North Carolina Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

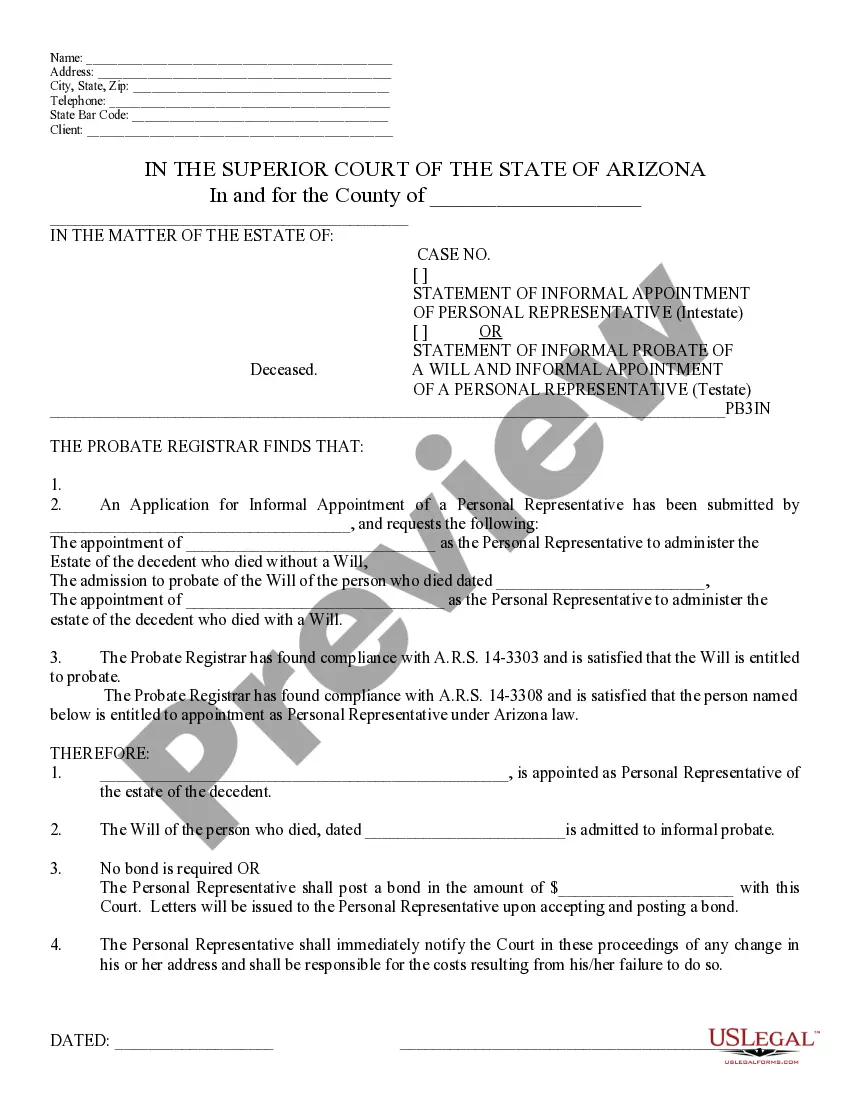

Finding the right legal file design can be a struggle. Needless to say, there are a variety of themes accessible on the Internet, but how do you find the legal form you want? Make use of the US Legal Forms site. The assistance gives a huge number of themes, like the North Carolina Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which you can use for company and personal requires. All the forms are examined by professionals and fulfill federal and state requirements.

In case you are currently authorized, log in in your account and click the Obtain option to obtain the North Carolina Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Utilize your account to look throughout the legal forms you might have ordered earlier. Visit the My Forms tab of your account and obtain yet another copy in the file you want.

In case you are a brand new customer of US Legal Forms, listed here are straightforward recommendations for you to follow:

- First, make sure you have chosen the appropriate form for your personal area/state. You are able to look through the shape using the Preview option and look at the shape description to ensure this is basically the best for you.

- When the form fails to fulfill your expectations, take advantage of the Seach industry to obtain the proper form.

- When you are positive that the shape would work, click on the Buy now option to obtain the form.

- Pick the prices plan you want and enter in the required information and facts. Build your account and buy your order making use of your PayPal account or credit card.

- Select the document format and down load the legal file design in your gadget.

- Comprehensive, edit and print out and indication the acquired North Carolina Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

US Legal Forms is definitely the greatest catalogue of legal forms that you can discover a variety of file themes. Make use of the company to down load skillfully-created documents that follow state requirements.