North Carolina Employment Services Agreement - Self-Employed Independent Contractor

Description

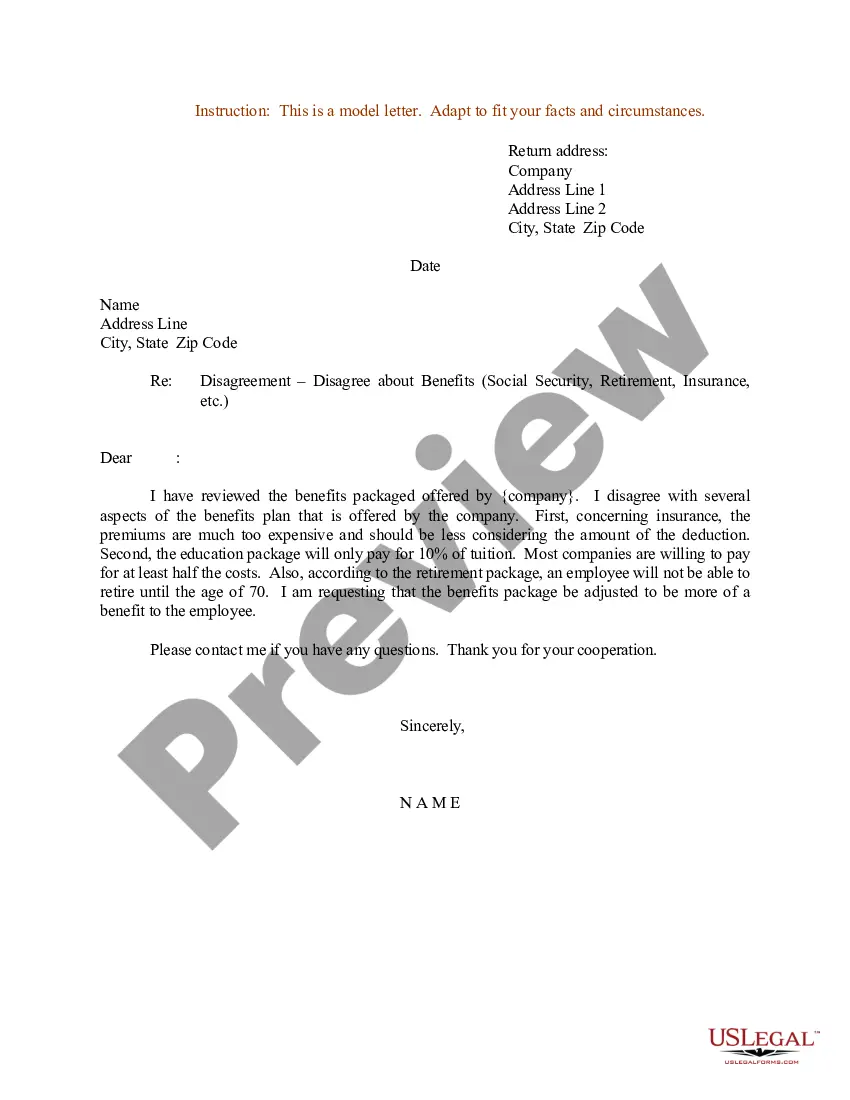

How to fill out Employment Services Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn't easy.

US Legal Forms provides a vast array of form templates, including the North Carolina Employment Services Agreement - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

Use US Legal Forms, the most extensive selection of legal forms, to save time and avoid mistakes.

The service offers properly designed legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Employment Services Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

