North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

You might spend countless hours online attempting to locate the legal document template that fulfills the federal and state requirements you seek. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can effortlessly download or print the North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor from our platform.

If you already possess a US Legal Forms account, you may Log In and then click the Obtain button. After that, you can complete, modify, print, or sign the North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor. Each legal document template you obtain is yours indefinitely. To obtain an additional copy of the purchased form, visit the My documents tab and click the corresponding button.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make alterations to your document if necessary. You can complete, modify, sign, and print the North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor. Obtain and print numerous document templates using the US Legal Forms site, which offers the most extensive collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form details to confirm you have chosen the right template.

- If available, use the Preview button to view the document template as well.

- If you wish to get another version of the form, use the Search field to find the template that suits your needs and requirements.

- Once you have found the template you desire, click Obtain now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

Yes, in many cases, adjunct professors operate as independent contractors, especially when under a North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor. This status allows them the flexibility to manage their own schedules and choose their teaching engagements. However, it's important to review your specific contract to confirm your status. Platforms like US Legal Forms offer valuable resources to help you understand the implications of this classification.

Adjunct professors usually receive 1099 forms when working under a North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor. This classification indicates they are independent contractors rather than employees, meaning they are responsible for their taxes. However, some institutions may still classify adjuncts as employees, resulting in W2 forms. It's crucial to confirm which classification applies to your situation.

An adjunct professor is generally not classified as a traditional employee, especially under a North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor. Adjuncts typically work on a contracted basis and maintain a level of independence in their work. This distinction impacts benefits and taxes, so it's essential to understand your status clearly. Consulting with legal resources can help clarify your position.

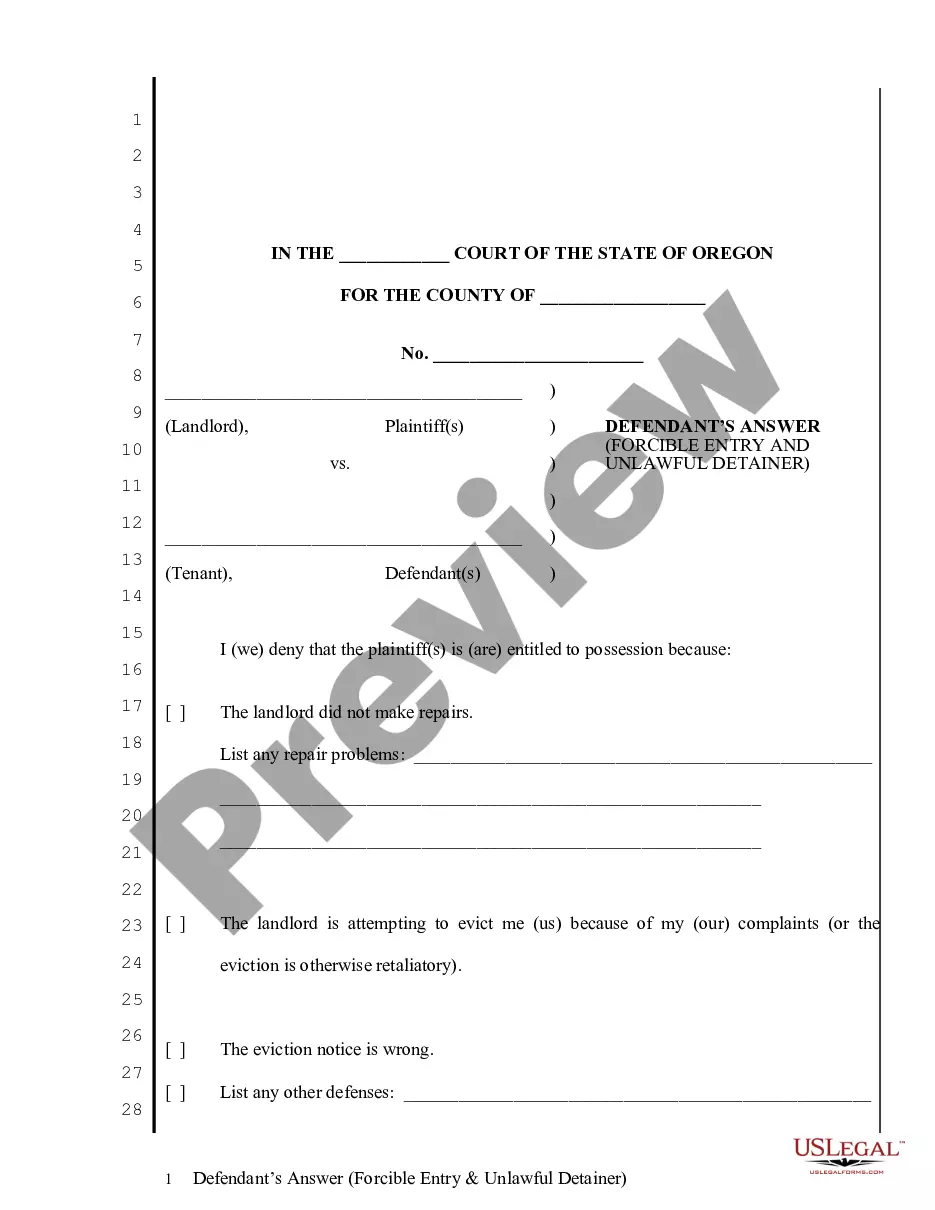

To fill out a North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor, start by gathering essential information such as your name, contact details, and scope of work. Clearly outline the services you will provide, the payment terms, and any deadlines. It's important to review state laws regarding independent contractors, as this ensures compliance. You can find convenient templates at US Legal Forms that make the process easier.

Writing an independent contractor agreement involves outlining the terms of your relationship with the contractor. Begin by stating the project scope, payment terms, and duration of the agreement, referencing the North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor if applicable. It is essential to include clauses about confidentiality and termination conditions. For a streamlined approach, U.S. Legal Forms provides templates to help you draft a professional and comprehensive agreement.

To fill out an independent contractor form, start by gathering all necessary information such as your full name, business name, and contact details. Next, provide specific details regarding the services you will offer under the North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor. Remember to sign and date the form to validate your agreement. If you need assistance, consider using U.S. Legal Forms, which offers templates to simplify this process.

Creating an independent contractor agreement in North Carolina is straightforward. Start by clearly outlining the terms of the work, payment structure, and responsibilities for both parties. If you are using a North Carolina Visiting Professor Agreement as a self-employed independent contractor, consider including specific clauses related to confidentiality and project delivery timelines. You can utilize platforms like uslegalforms to access templates and ensure compliance with state laws.

In North Carolina, independent contractors are generally not required to carry workers' compensation insurance. However, if you are a self-employed independent contractor under a North Carolina Visiting Professor Agreement, it’s wise to consider your personal situation. Optional coverage can protect you from potential financial risks associated with workplace injuries. Always consult a legal expert to ensure you meet your specific needs.

To determine your status as an independent contractor or employee, review the terms and conditions of your agreement. If you have signed a North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor, you likely fall into the independent contractor category. Always consider factors like control over your work, payment terms, and level of independence in your role.

Independent contractors span various fields, including education, consulting, and freelance work. In the academic realm, those teaching under the North Carolina Visiting Professor Agreement - Self-Employed Independent Contractor exemplify the independent contractor role. It's crucial to recognize that these individuals operate independently, managing their contracts and taxes without traditional employer benefits.