Minnesota Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock

Description

How to fill out Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

Choosing the best legitimate file design could be a struggle. Needless to say, there are a variety of web templates available on the Internet, but how will you discover the legitimate develop you want? Use the US Legal Forms website. The services provides 1000s of web templates, such as the Minnesota Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock, which you can use for organization and private needs. Every one of the kinds are examined by specialists and meet federal and state specifications.

Should you be presently registered, log in to your account and click the Download option to obtain the Minnesota Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock. Utilize your account to check through the legitimate kinds you possess purchased previously. Check out the My Forms tab of your respective account and acquire one more backup of your file you want.

Should you be a brand new consumer of US Legal Forms, here are easy instructions that you can stick to:

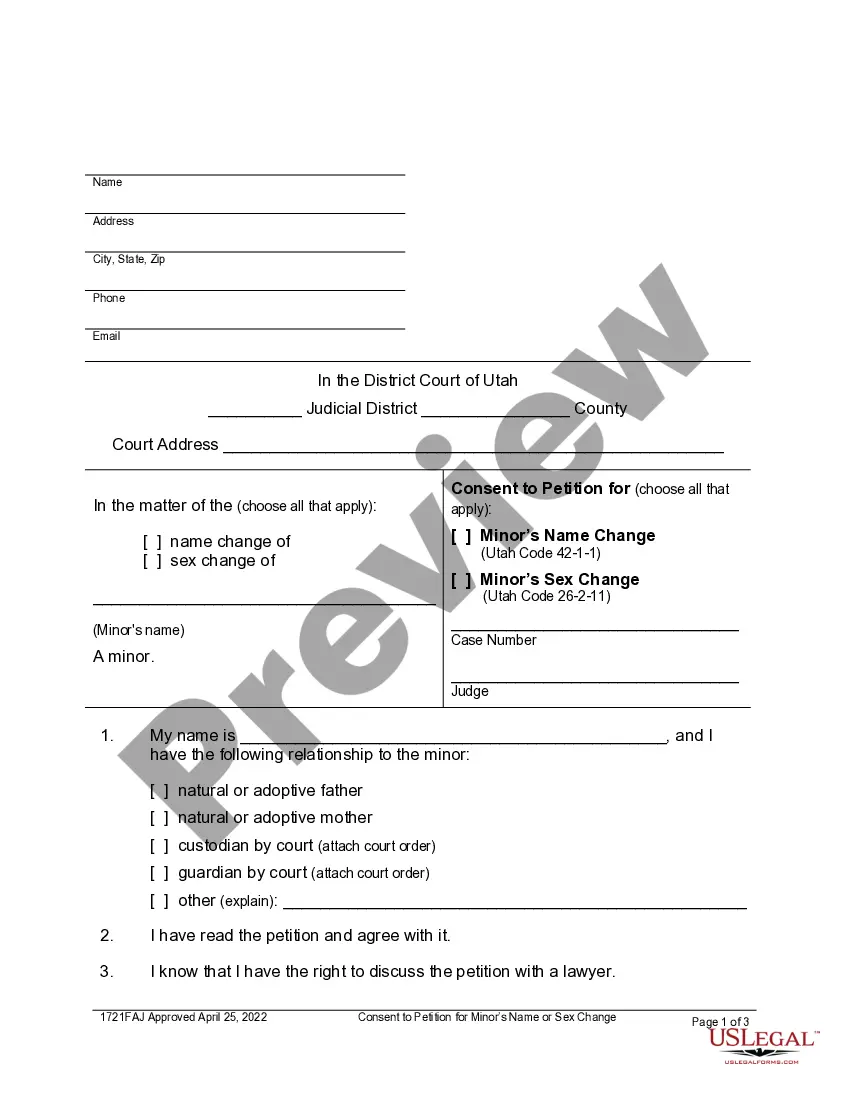

- Initial, ensure you have selected the appropriate develop for your personal city/county. You are able to check out the shape making use of the Preview option and study the shape explanation to make certain this is basically the right one for you.

- If the develop fails to meet your preferences, take advantage of the Seach industry to find the correct develop.

- Once you are certain that the shape is proper, go through the Buy now option to obtain the develop.

- Choose the pricing program you want and enter in the necessary details. Create your account and buy the order with your PayPal account or credit card.

- Pick the data file structure and obtain the legitimate file design to your gadget.

- Full, revise and print out and sign the obtained Minnesota Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock.

US Legal Forms may be the largest library of legitimate kinds for which you can find numerous file web templates. Use the service to obtain appropriately-created files that stick to state specifications.

Form popularity

FAQ

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

The main difference between a stock split and a reverse split is that while a reverse stock split decreases the number of outstanding shares without affecting the overall value, a conventional stock split increases the number of shares in the same way.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

The four-for-one stock split will not change the value of any investor's total holding of Apple, it will just grow the number of shares making up that pot. So, if a potential investor has a set amount of money they want to invest in the company, it wouldn't necessarily matter if they bought before or after the split.

The other statements are true. If there is a reverse stock split, the market price per share will be increased and the number of outstanding shares will be reduced.

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.