A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

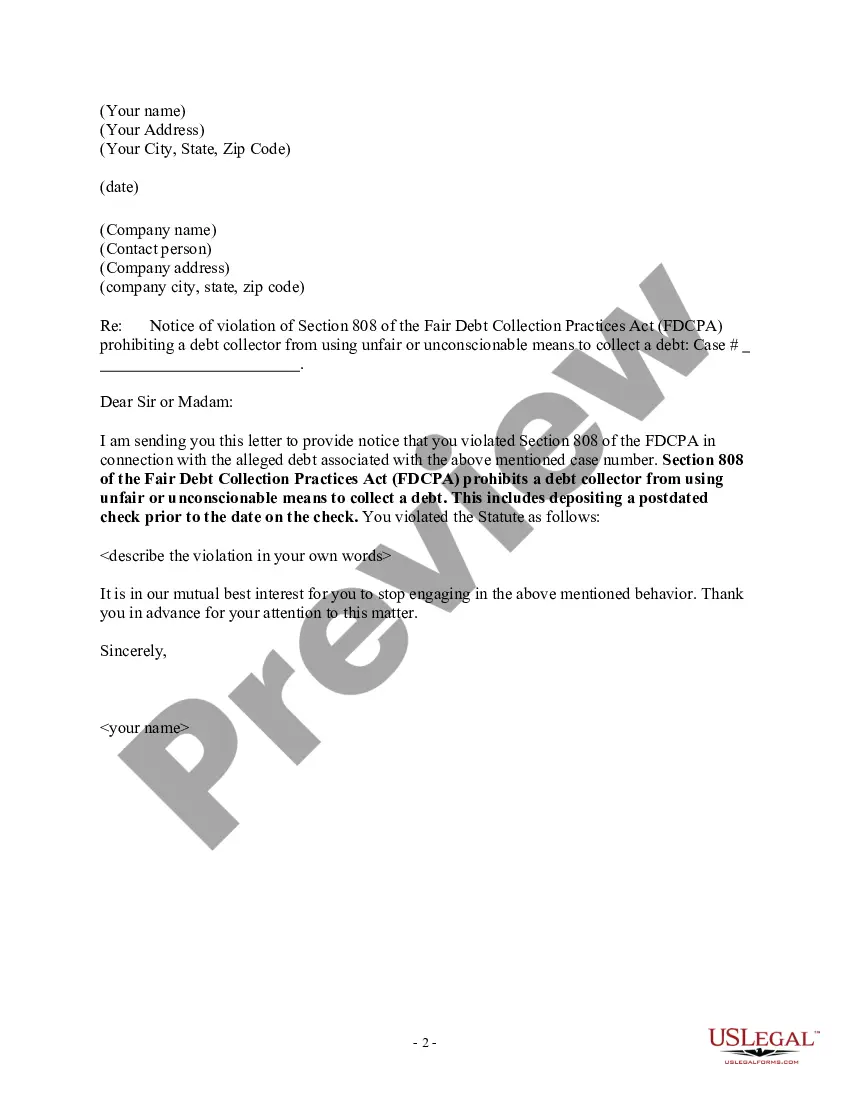

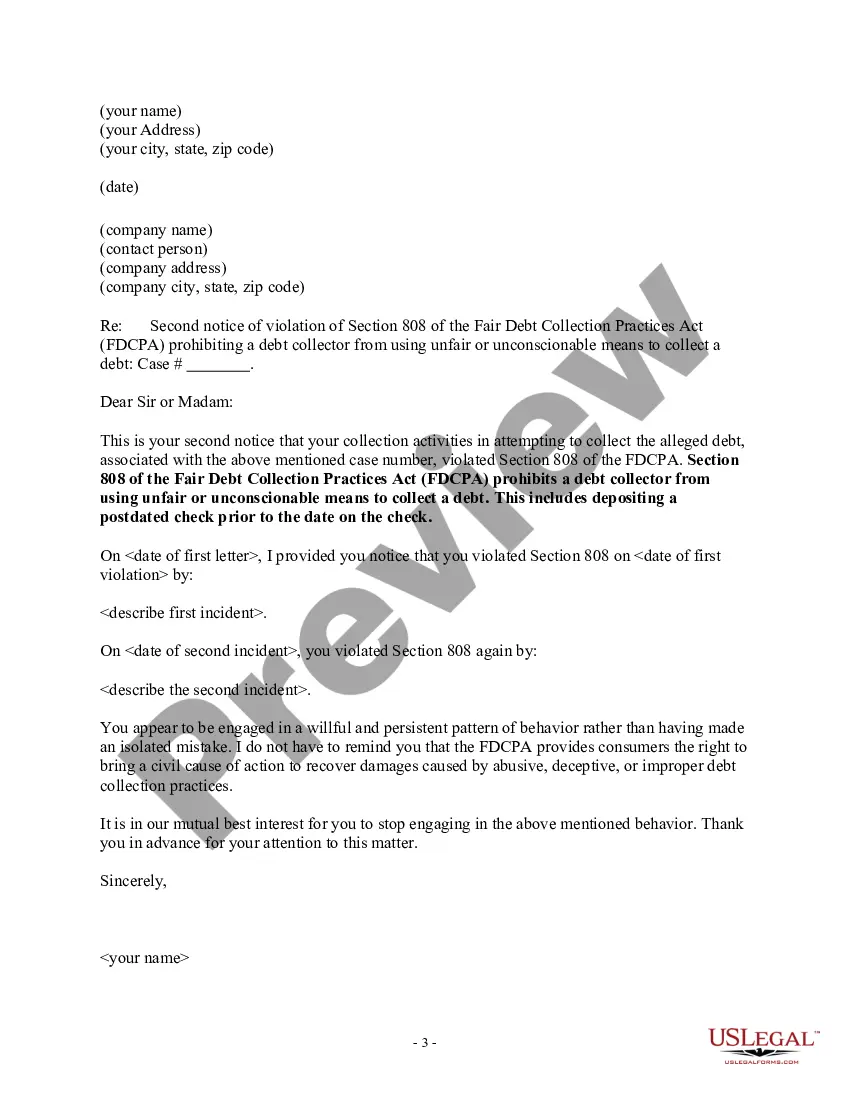

North Dakota Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

If you require extensive, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and convenient search feature to locate the documents you need.

A variety of templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and input your information to register for an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the North Dakota Notice to Debt Collector - Depositing a Postdated Check Before the Date on the Check with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Download button to obtain the North Dakota Notice to Debt Collector - Depositing a Postdated Check Before the Date on the Check.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's contents. Remember to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form design.

Form popularity

FAQ

The 11-word phrase to stop debt collectors generally serves as a request for proof of the debt and emphasizes your rights. It demands that collectors cease communication unless they provide necessary documentation. By leveraging this phrase, you can manage interactions more effectively, particularly concerning the North Dakota Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

In the book Credit Secrets, the 11-word phrase is designed to disrupt debt collection processes and empower consumers. It serves as a strong assertion of your rights under debt collection laws. Utilizing this phrase can be critical in situations involving the North Dakota Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

The 11-word credit phrase loophole refers to a specific statement that, when communicated to debt collectors, can halt their collection efforts immediately. This phrase provides consumers with a powerful tool for managing harassment from debt collectors. By learning this loophole, you can effectively reinforce your position regarding the North Dakota Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Several banks now offer a service where your paycheck is available one or two days before the regular payday if your employer uses direct deposit. This early direct deposit of your paycheck could help you keep up with bills and avoid late fees, especially on bills due around the time you receive your salary.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.