North Dakota Miller Trust Forms for Medicaid

Description

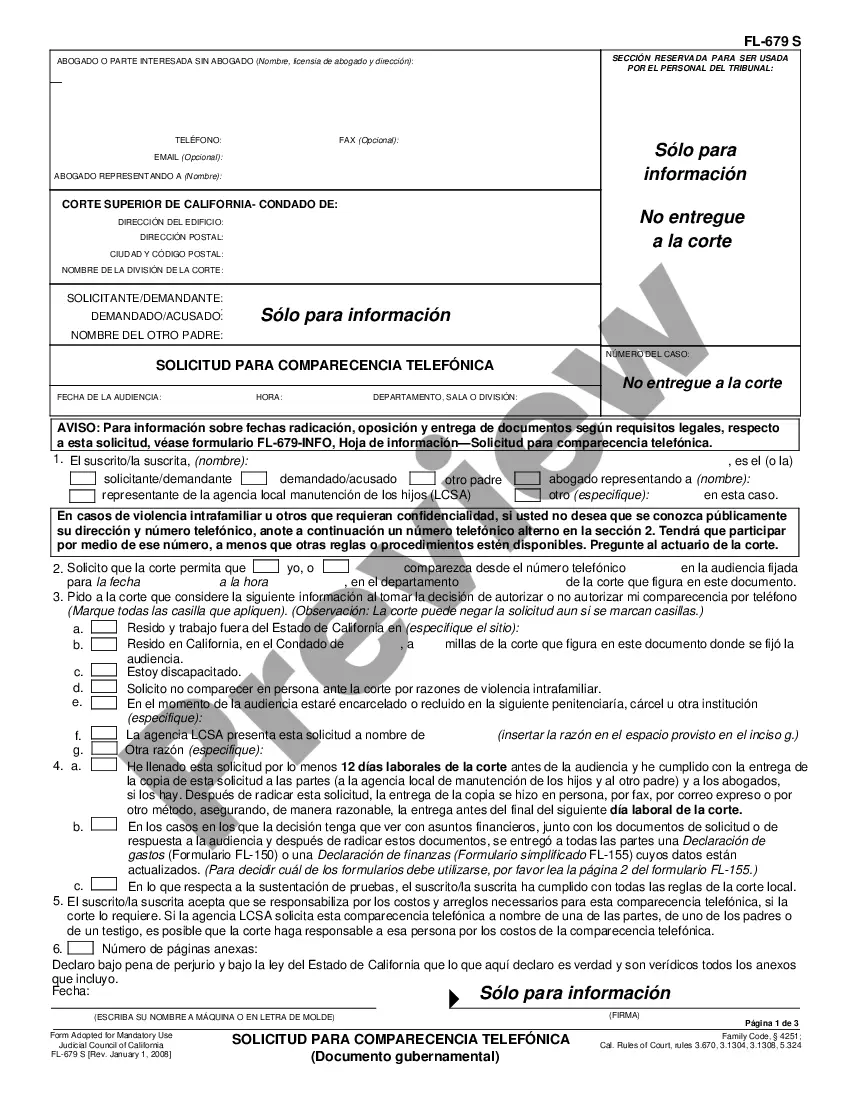

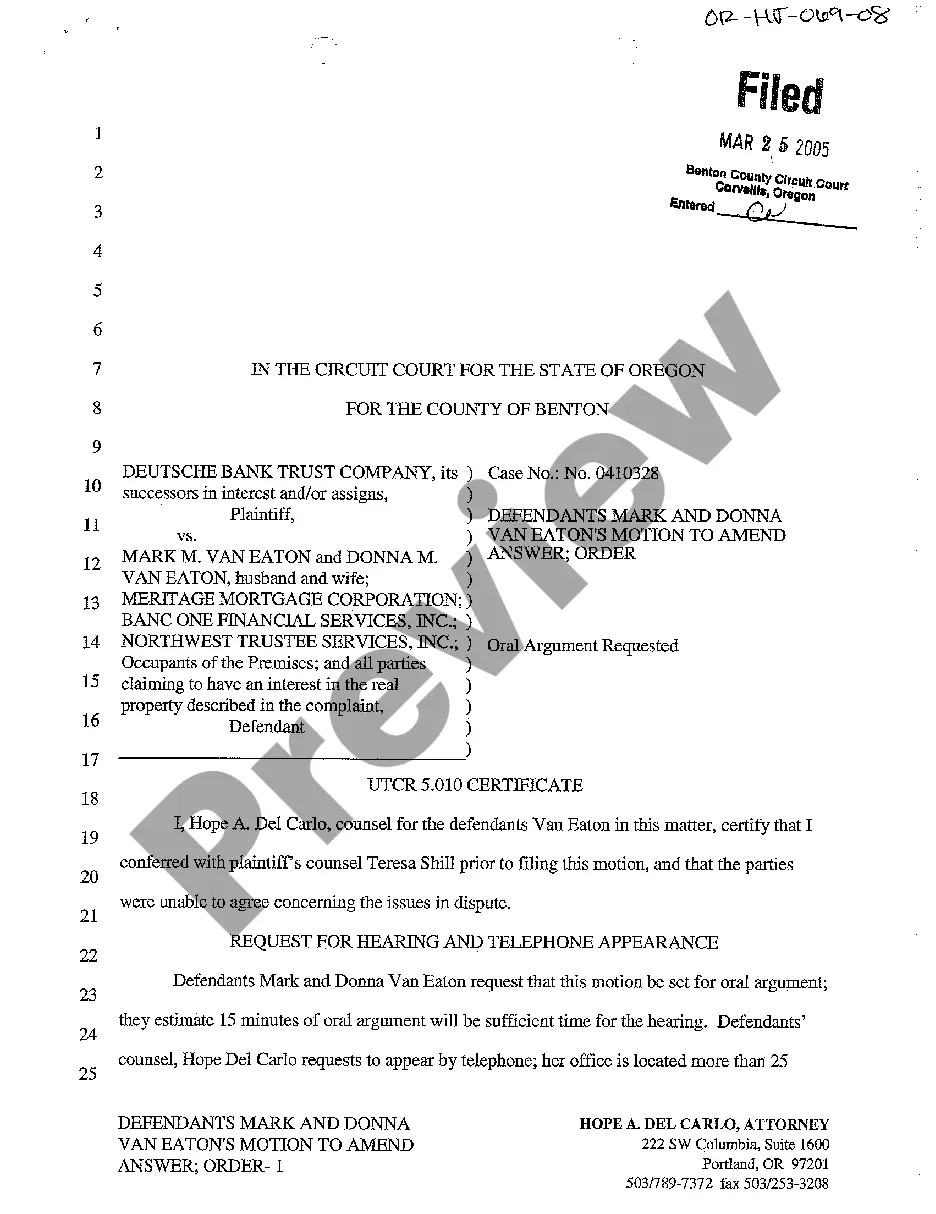

How to fill out Miller Trust Forms For Medicaid?

Selecting the ideal licensed document template can be a challenge. Obviously, there is a multitude of templates available online, but how can you find the legal form you require? Visit the US Legal Forms website.

The platform offers a vast selection of templates, including the North Dakota Miller Trust Forms for Medicaid, suitable for both business and personal needs. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to locate the North Dakota Miller Trust Forms for Medicaid. Utilize your account to browse the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you require.

Select the document format and download the legal document template to your device. Complete, edit, print, and sign the downloaded North Dakota Miller Trust Forms for Medicaid. US Legal Forms is the largest repository of legal templates where you can find various document forms. Use the service to acquire professionally crafted documents that comply with state regulations.

- Firstly, confirm that you have selected the correct form for your city/state.

- You can review the form using the Review button and read the form description to ensure it is suitable for you.

- If the form does not satisfy your criteria, employ the Search field to find the appropriate form.

- When you are certain the form is accurate, click the Acquire now button to obtain the form.

- Choose the pricing option you prefer and input the necessary information.

- Create your account and pay for the transaction using your PayPal account or credit card.

Form popularity

FAQ

The primary benefit of a Miller trust is that it allows individuals to qualify for Medicaid while keeping certain assets and income. By using North Dakota Miller Trust Forms for Medicaid, you can effectively manage your financial resources without losing your eligibility. This trust helps ensure you receive the medical care you need while maintaining some financial security.

Setting up a Miller's trust involves several key steps. First, download the North Dakota Miller Trust Forms for Medicaid from a trusted source. Next, gather your financial documents and complete the forms accurately. Finally, submit your application to your local Medicaid office to secure your eligibility and benefits.

To establish a Miller trust, start by filling out the North Dakota Miller Trust Forms for Medicaid. Obtain the necessary documentation, including income details and eligibility criteria. Once completed, submit the forms to the appropriate agency for approval. This process ensures that you meet Medicaid requirements while protecting your income.

