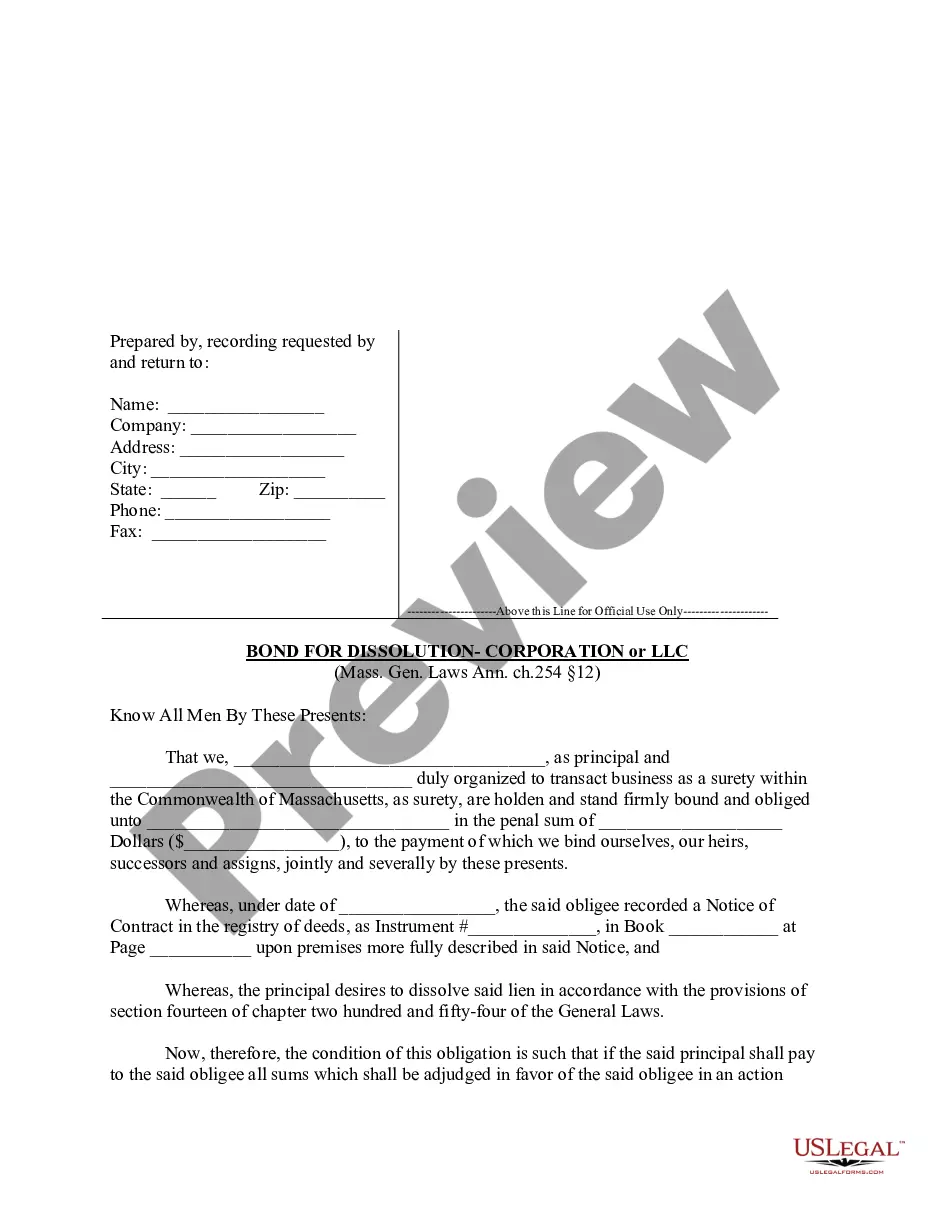

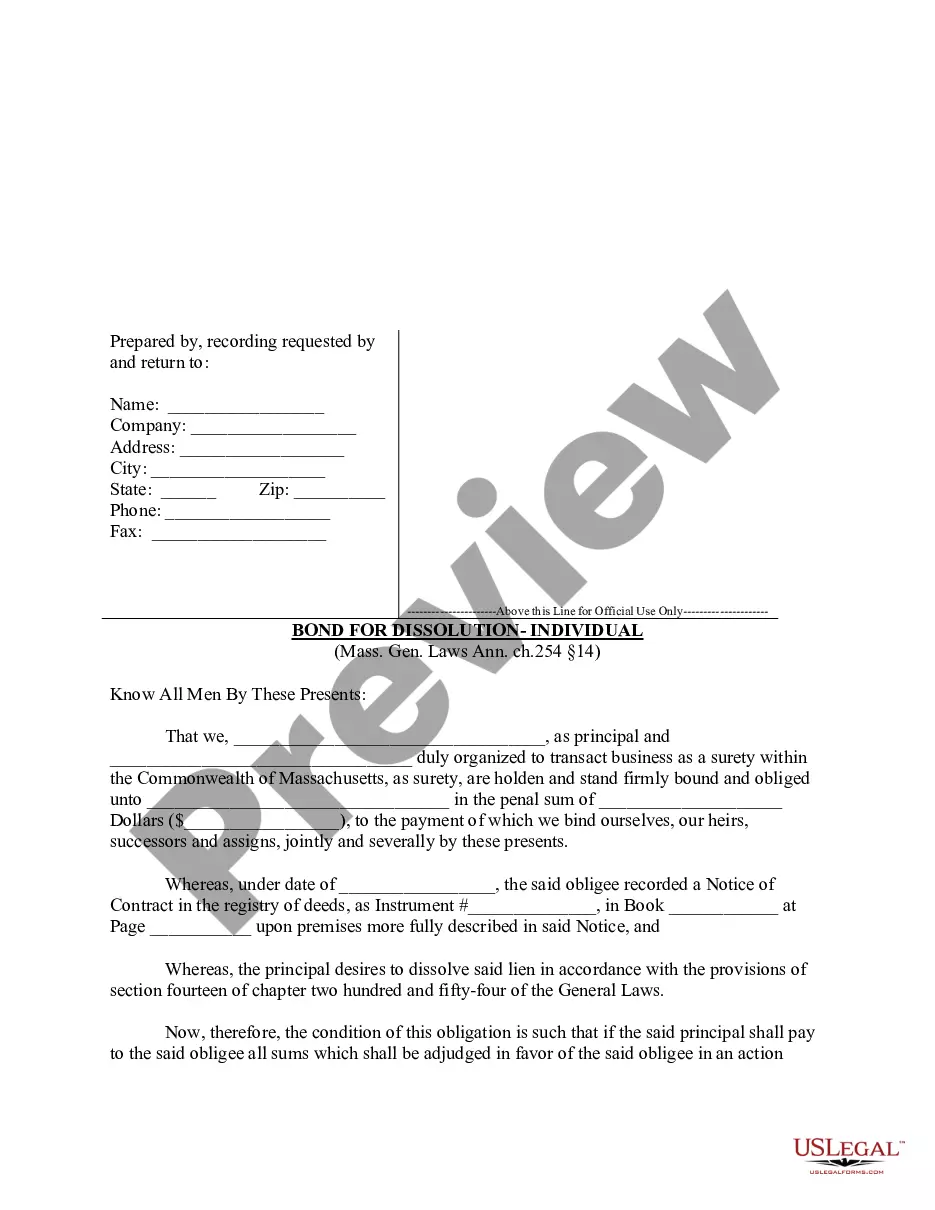

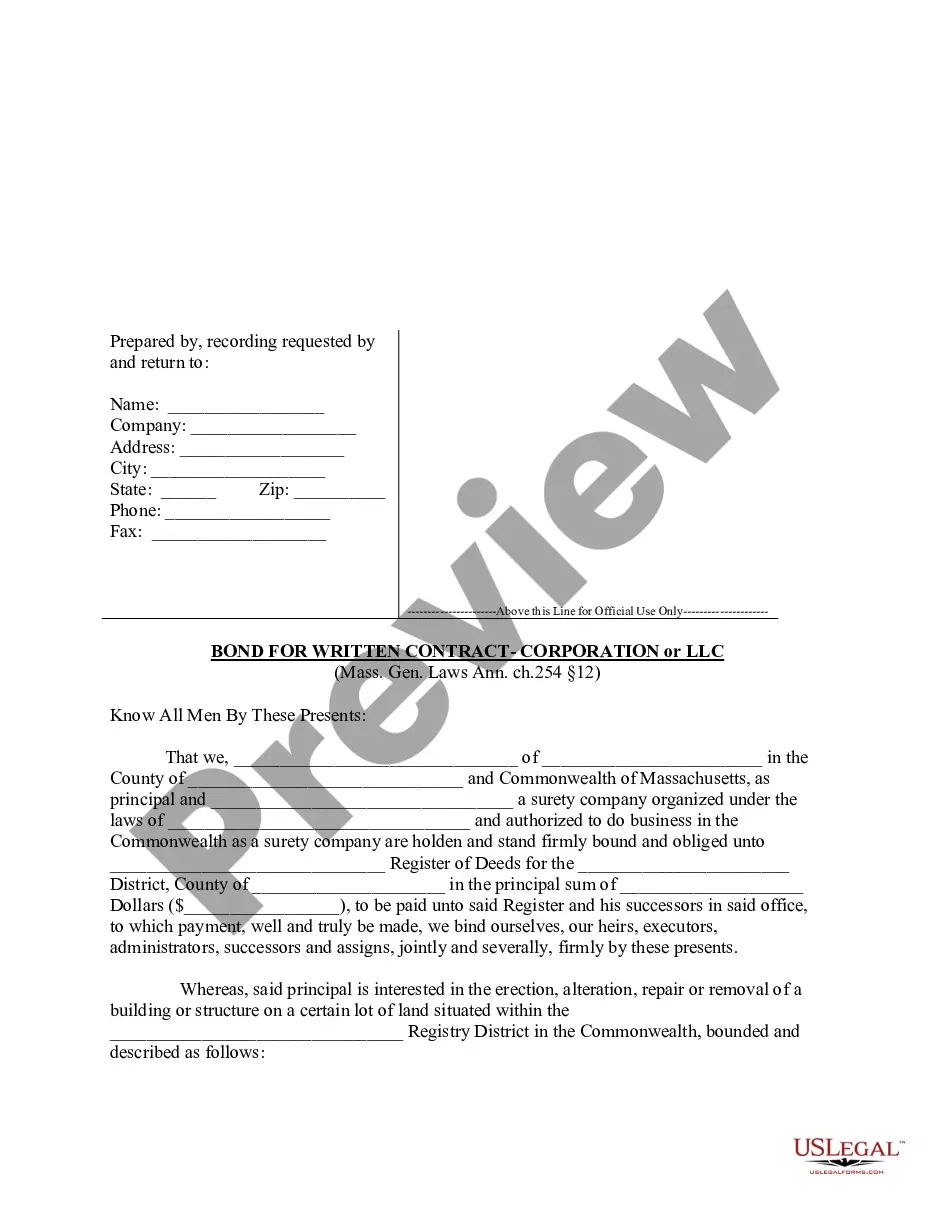

Massachusetts law provides for a very specific form with which a party with an interest in property may enter a bond equal to the amount of the contract.

Massachusetts Bond for Dissolution Form - Corporation or LLC

Description

How to fill out Massachusetts Bond For Dissolution Form - Corporation Or LLC?

You are invited to the most important legal documents collection, US Legal Forms.

Here, you can obtain any template like the Massachusetts Bond for Dissolution Form - Corporation or LLC and store as many as you desire.

Prepare official paperwork in just a few hours instead of days or weeks, without spending a fortune on an attorney.