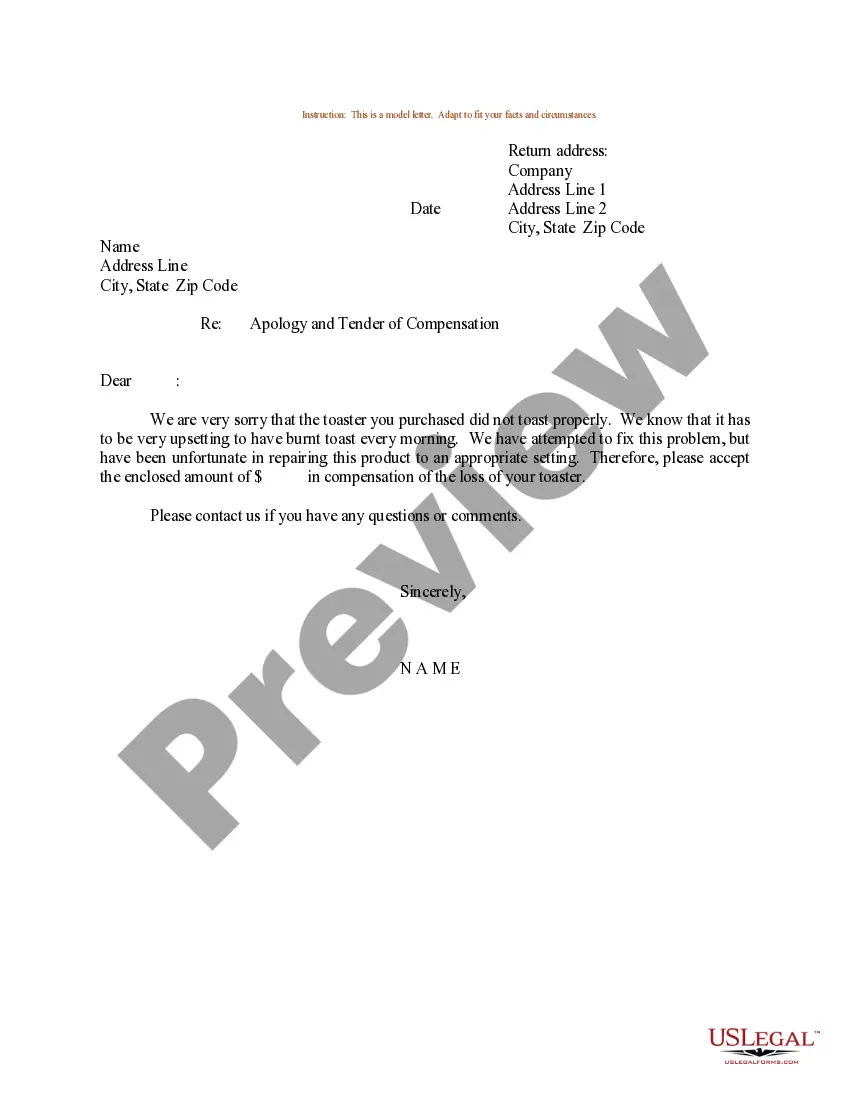

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Research section to find a form that fits your needs and requirements.

- Once you have the correct form, click Acquire now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a suitable document format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

- You can obtain another copy of the North Carolina Employment Services Agreement - Self-Employed Independent Contractor anytime, if needed. Just select the required form to download or print the document template.

Form popularity

FAQ

Independent contractors typically need to fill out several important forms, including a W-9 for tax purposes and an independent contractor agreement. It is also beneficial to review the North Carolina Employment Services Agreement - Self-Employed Independent Contractor to ensure you meet state requirements. For convenience, U.S. Legal Forms offers a variety of templates that can help streamline this process.

