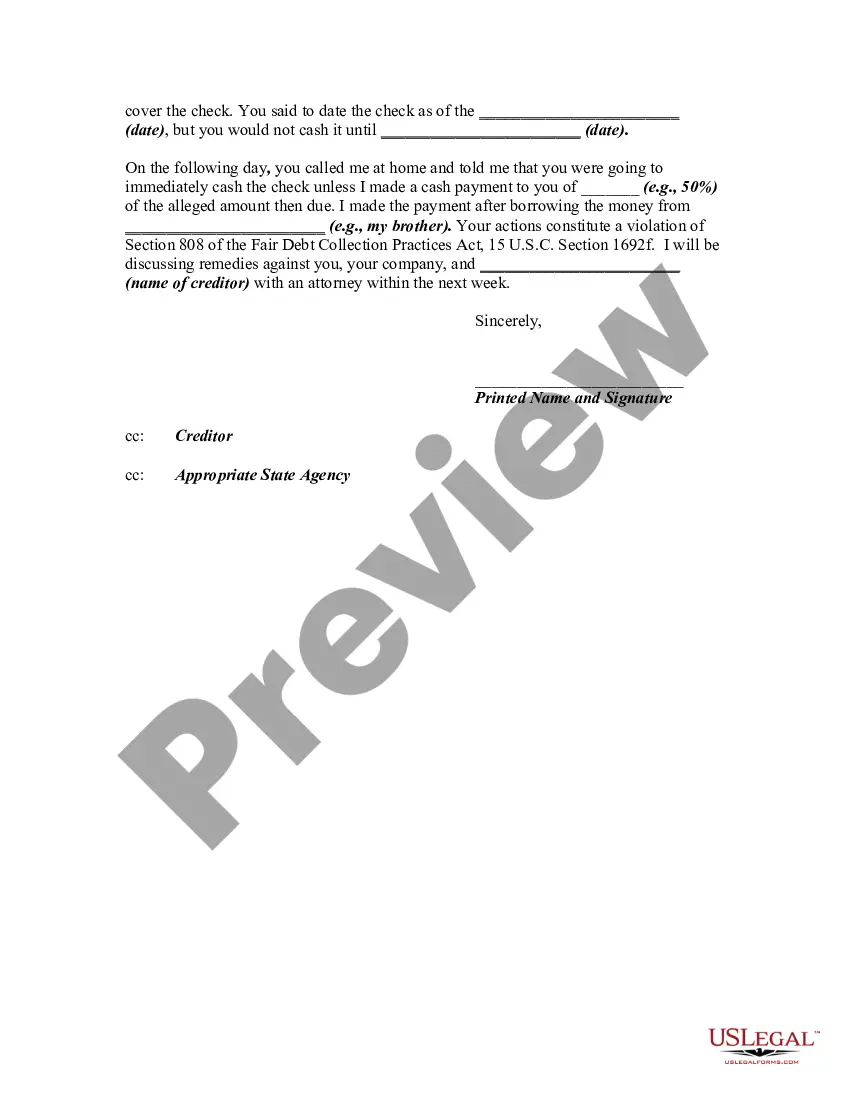

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."