Several trusts, like irrevocable trusts or the Miller Trust, often qualify for exempt status under Medicaid guidelines. These trusts are specifically tailored to protect income and assets from Medicaid eligibility assessments. Properly set up, they offer significant advantages while applying for Medicaid benefits. Using North Dakota Miller Trust Forms for Medicaid can help you navigate the requirements and create a compliant trust.

Certain assets remain protected from Medicaid claims, including your home, personal effects, and a vehicle. Moreover, designed trusts like the Miller Trust can safeguard your income while you qualify for Medicaid. Understanding the specifics of these protections is crucial for planning. North Dakota Miller Trust Forms for Medicaid simplify this process and provide necessary documentation.

Medicaid typically reviews trust funds during the eligibility determination process. Depending on the type of trust, the funds may be considered part of your available resources. A properly established Miller Trust can help shield your income from being counted against Medicaid limits. Using North Dakota Miller Trust Forms for Medicaid can ensure your trust is compliant.

Yes, Medi-Cal can pursue recovery from certain trusts in specific situations. However, trusts established for specific needs, like a Miller Trust, may offer protection from such claims. It's essential to structure these trusts correctly to maintain their benefits. North Dakota Miller Trust Forms for Medicaid can help guide you through this process.

In North Dakota, certain assets do not count against Medicaid eligibility. For instance, your primary residence, personal belongings, and a car may be exempt. Additionally, a Miller Trust can help you qualify for Medicaid while protecting some income. Utilizing North Dakota Miller Trust Forms for Medicaid can assist you in managing your assets effectively.

A Medicaid income trust, often referred to as a Miller Trust, allows individuals to qualify for Medicaid while maintaining a higher income than the state limits. When you establish a Miller Trust, your excess income is deposited into the trust, which Medicaid does not consider while assessing your eligibility. Utilizing North Dakota Miller Trust Forms for Medicaid can streamline this process, providing you with a clear path to access crucial services without sacrificing your financial stability.

The total amount of personal countable assets exempt from the Medicaid spend down requirement varies by state and situation. In North Dakota, certain types of property such as a primary residence and personal items may be considered exempt. By completing the North Dakota Miller Trust Forms for Medicaid, you can potentially protect more assets while still meeting all Medicaid requirements.