North Dakota Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

Through the website, you can discover thousands of forms for both business and personal use, categorized by types, states, or keywords.

You can find the latest versions of forms such as the North Dakota Miller Trust Forms for Assisted Living in just a few minutes.

Check the form summary to confirm you have selected the right document. If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

When you are satisfied with the form, validate your choice by clicking the Acquire now button. Next, choose the pricing plan you want and provide your details to register for an account.

- If you already have a monthly subscription, Log In and download the North Dakota Miller Trust Forms for Assisted Living from the US Legal Forms library.

- The Download button will appear on every form you review.

- You can access all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get going.

- Ensure you have selected the appropriate form for your area/state.

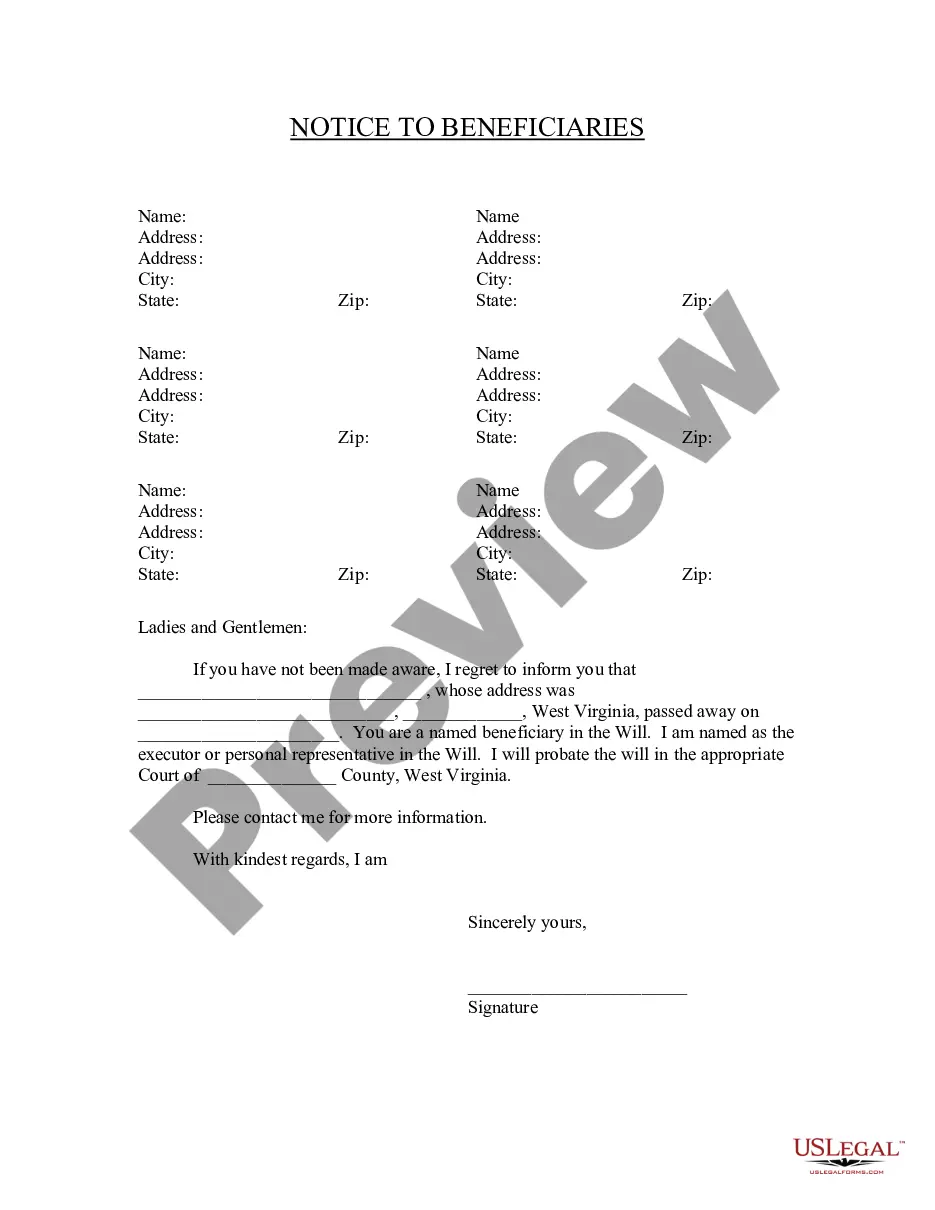

- Click the Preview button to review the form's content.

Form popularity

FAQ

Miller Trusts are allowed in various states as a strategy to meet Medicaid income limits. Each state has its requirements and processes for establishing these trusts. To navigate this complex area effectively, consider using North Dakota Miller Trust Forms for Assisted Living through US Legal Forms, where you can find comprehensive guidance and document templates designed to simplify your experience.

Miller Trusts, also known as Qualified Income Trusts, are available in many states to help individuals qualify for Medicaid benefits while preserving some assets. It is crucial to check each state’s specific regulations. If you're looking into North Dakota Miller Trust Forms for Assisted Living, your best course would be to review North Dakota’s implementation of Miller Trusts and any relevant guidelines.

Silent trusts, often utilized for privacy and asset protection, are recognized in several states. However, the specifics can differ. If you are considering North Dakota Miller Trust Forms for Assisted Living, it is essential to understand how your state views silent trusts. Consulting with a legal expert can provide clarity on your options.

While you can set up a Miller trust yourself using North Dakota Miller Trust Forms for Assisted Living available online, consulting a lawyer is often beneficial. A legal expert can guide you through complex regulations and ensure the trust aligns with your needs and goals. You’ll want the setup to meet legal standards, especially regarding Medicaid eligibility. Engaging a professional can save you time and prevent costly mistakes down the line.

Yes, North Dakota Medicaid does cover assisted living services, but eligibility depends on various factors. Utilizing North Dakota Miller Trust Forms for Assisted Living can assist individuals in meeting the financial criteria for Medicaid. This trust can help increase your income while still qualifying for assistance. Be sure to check the latest Medicaid guidelines to understand your benefits fully.

A trust fund, including a Miller trust, can be used for a variety of expenses, but it must adhere to specific guidelines. For individuals using North Dakota Miller Trust Forms for Assisted Living, the funds typically cover necessary living expenses like housing, food, and medical care. However, certain items may be restricted based on Medicaid regulations. Therefore, understanding the rules can help you optimize your trust fund usage effectively.

Filling out a trust fund, particularly with North Dakota Miller Trust Forms for Assisted Living, requires you to provide clear and accurate information. Begin by gathering the necessary documents, such as identification and financial records. Next, follow the instructions on the forms carefully to ensure that you complete each section correctly. If you need assistance, consider using platforms like US Legal Forms to simplify the process and enhance accuracy.