North Carolina Educator Agreement - Self-Employed Independent Contractor

Description

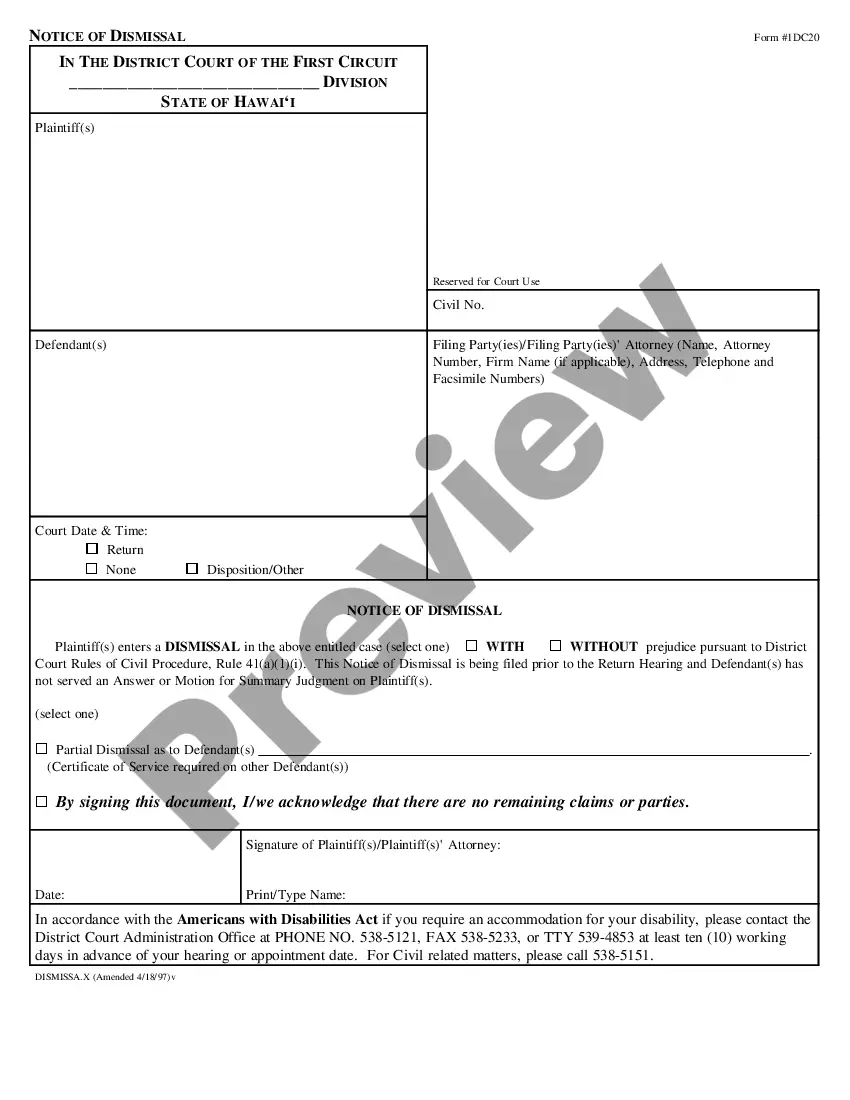

How to fill out Educator Agreement - Self-Employed Independent Contractor?

If you wish to compile, retrieve, or create sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online. Make use of the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to obtain the North Carolina Educator Agreement - Self-Employed Independent Contractor with just a few clicks. If you are already a US Legal Forms client, Log In to your account and click on the Acquire button to obtain the North Carolina Educator Agreement - Self-Employed Independent Contractor. You can also find forms you have previously downloaded in the My documents section of your account.

If you are accessing US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have chosen the form for your specific city/state. Step 2. Utilize the Preview option to review the form's details. Don’t forget to check the description. Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template. Step 4. Once you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the North Carolina Educator Agreement - Self-Employed Independent Contractor.

Every legal document format you acquire is yours indefinitely. You can access all the forms you downloaded in your account. Simply click on the My documents section and choose a form to print or download again.

Remain competitive and obtain, and print the North Carolina Educator Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous expert and state-specific templates available for your business or personal needs.

- Each legal document template you obtain is yours permanently.

- You have access to every form you downloaded in your account.

- Click on the My documents section and select a form to print or download again.

- Stay competitive and download, and print the North Carolina Educator Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are countless professional and state-specific templates you can use for your business or personal needs.

- Make the most of your legal document requirements with US Legal Forms.

- Access a wide range of options tailored to your requirements.

Form popularity

FAQ

Filling out an independent contractor agreement requires you to include essential details such as the scope of work, payment terms, and project timelines. It's crucial to clearly outline roles and expectations to prevent misunderstandings. Utilizing US Legal Forms can simplify this process, ensuring your North Carolina Educator Agreement - Self-Employed Independent Contractor is thorough and properly structured.

The new federal rule on independent contractors clarifies the criteria for classifying a worker as an independent contractor versus an employee. This rule impacts how businesses hire and how contractors are taxed. If you operate under the North Carolina Educator Agreement - Self-Employed Independent Contractor, staying informed about these changes can help you understand your rights and responsibilities.

Not everyone can file a Schedule C; it is specifically for individuals who operate a business as sole proprietors or independent contractors. If you earn business income, such as from your North Carolina Educator Agreement - Self-Employed Independent Contractor, you are eligible to file this form. Keep in mind that you must maintain proper documentation to support your filing.

Freelance income is reported on Schedule C when you work as an independent contractor. This form enables you to outline the income derived from your freelance activities. If you’re engaged in projects under the North Carolina Educator Agreement - Self-Employed Independent Contractor, filling out Schedule C helps in clarifying your financial picture to the IRS.

Yes, independent contractors typically file Schedule C with their personal tax returns. This form allows them to report income and expenses related to their business activities. If you’re working under the North Carolina Educator Agreement - Self-Employed Independent Contractor, completing Schedule C accurately ensures you account for your earnings and eligible expenses.

You can provide proof of employment as an independent contractor by presenting documents such as your contract, invoices, and payment records. These documents demonstrate your work relationship and the payments received under the North Carolina Educator Agreement - Self-Employed Independent Contractor. Using a platform like US Legal Forms can help you create professional contracts that serve as clear proof of employment.

Typically, either party can draft the independent contractor agreement, but it is advisable for the hiring party to take the lead. The North Carolina Educator Agreement - Self-Employed Independent Contractor should reflect the needs and expectations of both sides clearly. Many individuals choose to utilize online platforms, such as uslegalforms, to ensure their agreement adheres to local laws and industry standards. That way, you ensure that all important aspects are covered effectively.

Yes, having a contract as an independent contractor is essential for your protection and clarity in working relationships. The North Carolina Educator Agreement - Self-Employed Independent Contractor provides a formal structure that details responsibilities and expectations. This document not only mitigates misunderstandings but also establishes legal grounds in case of disputes. Using a service like uslegalforms can provide you with the necessary tools to create a robust contract efficiently.

Creating an independent contractor agreement starts with identifying the key elements necessary for the North Carolina Educator Agreement - Self-Employed Independent Contractor. Begin by outlining the scope of work, payment terms, and duration of the contract. You can ensure compliance with local regulations by using templates available on platforms like uslegalforms, which guide you through each step. This approach not only saves time but also helps you create a comprehensive and legally sound agreement.

Independent contractor status in North Carolina carries various implications, including tax responsibilities and business liabilities. As an independent contractor, you are responsible for your own taxes and often lack employee benefits. Understanding the North Carolina Educator Agreement - Self-Employed Independent Contractor can clarify these implications, helping you navigate your rights and obligations effectively.