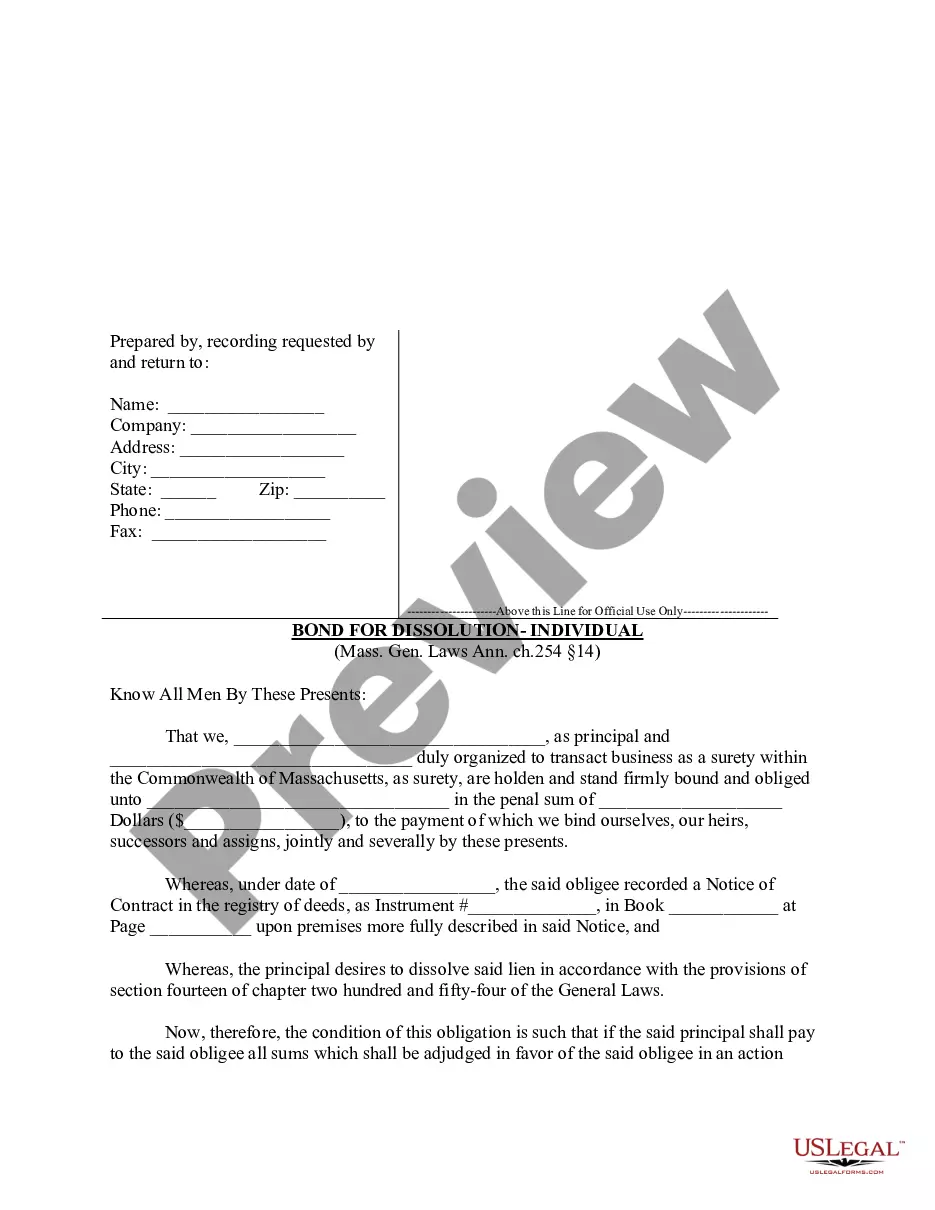

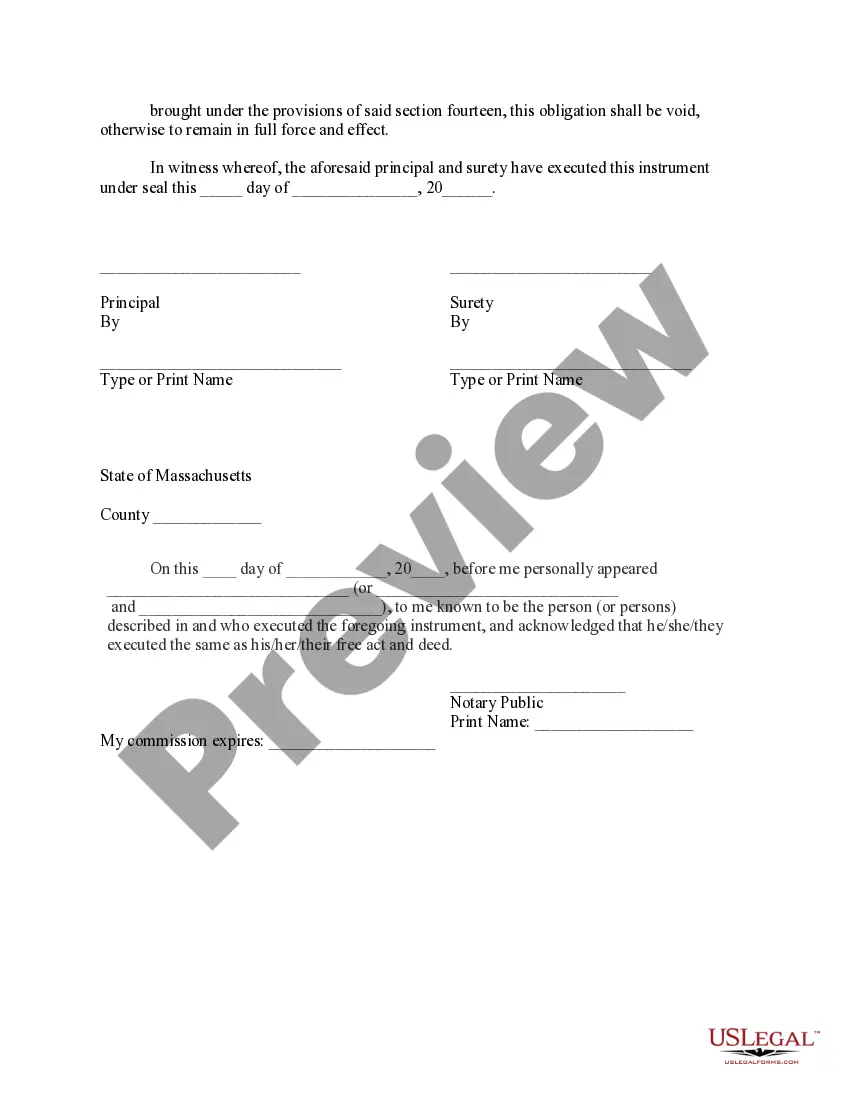

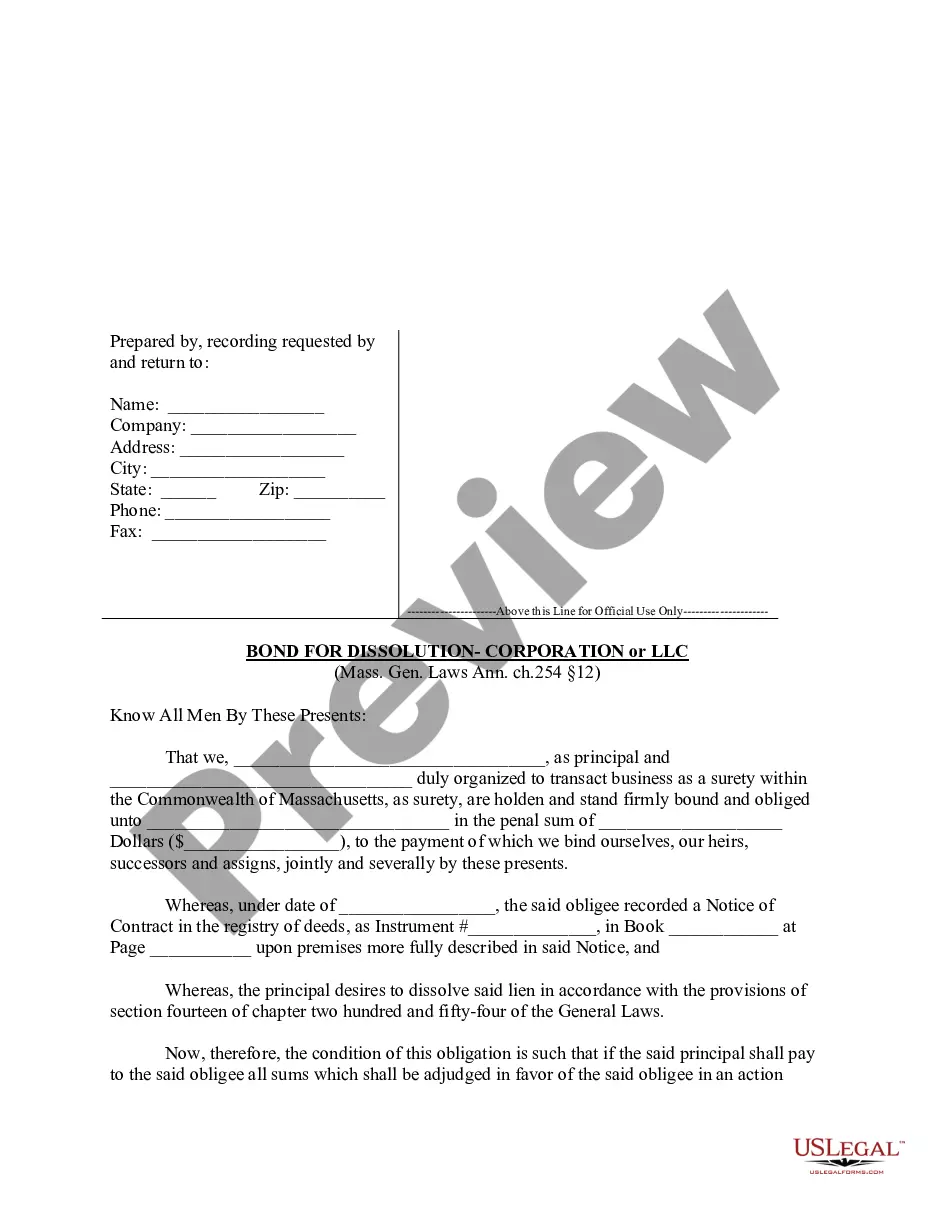

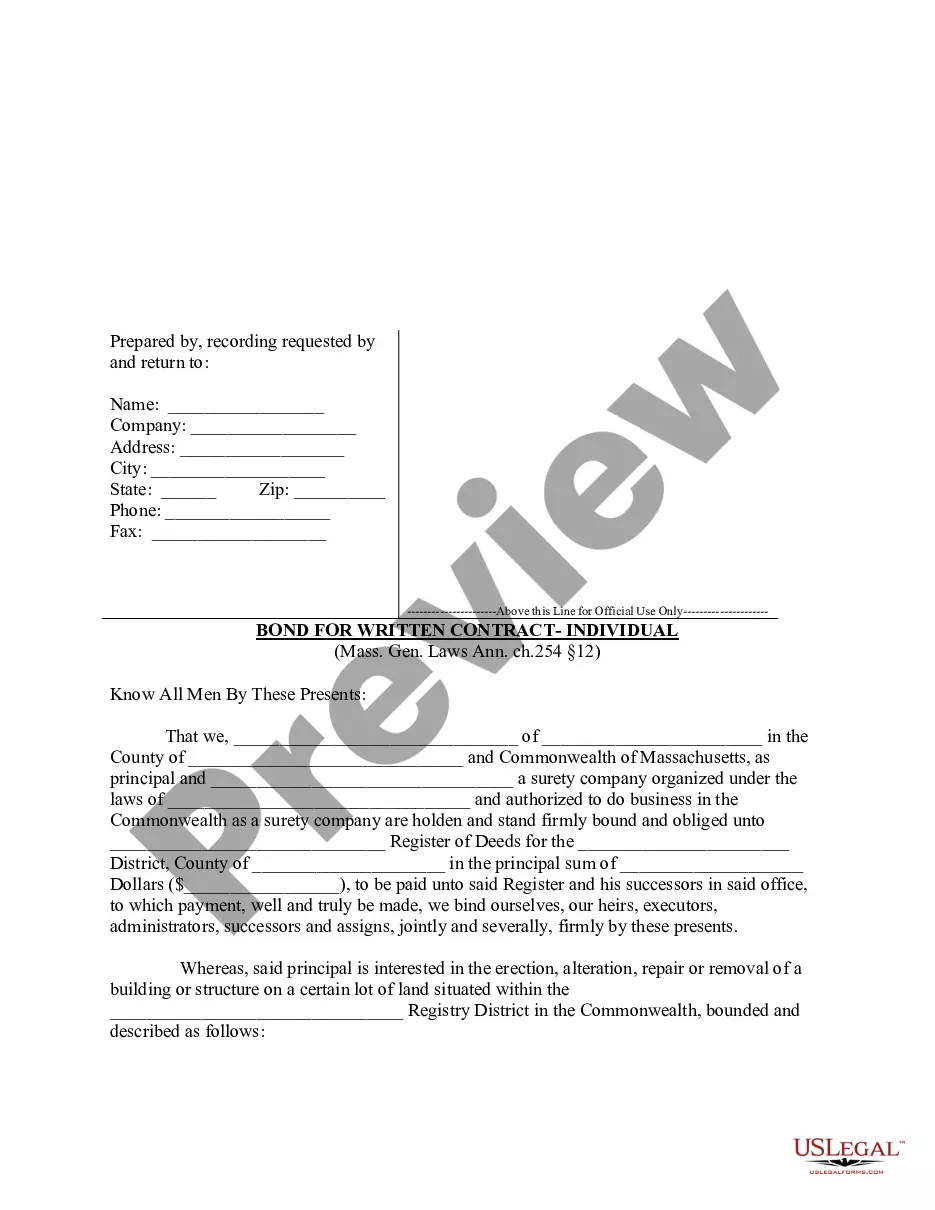

Massachusetts law provides for a very specific form with which a party with an interest in property may enter a bond equal to the amount of the contract.

Massachusetts Bond for Dissolution Form - Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Bond For Dissolution Form - Individual?

You are invited to the most important legal documents repository, US Legal Forms.

Here you will discover any template, including Massachusetts Bond for Dissolution Form - Individual templates, and download them as many as you desire/require.