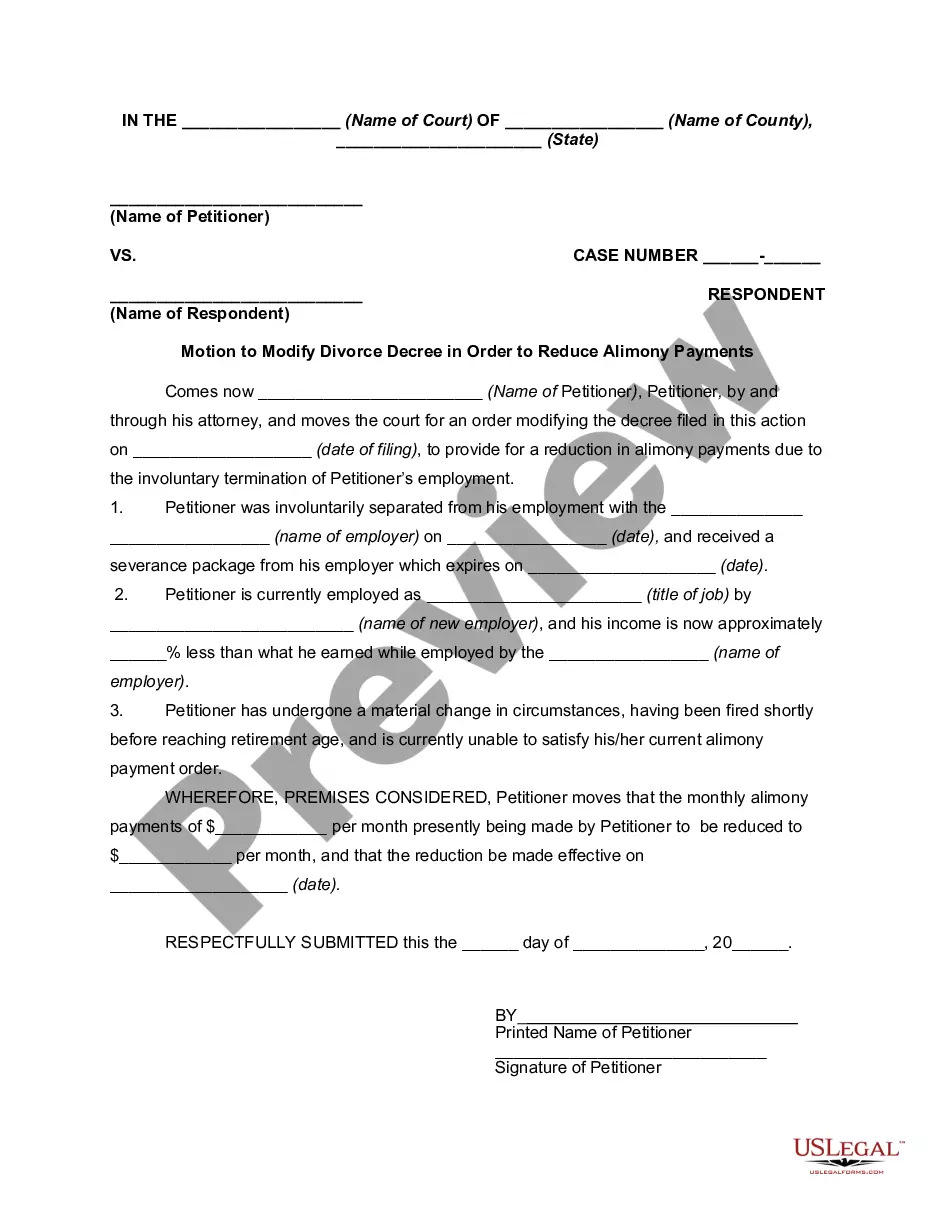

Writing an independent contractor agreement requires clarity and precision. Begin by outlining the services you will provide and the expected compensation. Next, incorporate terms that are aligned with the North Carolina Employment Services Agreement - Self-Employed Independent Contractor to protect both parties. Utilizing the resources available on U.S. Legal Forms can help you draft a comprehensive and enforceable agreement.

Filling out an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, payment structure, and the duration of the agreement. Make sure to include any specific clauses that are relevant to the North Carolina Employment Services Agreement - Self-Employed Independent Contractor. Using U.S. Legal Forms can simplify this process by providing you with customizable templates.

To fill out an independent contractor form, begin by gathering all necessary personal and business information. Next, include details such as the services you will provide, your payment terms, and any relevant deadlines. Remember to review the North Carolina Employment Services Agreement - Self-Employed Independent Contractor to ensure compliance with state regulations. If you need assistance, consider using the U.S. Legal Forms platform for easy access to templates.

