Security Agreement with Farm Products as Collateral

What is this form?

A security agreement with farm products as collateral is a legal document that allows a debtor to grant a security interest in their personal property, specifically farm products, to secure a loan or obligation. This form is distinct from other types of security agreements because it specifically addresses the use of farm-related assets as collateral, ensuring lenders have a claim on these personal properties in case of default.

What’s included in this form

- Identification of parties involved: Debtor and Secured Party details, including addresses and legal structure.

- Creation of security interest: Specifies the obligations secured by the collateral.

- Description of collateral: Detailed listing of farm products, equipment, and associated assets.

- Default clauses: Conditions under which the Debtor may be considered in default.

- Remedies available to Secured Party: Rights and actions available in case of default.

- Governing law: Specifies jurisdiction under which the agreement will be enforced.

State law considerations

This form is a general form that can be adapted for use in different states. Since each state has its own laws, make any needed updates before completing it.

When to use this document

This form is applicable when a farmer (Debtor) requires a loan and is willing to use farm products and equipment as collateral. It is suitable for agricultural businesses that need to secure financing against their assets to purchase supplies, expand operations, or cover operational costs. This form lays out the terms of the agreement clearly and protects both parties' interests in case of any disputes or defaults.

Intended users of this form

- Farmers or agricultural business owners seeking financing.

- Lenders offering loans secured by farm products and related assets.

- Individuals or entities involved in agricultural investment or financing.

- Anyone looking to formalize agreement terms around farm-related assets as collateral for loans.

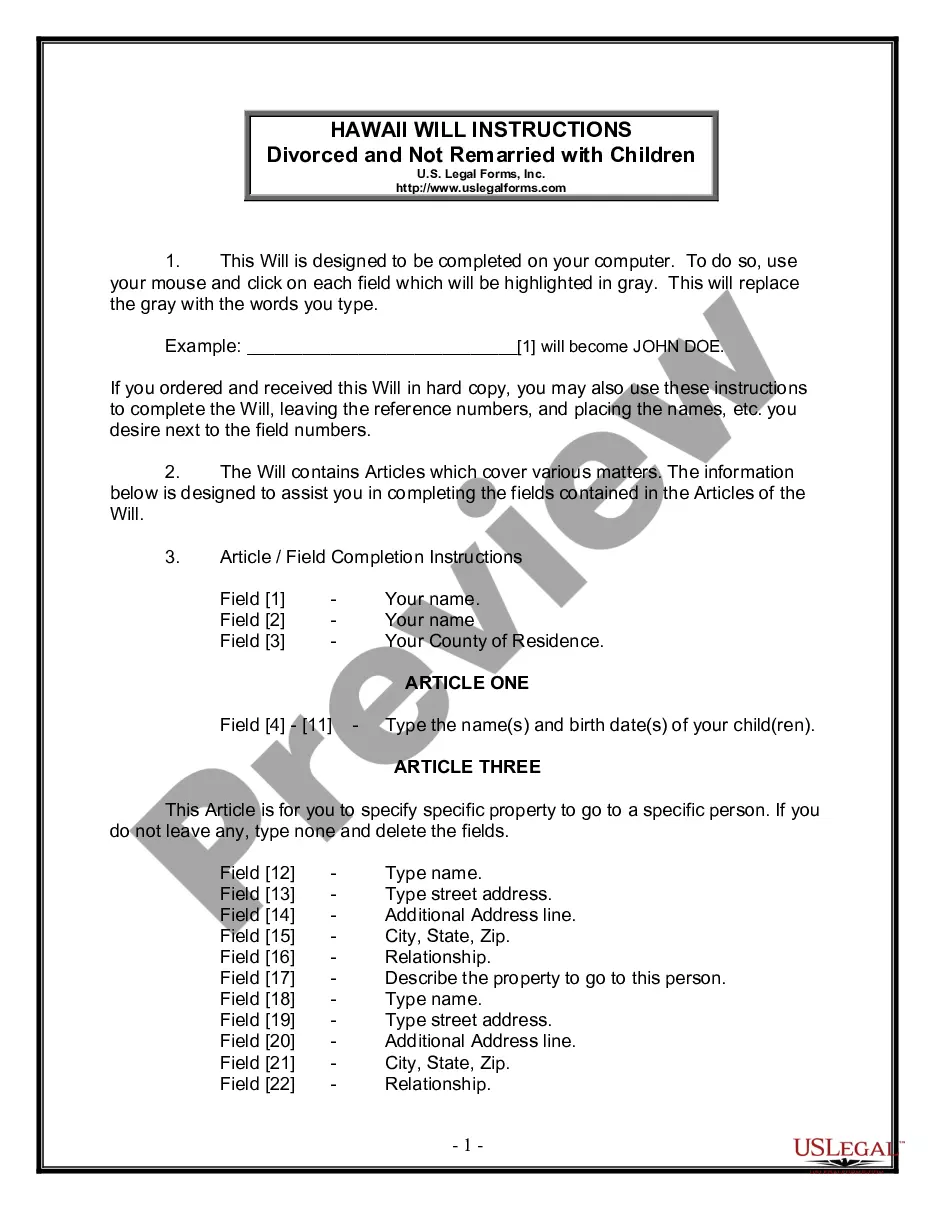

How to complete this form

- Identify the parties: Enter the full names and addresses of both the Debtor and the Secured Party.

- Specify the collateral: List all farm products, equipment, and other assets being used as collateral.

- Outline obligations: Clearly state the obligations that are being secured by this agreement.

- Complete financing statements: Fill in any required legal citations regarding the Uniform Commercial Code.

- Review and sign: Ensure both parties read the agreement, fill in necessary dates, and sign the document.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Avoid these common issues

- Failing to clearly identify the collateral could lead to disputes.

- Not detailing the obligations secured may result in confusion later.

- Incomplete signatures or improperly filled dates can invalidate the agreement.

- Neglecting to check state-specific requirements might lead to non-compliance.

Advantages of online completion

- Convenience: Access and download the form anytime from anywhere.

- Editability: Customize the form quickly to meet specific needs.

- Reliability: Forms are drafted by licensed attorneys to ensure accuracy and compliance.

Form popularity

FAQ

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

By filing a financing statement with the appropriate public office. by possessing the collateral. by controlling the collateral; or. it's done automatically upon attachment of the security interest.

An assignment of record of a security interest in a fixture covered by a record of a mortgage which is effective as a financing statement filed as a fixture filing under Section 9-502(c) may be made only by an assignment of record of the mortgage in the manner provided by law of this State other than the Uniform

Attachment is essentially the moment when a security interest becomes enforceable against a Debtor.

Executing Your Security Agreement Again, although a notary and witness are not required in most jurisdictions, it is always a good idea to include them. When the document has been signed and witnessed, you are done! Make sure each debtor, secured party, and co-signer (if any) get a copy.

By filing a financing statement with the appropriate public office. by possessing the collateral. by controlling the collateral; or. it's done automatically upon attachment of the security interest.

For agricultural secured transactions, there are a few general methods of perfection: (1) possession of the collateral; (2) control of the collateral; (3) automatic perfection when the security interest attaches; and (4) filing a financing statement.

To be valid, a secured transaction must contain an express agreement between the debtor and the secured party. The agreement must be in writing, must be signed by both parties, must describe the collateral, and must contain language indicating a grant of a security interest to the creditor.