North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

If you require thorough, acquire, or printing legal document templates, utilize US Legal Forms, the foremost assortment of legal forms, which are accessible online.

Employ the site’s straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Acquire button to obtain the North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

1099 employees are often viewed as temporary workers, but it depends on the nature of their engagement. In the context of a North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor, these individuals may be contracted for specific projects or time periods. This means they are not entitled to the same benefits as full-time employees but enjoy flexibility in their work. Understanding your classification and rights is crucial for both contractors and clients.

Yes, a self-employed person can absolutely have a contract. A North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor serves as a legal document that outlines the terms of work between a client and the contractor. This agreement clearly defines the responsibilities, compensation, and timelines for both parties. It's essential to have a solid contract to protect your rights and ensure a smooth working relationship.

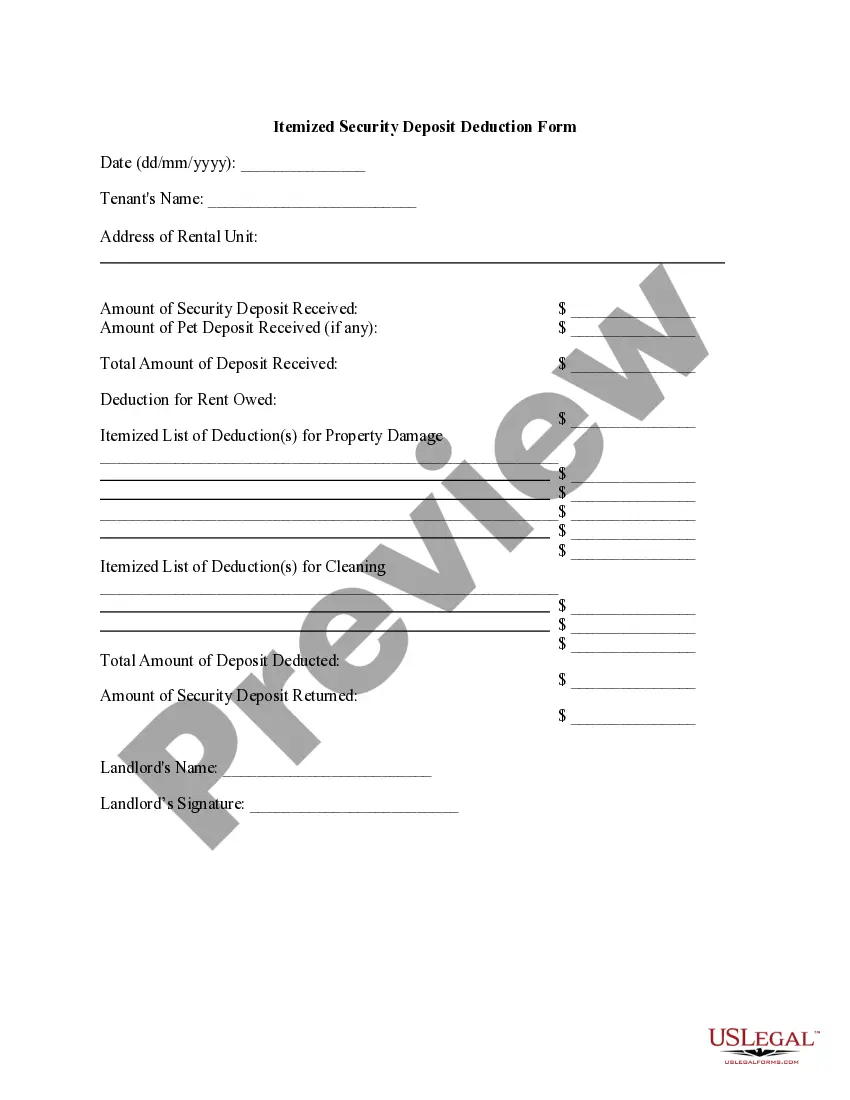

Filling out an independent contractor form involves entering essential details such as the nature of the work, compensation rates, and payment schedules. Ensure you include sections that address confidentiality and liability, adapting the form to meet the nuances of a North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor. For a seamless experience, consider using the resources available at USLegalForms, where you can find comprehensive forms tailored to your needs.

When filling out an independent contractor agreement, start by entering the names and contact information of both the contractor and the client. Next, specify the scope of work, deadlines, and payment structure. Don't forget to indicate that this represents a North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor. USLegalForms offers user-friendly templates that can help you complete this agreement correctly and efficiently.

To write an independent contractor agreement, begin by clearly outlining the roles and responsibilities of both parties. Include essential details such as payment terms, project deadlines, and conditions for termination. Make sure to specify that this North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor is legally binding. You can utilize the USLegalForms platform to access templates and guidance that will streamline this process.

A temporary employee may not necessarily be classified as an independent contractor. Temporary employees usually work under the employer's control and supervision, while independent contractors operate with more autonomy. For clarity on these distinctions, refer to the North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor, which outlines the differences to help you make informed decisions.

In North Carolina, several groups are exempt from workers' compensation, including certain sole proprietors and independent contractors. Additionally, specific professions, such as real estate agents and certain agricultural workers, often qualify for exemption. To ensure compliance, review the North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor, which outlines the nuances of worker classifications.

Independent contractors should consider liability insurance, as it protects them from claims of negligence or injury. Additionally, some contractors opt for health insurance and property insurance based on their individual needs. The North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor serves as a valuable resource for understanding what insurance might be necessary.

Typically, you do not need to provide workers' compensation insurance for 1099 employees in North Carolina, as they qualify as independent contractors. There are exceptions depending on the nature of the job and industry practices. Understanding the North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor can help you navigate your insurance obligations more effectively.

Generally, independent contractors in North Carolina are not required to carry workers' compensation insurance. That said, if a contractor operates under specific conditions or in high-risk sectors, they may still need coverage. Using the North Carolina Temporary Worker Agreement - Self-Employed Independent Contractor can guide you and your contractors on best practices.