North Dakota Insurance Agents Stock option plan

Description

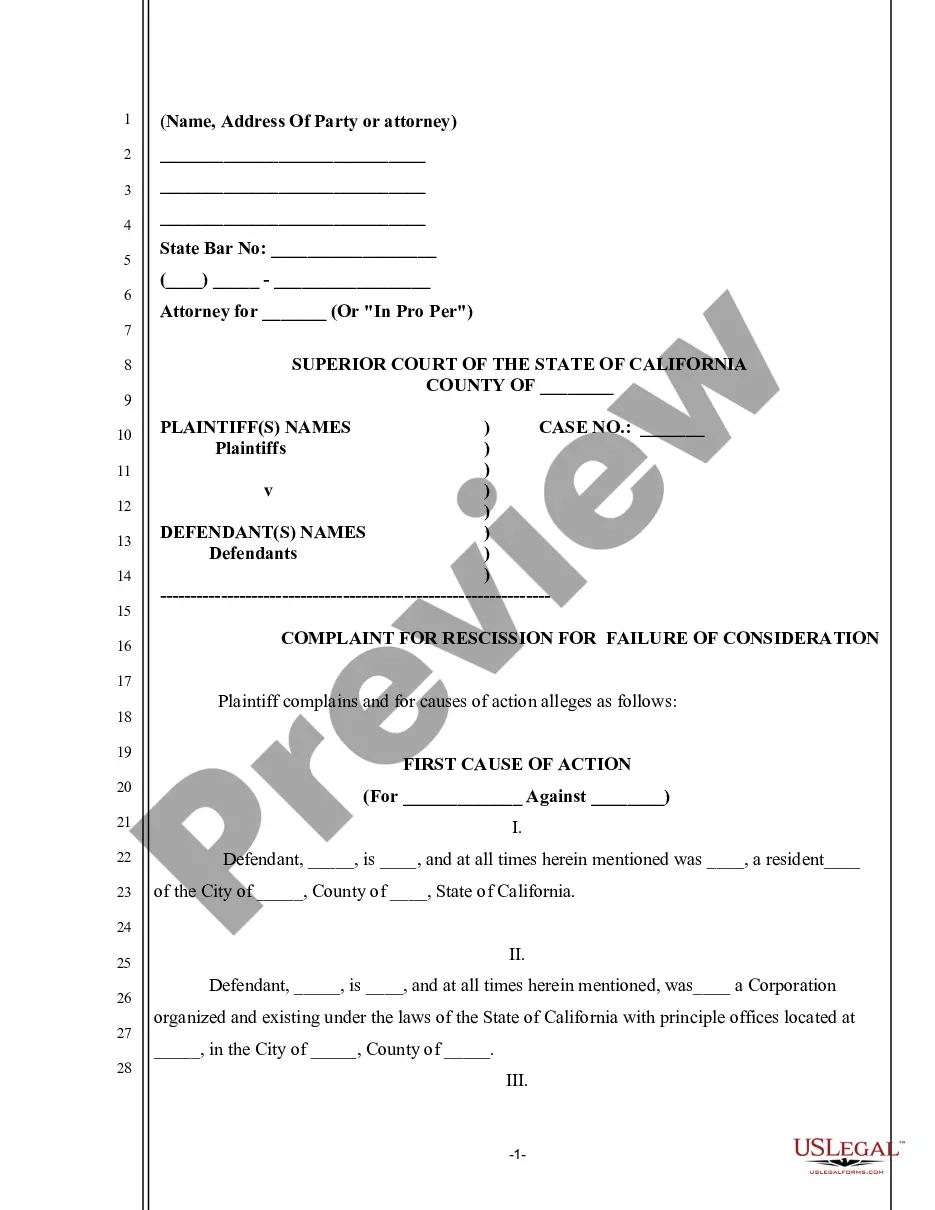

How to fill out Insurance Agents Stock Option Plan?

You may commit hours on the web looking for the legitimate papers template that fits the state and federal requirements you will need. US Legal Forms supplies a huge number of legitimate forms that happen to be analyzed by experts. You can actually acquire or print out the North Dakota Insurance Agents Stock option plan from my assistance.

If you currently have a US Legal Forms account, you can log in and then click the Acquire switch. Next, you can comprehensive, change, print out, or indicator the North Dakota Insurance Agents Stock option plan. Each and every legitimate papers template you buy is your own for a long time. To obtain an additional version of the bought form, go to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site for the first time, keep to the straightforward recommendations beneath:

- Initial, make sure that you have chosen the proper papers template for your area/city that you pick. Read the form description to ensure you have selected the proper form. If readily available, use the Preview switch to appear from the papers template also.

- If you wish to get an additional model from the form, use the Research discipline to discover the template that meets your requirements and requirements.

- Upon having identified the template you would like, simply click Get now to move forward.

- Find the rates plan you would like, enter your credentials, and register for your account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal account to purchase the legitimate form.

- Find the file format from the papers and acquire it for your device.

- Make adjustments for your papers if needed. You may comprehensive, change and indicator and print out North Dakota Insurance Agents Stock option plan.

Acquire and print out a huge number of papers themes making use of the US Legal Forms site, which provides the largest collection of legitimate forms. Use expert and status-specific themes to take on your company or person needs.

Form popularity

FAQ

North Dakota Insurance Licensing State Requirements Complete an Insurance Exam Prep Course. ... Pass Your North Dakota Licensing Exam. ... Get Fingerprinted. ... Apply for North Dakota Insurance License. ... Plan to Complete Required Insurance Continuing Education (CE) Credits.

Hear this out loud PauseNorth Dakota requires that the owner of a motor vehicle carry liability, uninsured and underinsured motorist, and no-fault insurance coverages.

North Dakota state law requires that all vehicles carry the following minimum insurance coverages: Bodily injury: $25,000 per person and $50,000 per accident. Property damage: $25,000 per accident. Uninsured motorist: $25,000 per person and $50,000 per accident.

To get a life insurance license in North Dakota, you must pass the licensing exam administered at PSI test centers. Before taking the exam, a fingerprint-based criminal background check is required as part of the application process. After successfully passing the exam, you can apply for your life insurance license.