Minnesota Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

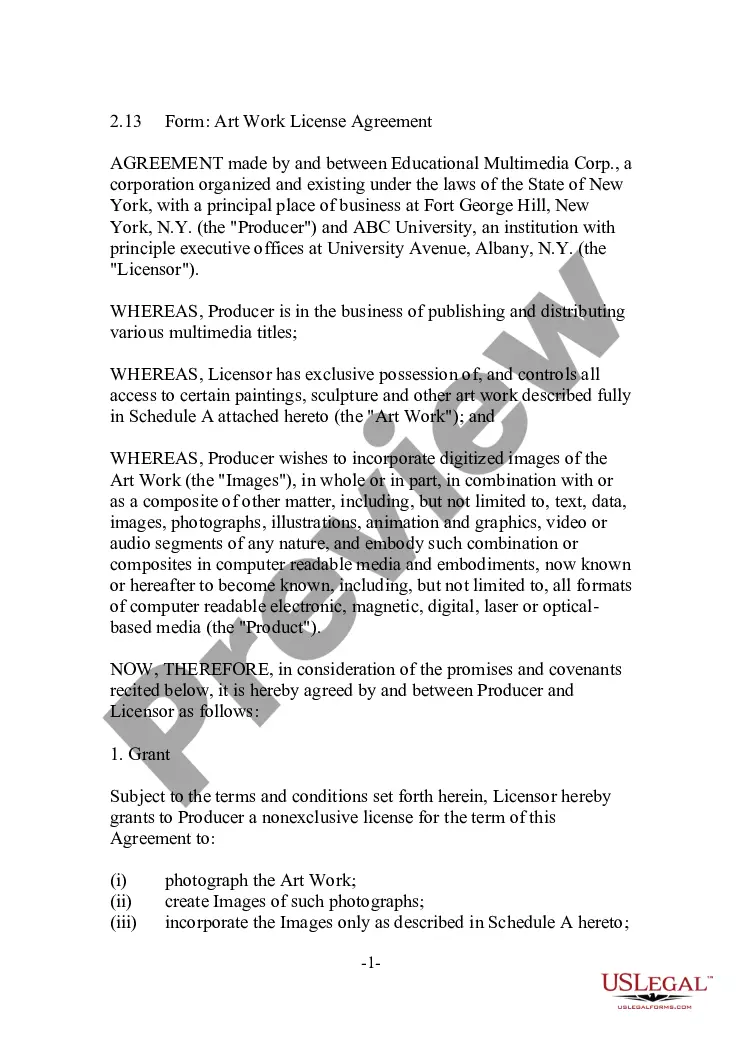

You can spend hrs online searching for the authorized papers format that fits the state and federal specifications you require. US Legal Forms supplies a huge number of authorized forms which can be examined by pros. It is possible to acquire or print the Minnesota Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit from our service.

If you currently have a US Legal Forms profile, you may log in and click the Download button. Afterward, you may total, revise, print, or indication the Minnesota Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit. Every authorized papers format you buy is yours forever. To obtain an additional version of any obtained type, check out the My Forms tab and click the related button.

If you use the US Legal Forms website initially, keep to the easy guidelines listed below:

- Initial, make certain you have selected the best papers format for the region/town of your liking. Read the type explanation to make sure you have picked out the right type. If offered, use the Preview button to appear throughout the papers format at the same time.

- If you would like locate an additional version from the type, use the Look for area to obtain the format that suits you and specifications.

- Once you have identified the format you need, click on Purchase now to continue.

- Select the pricing plan you need, type your credentials, and register for an account on US Legal Forms.

- Full the deal. You should use your credit card or PayPal profile to cover the authorized type.

- Select the file format from the papers and acquire it for your system.

- Make adjustments for your papers if required. You can total, revise and indication and print Minnesota Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit.

Download and print a huge number of papers layouts while using US Legal Forms Internet site, which provides the most important selection of authorized forms. Use skilled and status-particular layouts to tackle your small business or individual requires.

