North Carolina Assignment of Promissory Note & Liens

Description

How to fill out Assignment Of Promissory Note & Liens?

Finding the right legitimate record web template can be a have difficulties. Naturally, there are a lot of themes accessible on the Internet, but how would you obtain the legitimate type you want? Utilize the US Legal Forms web site. The support offers a large number of themes, for example the North Carolina Assignment of Promissory Note & Liens, that can be used for business and personal requirements. All of the varieties are inspected by specialists and fulfill federal and state requirements.

Should you be already authorized, log in to your bank account and click the Download key to obtain the North Carolina Assignment of Promissory Note & Liens. Make use of your bank account to search through the legitimate varieties you might have ordered earlier. Check out the My Forms tab of the bank account and acquire another version in the record you want.

Should you be a whole new consumer of US Legal Forms, listed below are straightforward recommendations for you to follow:

- Very first, make certain you have chosen the correct type for the city/state. You are able to check out the form utilizing the Preview key and browse the form description to guarantee it will be the best for you.

- When the type fails to fulfill your preferences, use the Seach industry to obtain the proper type.

- Once you are sure that the form is suitable, go through the Buy now key to obtain the type.

- Pick the costs plan you desire and enter the needed information. Build your bank account and pay money for your order utilizing your PayPal bank account or bank card.

- Opt for the submit file format and download the legitimate record web template to your gadget.

- Total, change and print and indicator the obtained North Carolina Assignment of Promissory Note & Liens.

US Legal Forms will be the greatest collection of legitimate varieties in which you can find different record themes. Utilize the company to download professionally-manufactured papers that follow status requirements.

Form popularity

FAQ

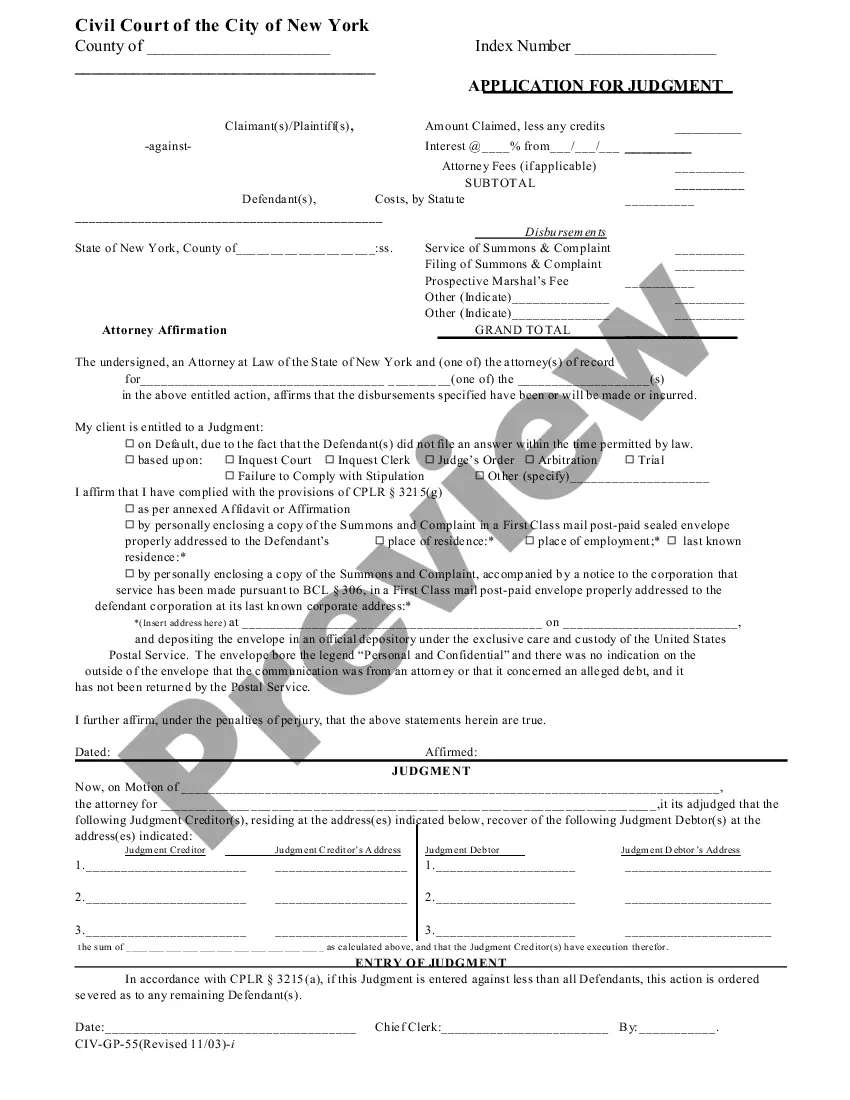

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

3 Year Statute of Limitations on Most Debts in North Carolina. In North Carolina, Section 1-52.1 of the North Carolina Rules of Civil Procedure explains the statute of limitations for debts is 3 years for auto and installment loans, promissory notes, and credit cards.

Promissory notes are generally governed by state law. The most common restrictions cover interest rates and secured loans.

Promissory notes have a statute of limitations. Depending on which U.S. state you live in, a written loan agreement may expire 3?15 years after creation.

A Standard Document used for transferring an interest in an unsecured promissory note to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

Promissory notes have a statute of limitations. Depending on which U.S. state you live in, a written loan agreement may expire 3?15 years after creation.

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Once you sign the promissory note, it's official ? you're on the hook for the mortgage payments. If the lender has agreed to the assumption, they'll also release the seller from all obligations related to the loan.