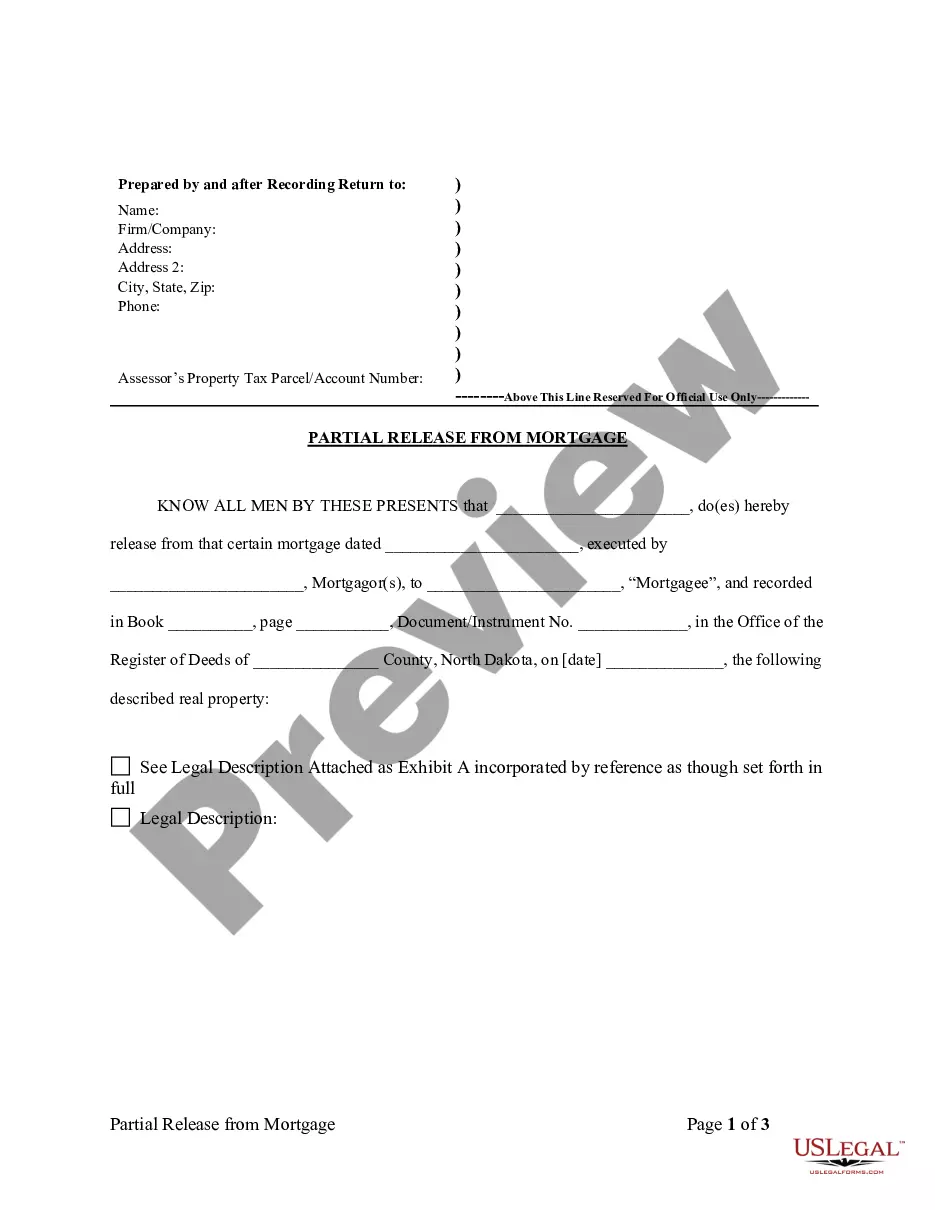

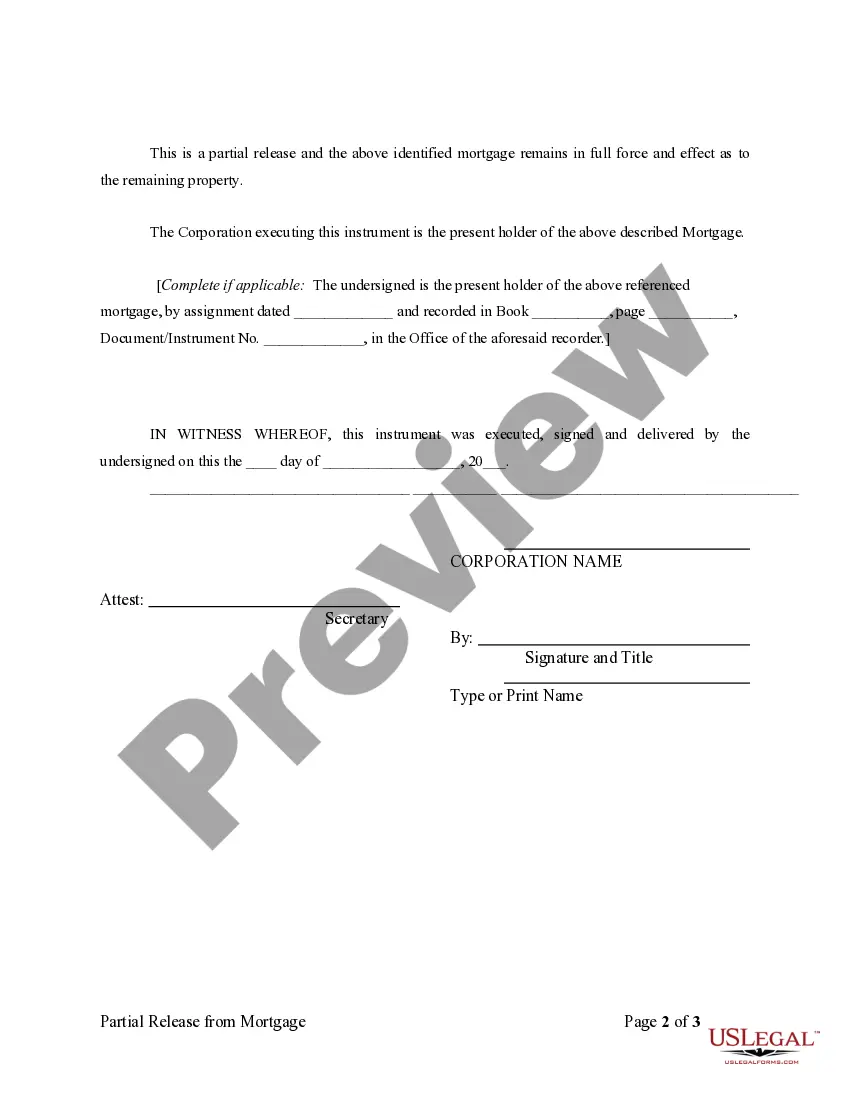

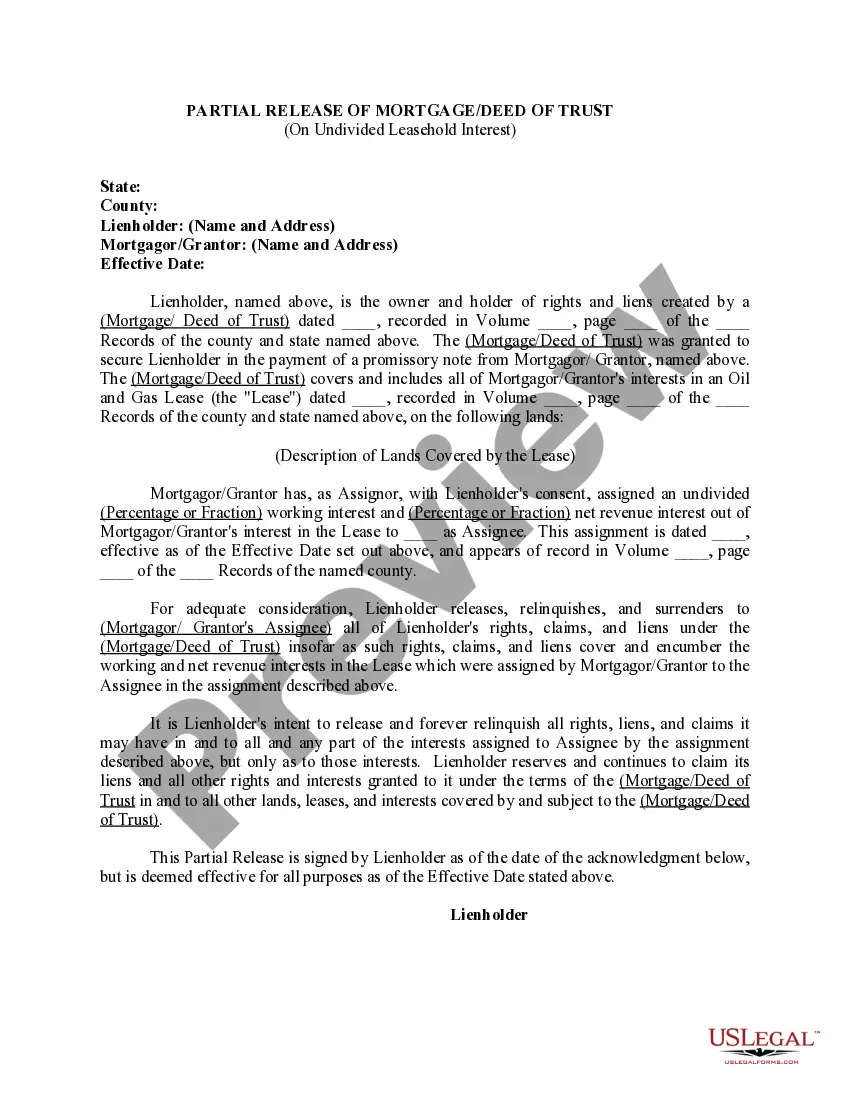

North Dakota Partial Release of Property From Mortgage for Corporation

Description

How to fill out North Dakota Partial Release Of Property From Mortgage For Corporation?

Avoid costly lawyers and find the North Dakota Partial Release of Property From Mortgage for Corporation you want at a reasonable price on the US Legal Forms website. Use our simple categories function to search for and download legal and tax files. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables customers with step-by-step instructions on how to download and complete every template.

US Legal Forms clients merely need to log in and obtain the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the guidelines below:

- Make sure the North Dakota Partial Release of Property From Mortgage for Corporation is eligible for use where you live.