Form popularity

FAQ

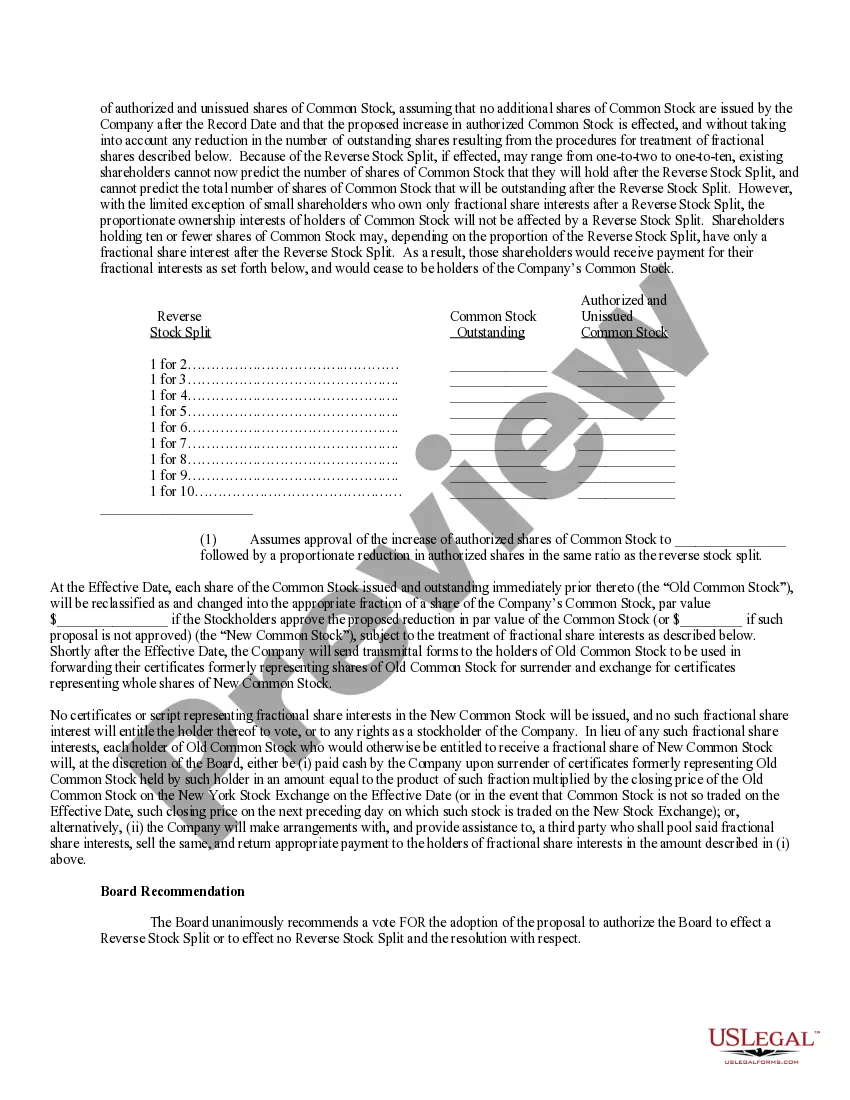

A reverse stock split consolidates the number of existing shares of stock held by shareholders into fewer shares. A reverse stock split does not directly impact a company's value (only its stock price). It can signal a company in distress since it raises the value of otherwise low-priced shares.

For example, in a one-for-ten () reverse split, shareholders receive one share of the company's new stock for every 10 shares that they owned. Each new share would be worth ten times that of the shares before the split.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

Reverse Stock Splits. The plan calls for the corporation to redeem all fractional shares for cash, forcing the minority shareholders to sell their fractional shares back to the corporation.

(EXPR) has announced a 1-for-20 reverse stock split. As a result of the reverse stock split, each EXPR Common Share will be converted into the right to receive 0.05 (New) Express, Inc. Common Shares.

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.