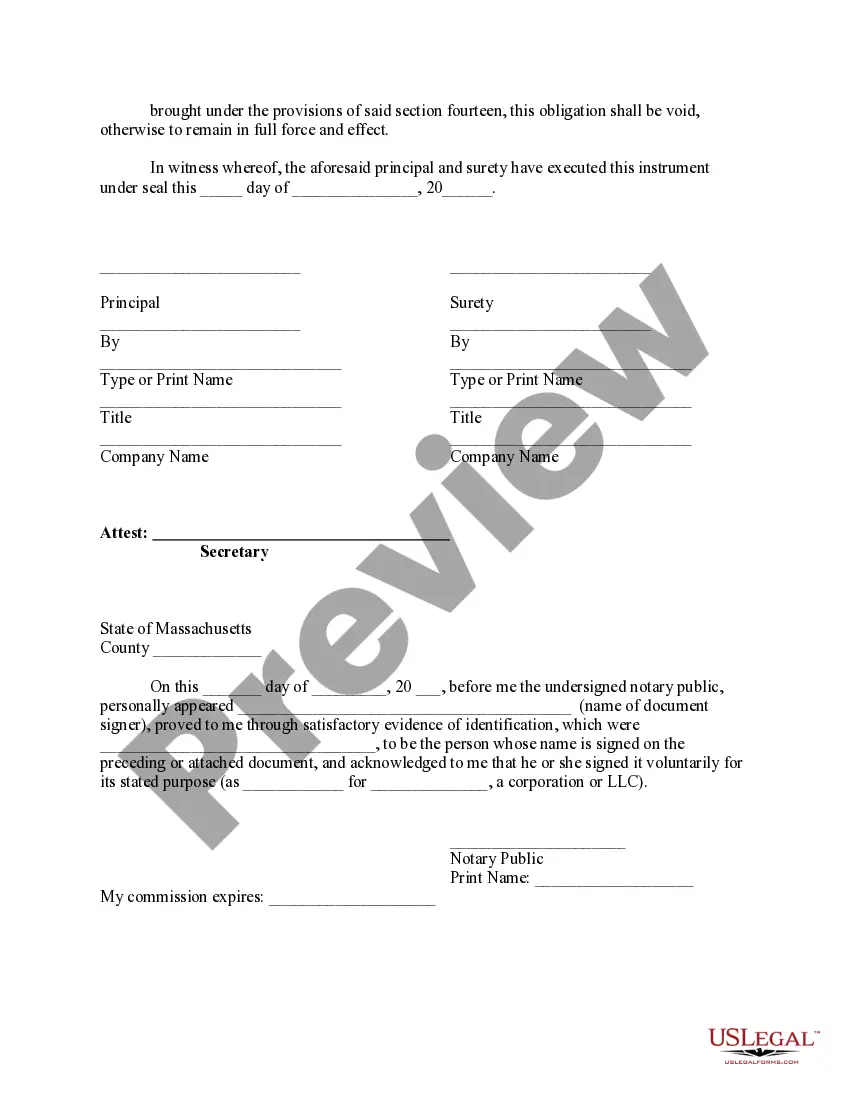

If the document meets all your needs, click Buy Now. To establish an account, select a pricing plan. Utilize a card or PayPal account to register. Store the document in your preferred format (Word or PDF). Print the document and complete it with your/your business’s details. Once you’ve completed the Massachusetts Bond for Dissolution Form - Corporation or LLC, send it to your attorney for confirmation. It's an extra measure but essential for ensuring you are comprehensively protected. Register with US Legal Forms now and gain access to a multitude of reusable samples.

- Acquire your state-specific sample in just a few clicks and feel confident knowing it was created by our qualified legal experts.

- If you are an existing subscriber, simply sign in to your account and click Download next to the Massachusetts Bond for Dissolution Form - Corporation or LLC you require.

- Being web-based, US Legal Forms ensures you will always have access to your downloaded documents, regardless of the device you are on.

- Review them in the My documents section.

- If you still do not have an account, what are you waiting for? Follow our instructions below to get started.

- If the document is state-specific, verify its relevance in your residing state.

- Examine the description (if available) to determine if it is the appropriate template.

- Explore more details using the Preview feature.

Form popularity

FAQ

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Under the primary BCA procedure, your corporation is dissolved through action by your board of directors followed by a shareholder vote. More specifically, your board of directors must adopt and submit a proposal to dissolve to the shareholders. The shareholders must then vote on the proposal at a shareholder meeting.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

The power of the Secretary of State, however, is broad, and in many states, an LLC can be dissolved for nearly any reason the Secretary deems fit. Voluntary dissolution is the result of members willingly choosing to close their business.

Step 1: Hold a Board Meeting and Seek Shareholder Approval. Step 2: File a Certificate of Dissolution with the Secretary of State. Step 3: Notify the Internal Revenue Service and Other Taxing Authorities. Step 4: Formal Notice of Dissolution. Step 5: Settle Claims with Creditors.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.