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you are confident the template fits your needs, click Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, it is possible to fill out the North Dakota Partial Release of Property From Mortgage for Corporation by hand or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Closing costs: ~1-3% While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing. Based on the average home value in North Dakota of $238,000, that roughly translates to $2,000 to $7,000.

Lawrence Yun, Chief Economist with the National Association of Realtors. Yun believes that mortgage rates will remain stable in 2021 with the potential for a slight increase from the all-time low of 2.71% we saw in 2020 for 30-year, fixed rate mortgages.

Closing costs typically range from 3% to 6% of the home's purchase price. 1feff Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so it's important to pay close attention to these fees.

The mortgage rates trend continued to decline until rates dropped to 3.31% in November 2012 the lowest level in the history of mortgage rates.

The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5% of the home value. True enough, but even on a $150,000 house, that means closing costs could be anywhere between $3,000 and $7,500 that's a huge range!

Average closing costs for the buyer run between about 2% and 5% of the loan amount. That means, on a $300,000 home purchase, you would pay from $6,000 to $15,000 in closing costs. The most cost-effective way to cover your closing costs is to pay them out-of-pocket as a one-time expense.

As a general rule, expect to pay about $35 a month for every $100,000 in home value. For example, if you buy a home worth $200,000, you'll likely pay about $70 per month for homeowners insurance. This means that your lender might require you to pay $840 into an escrow fund at closing.

2016 held the lowest annual mortgage rate on record going back to 1971. Freddie Mac says the typical 2016 mortgage was priced at just 3.65%. Mortgage rates had dropped lower in 2012, when one week in November averaged 3.31%.

Can you get a 30-year home loan as a senior? First, if you have the means, no age is too old to buy or refinance a house. The Equal Credit Opportunity Act prohibits lenders from blocking or discouraging anyone from a mortgage based on age.