You may face criminal charges, and this could result in fines or even jail time. Additionally, a North Dakota Notice of Returned Check will detail the repercussions you face. It is essential to address this situation quickly, as you can seek guidance from platforms like USLegalForms to understand your options and obligations.

When a check is returned, the first step is to contact the bank to confirm the reason for the return. You should then notify the recipient of the check about the situation. If you have received a North Dakota Notice of Returned Check, carefully review it for details. It may also be wise to resolve the outstanding balance promptly to avoid further penalties.

A returned check does not get presented again automatically, but you can choose to resubmit it. If you decide to resubmit, ensure that you notify the individual who issued the check, especially if they received a North Dakota Notice of Returned Check. This communication can clarify the situation and promote resolution.