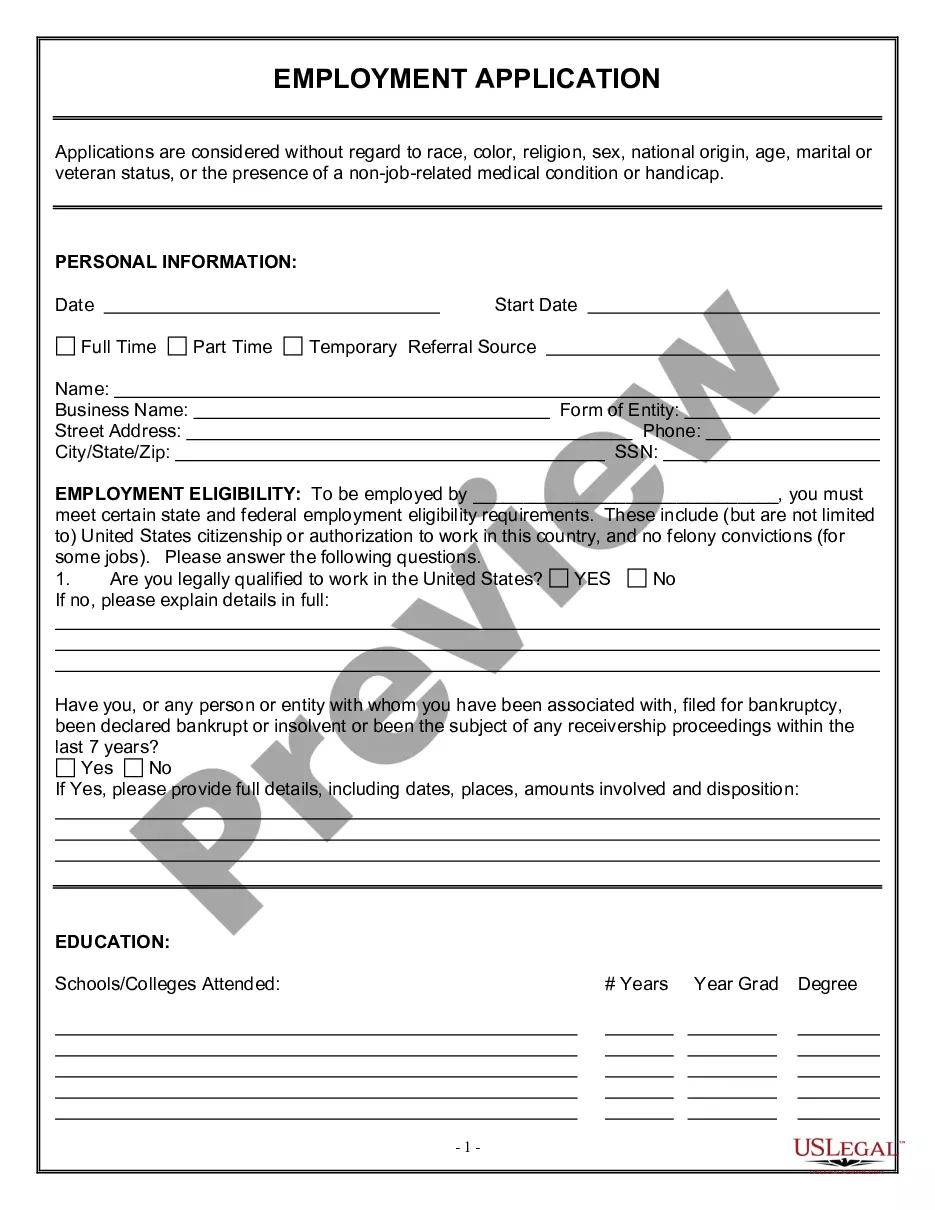

To hire an independent contractor, you should prepare a North Carolina Employment Services Agreement - Self-Employed Independent Contractor, which defines the scope of work and payment terms. Additionally, obtain a W-9 form to ensure accurate tax reporting. By utilizing U.S. Legal Forms, you can easily access the necessary documents and ensure compliance with state regulations.

In North Carolina, independent contractors generally do not require workers' compensation insurance unless they have employees. However, it is wise for contractors to have their own liability insurance to protect against potential claims. Including this information in a North Carolina Employment Services Agreement - Self-Employed Independent Contractor can help establish clear expectations.

For a 1099 employee, you will need to complete a W-9 form to gather their tax identification information. At the end of the year, you must issue a 1099-MISC form to report the payments made to the independent contractor. Utilizing a North Carolina Employment Services Agreement - Self-Employed Independent Contractor can streamline this process and ensure all terms are clear.

When employing an independent contractor in North Carolina, you need a North Carolina Employment Services Agreement - Self-Employed Independent Contractor. This document outlines the terms of the agreement, including payment details and project specifications. Additionally, you may require a W-9 form to collect the contractor's tax information for reporting purposes.

To prove employment when self-employed, gather documentation such as contracts, invoices, and bank statements showing payments received. The North Carolina Employment Services Agreement - Self-Employed Independent Contractor can act as a formal record of your business relationship with clients. Having a well-organized file of all relevant documents ensures you can present your employment status confidently. This comprehensive approach solidifies your standing as a self-employed individual.

An independent contractor can show proof of employment by providing a variety of documents, including signed contracts, invoices, and payment receipts. Utilizing the North Carolina Employment Services Agreement - Self-Employed Independent Contractor can add legitimacy to your claims. Additionally, obtaining testimonials or letters from clients can further validate your work. These documents collectively demonstrate your role and contributions as an independent contractor.