Prepare official documents within a few hours, instead of days or weeks, without spending a fortune on an attorney. Obtain your state-specific sample in just a few clicks and feel assured knowing it was created by our state-certified lawyers.

See additional content using the Preview feature. If the document meets your requirements, click Buy Now. To create an account, select a pricing plan. Use a credit card or PayPal account to subscribe. Save the template in the format you need (Word or PDF). Print the document and fill it out with your or your business’s information. Once you’ve completed the Massachusetts Bond for Dissolution Form - Individual, send it to your attorney for review. It’s an extra step but a necessary one to ensure you’re completely protected. Register for US Legal Forms today and access thousands of reusable samples.

- If you’re already a subscribed user, simply Log In to your account and click Download next to the Massachusetts Bond for Dissolution Form - Individual you need.

- Because US Legal Forms is online, you’ll always have access to your downloaded documents, regardless of the device you’re using.

- View them within the My documents section.

- If you do not have an account yet, what are you waiting for.

- Follow our instructions listed below to get started.

- If this is a state-specific template, verify its validity in your state.

- Review the description (if available) to determine if it’s the right template.

Form popularity

FAQ

A Form PC-F. an officer's certificate; and. a petition for administrative dissolution.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

Massachusetts requires business owners to submit their Certificate of Cancellation by mail, fax, or in-person. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock.