North Carolina Insurance Agents Stock option plan

Description

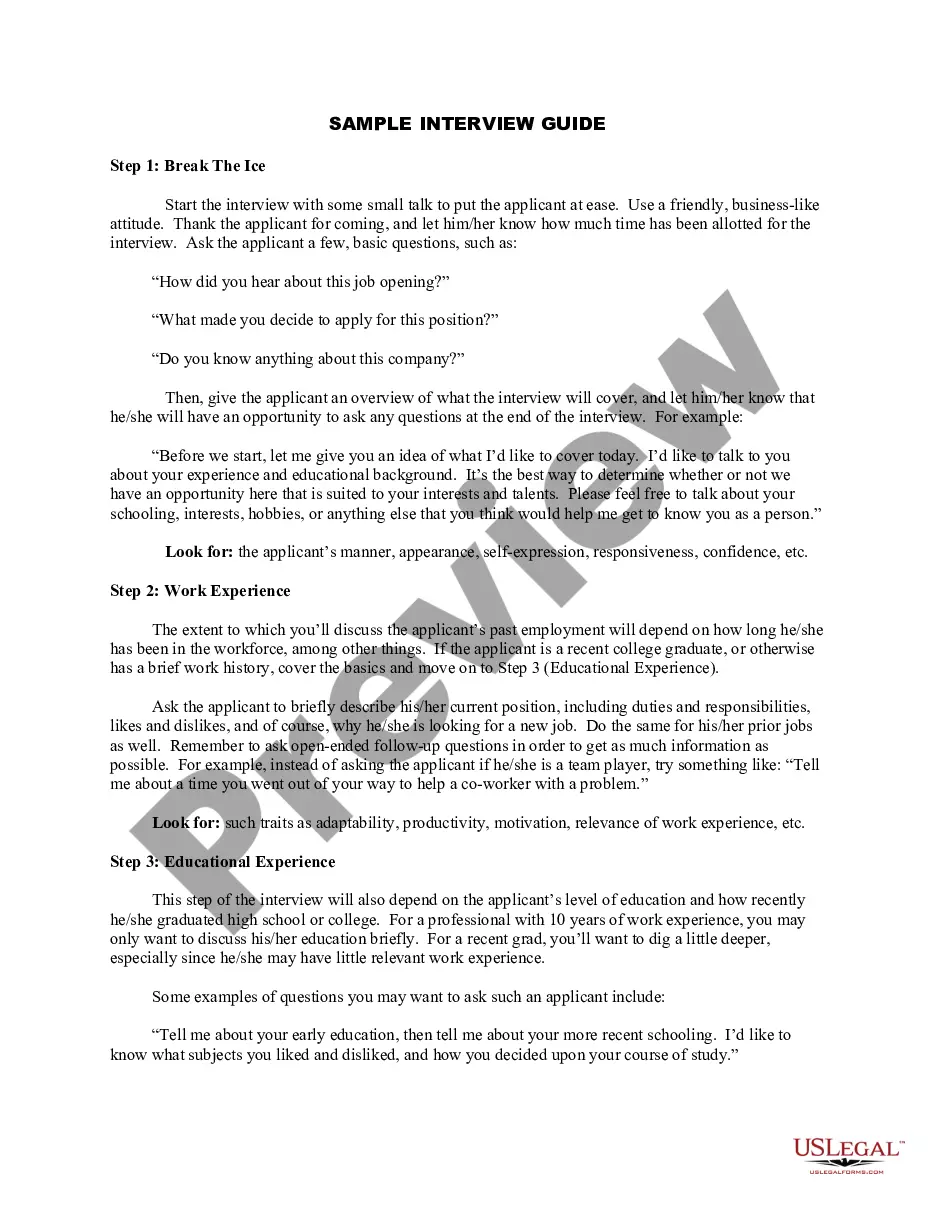

How to fill out Insurance Agents Stock Option Plan?

If you need to complete, down load, or produce legitimate papers templates, use US Legal Forms, the most important collection of legitimate forms, which can be found on the web. Utilize the site`s simple and hassle-free search to get the documents you need. Different templates for organization and individual uses are sorted by groups and says, or keywords. Use US Legal Forms to get the North Carolina Insurance Agents Stock option plan in just a number of mouse clicks.

In case you are already a US Legal Forms buyer, log in in your account and then click the Obtain key to have the North Carolina Insurance Agents Stock option plan. You can even access forms you earlier downloaded within the My Forms tab of the account.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the correct metropolis/land.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Don`t overlook to see the information.

- Step 3. In case you are not satisfied together with the develop, take advantage of the Search discipline on top of the screen to discover other versions in the legitimate develop template.

- Step 4. Upon having identified the shape you need, click the Acquire now key. Select the pricing strategy you favor and include your credentials to sign up for an account.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal account to complete the financial transaction.

- Step 6. Find the file format in the legitimate develop and down load it in your product.

- Step 7. Comprehensive, revise and produce or sign the North Carolina Insurance Agents Stock option plan.

Every legitimate papers template you buy is your own property eternally. You might have acces to every develop you downloaded within your acccount. Click the My Forms portion and choose a develop to produce or down load once more.

Be competitive and down load, and produce the North Carolina Insurance Agents Stock option plan with US Legal Forms. There are millions of specialist and condition-particular forms you can use for your personal organization or individual requirements.

Form popularity

FAQ

A replacement occurs when a new policy or contract is purchased and, in connection with the sale, you discontinue making premium payments on the existing policy or contract, or an existing policy or contract is surrendered, forfeited, assigned to the replacing insurer, or otherwise terminated or used in a financed ...

A claims reserve is a reserve of money that is set aside by an insurance company in order to pay policyholders who have filed or are expected to file legitimate claims on their policies. Insurers use the fund to pay out incurred claims that have yet to be settled.

Any insurer authorized to transact business in NC may appoint as its agent any individual who: Holds a valid agents license issued by the commissioner. When an insurance producer conducts business under any name other than the producers legal name, he or she must: Notify the commissioner before using the assumed name.

(a) It is unlawful for any insurance company licensed and admitted to do business in this State to issue, sell, or dispose of any policy, contract, certificate, or certificate of insurance, or use applications in connection therewith, until the forms of the same have been submitted to and approved by the Commissioner, ...

Making or permitting any unfair discrimination between individuals of the same class and of essentially the same hazard in the amount of premium, policy fees, or rates charged for any policy or contract of accident or health insurance or in the benefits payable thereunder, or in any of the terms or conditions of such ...

As its name indicates, the North Carolina Unfair and Deceptive Trade Practices Act (or ?UDTPA,? for short) prohibits businesses from engaging in unfair or deceptive acts or practices. Violating the UDTPA subjects a defendant to potential treble (triple) damages, costs, and attorney's fees.

The law is called the Unfair and Deceptive Trade Practices Act. An insurance company is guilty of unfair and deceptive trade practices if it harmed you by doing something that has tendency to deceive, that offends public policy, or that is immoral, unethical, oppressive, unscrupulous, or substantially hurts people.