North Carolina Document Locator and Personal Information Package including burial information form

What this document covers

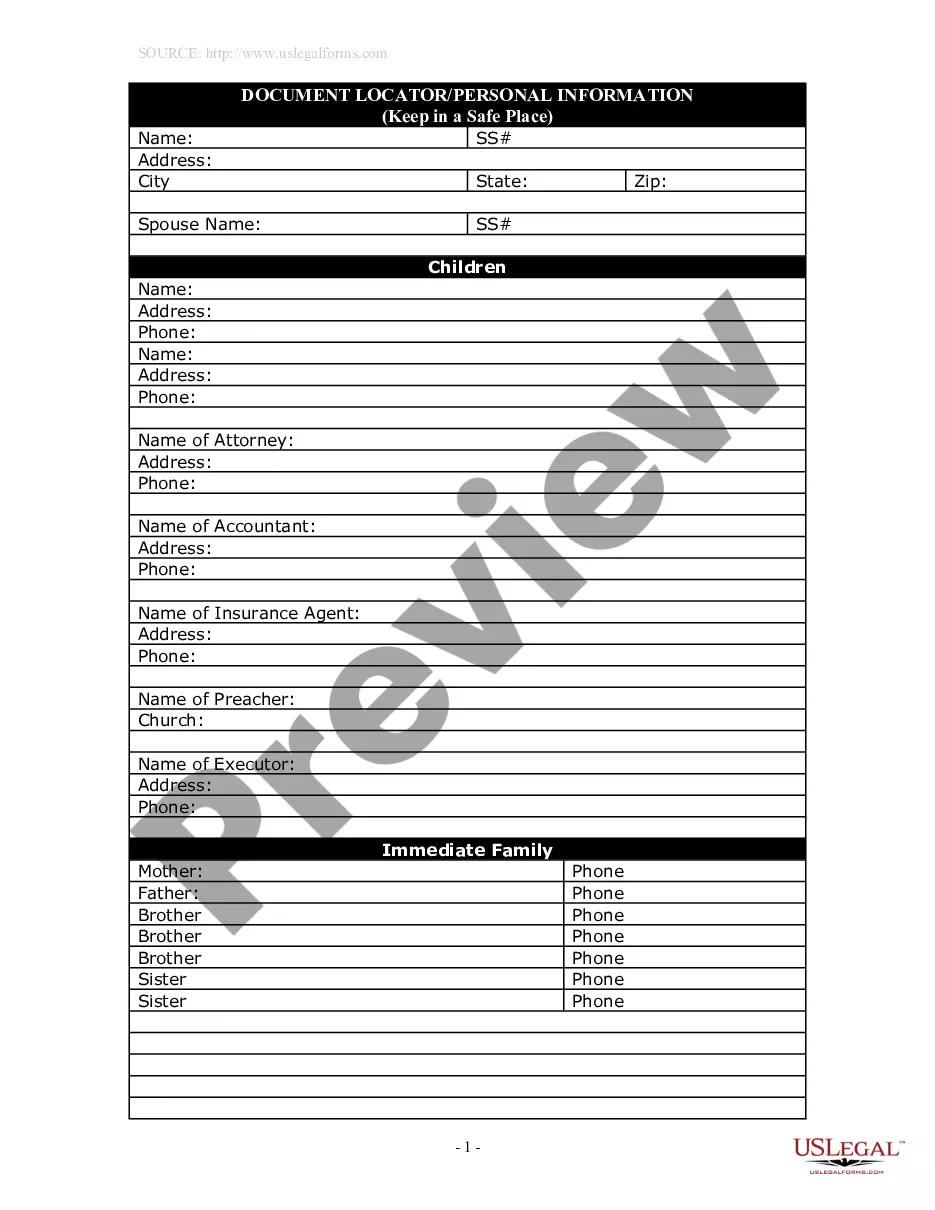

The Document Locator and Personal Information Package is designed to help individuals organize essential personal information and burial desires. This package stands out by not only listing important documents but also allowing you to record final wishes and messages to loved ones. It ensures that your relatives have a clear understanding of where specific documents are located and what your preferences are regarding burial and funeral arrangements.

Form components explained

- Personal Information section for listing family members and important contacts.

- Document Locator for identifying the location of essential documents.

- Burial Information section providing details about cemetery choices and preferences.

- Funeral Expense Information including service directions and asset lists.

- Message section for conveying final messages to loved ones.

Situations where this form applies

This form is useful in various scenarios, such as when planning for end-of-life decisions, preparing for estate management, or ensuring that family members are informed about your important documents and burial wishes. It is especially helpful for individuals looking to provide clarity for their loved ones during a challenging time.

Who can use this document

- Individuals planning their estate or organizing personal information.

- Persons preparing for end-of-life decisions and want to communicate their wishes.

- Families seeking a structured way to maintain important documents and information.

Instructions for completing this form

- Gather personal information for yourself and your family members, including names and contact details.

- Locate essential documents and record their names and physical locations in the Document Locator section.

- Fill in the Burial Information section with details about your cemetery preferences and any specific instructions.

- Add a message to loved ones that you would like to convey as part of your last wishes.

- Store this package in a safe location and communicate its whereabouts to trusted family members.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not updating the document locator as personal circumstances change.

- Failing to communicate the existence and location of this form to family members.

- Leaving out critical information regarding burial wishes or personal documents.

Why complete this form online

- Easy access and convenience for filling out personal information securely from home.

- Ability to edit and update information as needed without the hassle of reprinting forms.

- Form templates drafted by licensed attorneys, ensuring legal reliability and comprehensiveness.

Quick recap

- The Document Locator and Personal Information Package helps streamline essential end-of-life information.

- It's vital for ensuring that family members know your preferences regarding burial and important documents.

- Completing this form can provide peace of mind and clarity for you and your loved ones.

Looking for another form?

Form popularity

FAQ

If you are a close family member to the deceased, you might be able to get your own copy of the autopsy report for your genealogy records.If you want an autopsy report, note the county where the individual lived and died. You can start by looking up the county or state medical examiner's office on the Internet.

Autopsy results are not public records, and are available only to those legally entitled to receive them.

The North Carolina (NC) state sales tax rate is currently 4.75%. Depending on local municipalities, the total tax rate can be as high as 7.5%. County and local taxes in most areas bring the sales tax rate to 6.75%7% in most counties but some can be as high as 7.5%.

What items are subject to use tax. Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

File online - File online at the North Carolina Department of Revenue. File by mail - You can use form E-500 and file and pay through the mail, but North Carolina encourages all sellers to pay online.

Autopsy, Investigation, and Toxicology Reports: Autopsy, Investigation, and Toxicology Reports are also public records and once finalized, may be obtained from the OCME. To request any of these documents, please visit www.ocme.dhhs.nc.gov and click on the Document Request link on the left side.

F0f0 If you have overpaid your tax liability for a previously filed period, complete Form E-588, Business Claim for Refund State and County Sales and Use Taxes. marked Amended Return in the coupon booklet or write Amended at the top of a Form E-500 to report corrections for that period.

Honorably discharged North Carolina veterans who are 100% permanently and totally disabled by the VA are eligible for up to a $45,000 deduction in the assessed value of their home for property tax purposes. The surviving spouse is also eligible if they are drawing DIC from the VA.

Enter your business contact and sales tax ID number, then choose File E-500 and pay the full amount online. From the drop-down menu, select the month, date, and year. Enter your gross receipts for the reporting period in the NC Gross Receipts box 1.