North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

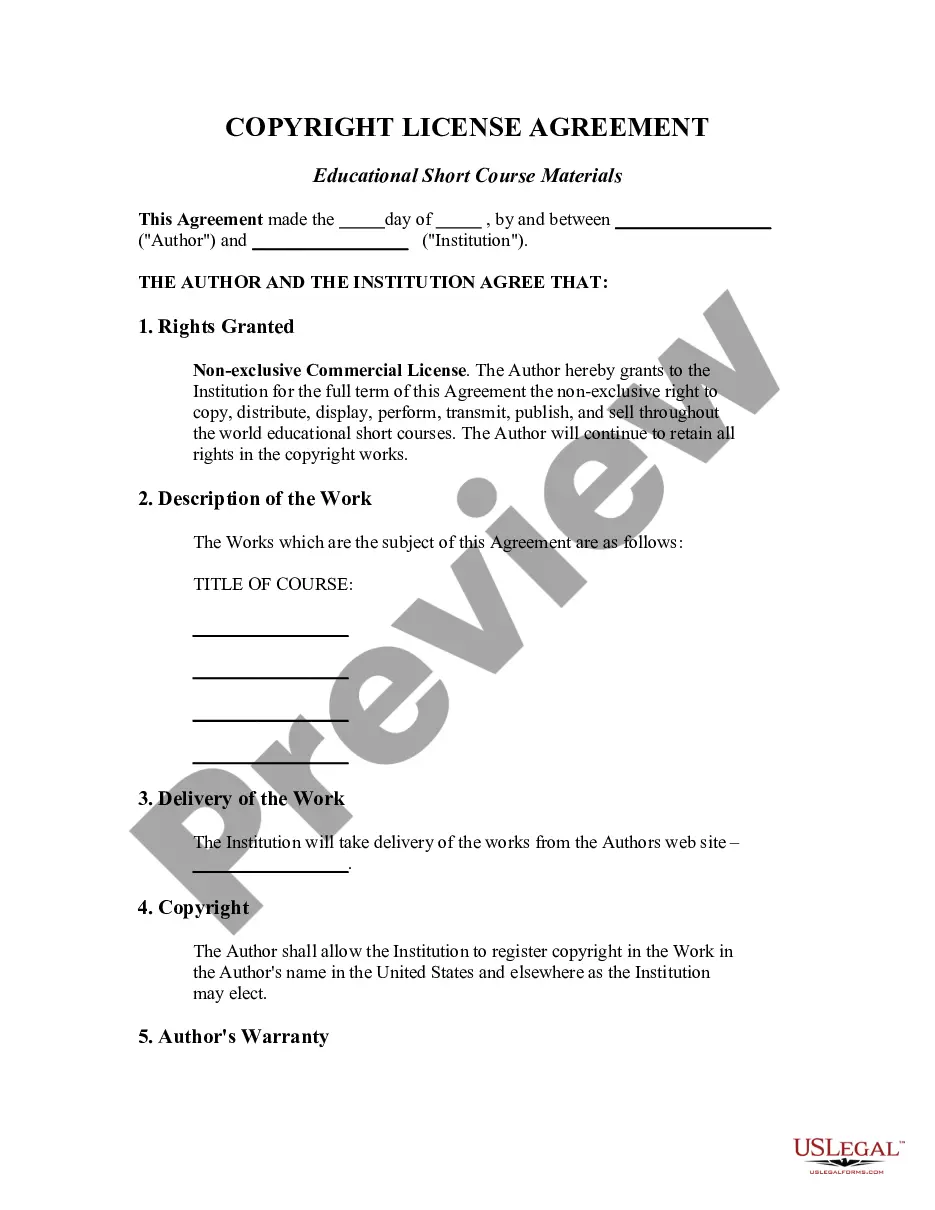

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

If you need to finalize, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and categories, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Choose your preferred pricing plan and input your information to create an account.

Step 5. Complete the transaction. You can use your Misa or Bastercard or PayPal account to finalize the purchase.

- Use US Legal Forms to find the North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Confirm you have chosen the form for the correct city/region.

- Step 2. Use the Review feature to examine the form's details. Be sure to read the outline.

- Step 3. If you are not satisfied with the form, make use of the Search bar at the top of the screen to find additional versions of the legal form template.

Form popularity

FAQ

A good hardship letter clearly explains the reasons for your financial difficulties and demonstrates your desire to keep your home. Include specific details about your situation, such as job loss or medical expenses, and how these events have impacted your ability to make mortgage payments. When submitting a North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, your letter should also express your commitment to fulfilling future payment obligations once your situation improves.

To apply for a loan modification, start by contacting your mortgage lender. You will need to fill out the North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP and provide necessary financial documents that detail your income and expenses. After submitting your application, stay in touch with your lender for updates and to ensure all required documentation has been received.

The HAMP loan modification program is designed to help struggling homeowners reduce their mortgage payments and avoid foreclosure. This program allows eligible borrowers to modify their loans, making them more affordable and sustainable. By submitting a North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you may be able to benefit from reduced interest rates or extended loan terms.

To qualify for a loan modification, you typically need to demonstrate financial hardship, such as loss of income or increased expenses. Additionally, lenders often require specific documentation, including a completed North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Staying current on your mortgage and having a good payment history can also enhance your chances of approval.

The process of a loan modification involves several key steps. First, you need to gather necessary financial documents, such as income statements and tax returns, to assess your eligibility. Next, you will submit a completed North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP application to your lender. Finally, the lender will review your request and make a decision regarding the terms of your modified loan.

The Home Owners' Loan Corporation (HOLC) was a program from the 1930s designed to help homeowners refinance their mortgages. It has since been dissolved and is no longer active today. However, understanding its history can provide insight into current programs like the North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, which serves a similar purpose in helping avoid foreclosure.

While the HAMP program officially ended in 2016, some options for modifications still exist for eligible homeowners. Lenders may offer their own programs similar to HAMP. It's essential to inquire about North Carolina Request for Loan Modification RMA options directly with your lender to explore available modifications.

Yes, Congress passed the Home Affordable Modification Program HAMP as part of broader efforts to provide mortgage relief. This program aims to assist homeowners struggling with their payments by offering loan modifications. The North Carolina Request for Loan Modification RMA enables homeowners to apply and potentially benefit from reduced monthly payments.

Applying for a loan modification typically begins with contacting your loan servicer. You should express your interest in modifying your loan under the North Carolina Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Make sure to provide all requested documents, as this will help expedite your application process and lead to a favorable outcome.

To request a mature modification on your loan, start by gathering your financial documents, including income statements and any relevant loan information. Next, you will need to complete a Request for Loan Modification RMA form. This form is essential under the Home Affordable Modification Program HAMP, offering you the best chance to receive the assistance you need.