North Carolina Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation

Description

How to fill out Sample Stock Purchase Agreement Between S.A. Louis Dreyfus Et CIE And Polo Ralph Lauren Corporation?

Finding the right authorized file design can be quite a struggle. Naturally, there are a variety of layouts available on the net, but how do you obtain the authorized form you require? Utilize the US Legal Forms web site. The services provides 1000s of layouts, for example the North Carolina Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation, which can be used for company and personal requirements. All the varieties are checked out by professionals and meet state and federal specifications.

If you are already listed, log in to your account and then click the Acquire option to find the North Carolina Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation. Make use of account to appear throughout the authorized varieties you might have purchased earlier. Proceed to the My Forms tab of your account and acquire another backup from the file you require.

If you are a brand new end user of US Legal Forms, listed below are straightforward guidelines that you can adhere to:

- Initial, make certain you have chosen the right form for the town/county. It is possible to look over the form while using Preview option and read the form information to make certain it will be the best for you.

- When the form will not meet your needs, utilize the Seach industry to obtain the proper form.

- When you are certain the form is acceptable, select the Acquire now option to find the form.

- Choose the prices prepare you desire and enter in the needed details. Design your account and pay money for the transaction utilizing your PayPal account or charge card.

- Select the data file file format and acquire the authorized file design to your device.

- Full, change and print out and indication the obtained North Carolina Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation.

US Legal Forms may be the most significant catalogue of authorized varieties in which you will find a variety of file layouts. Utilize the company to acquire professionally-created files that adhere to status specifications.

Form popularity

FAQ

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

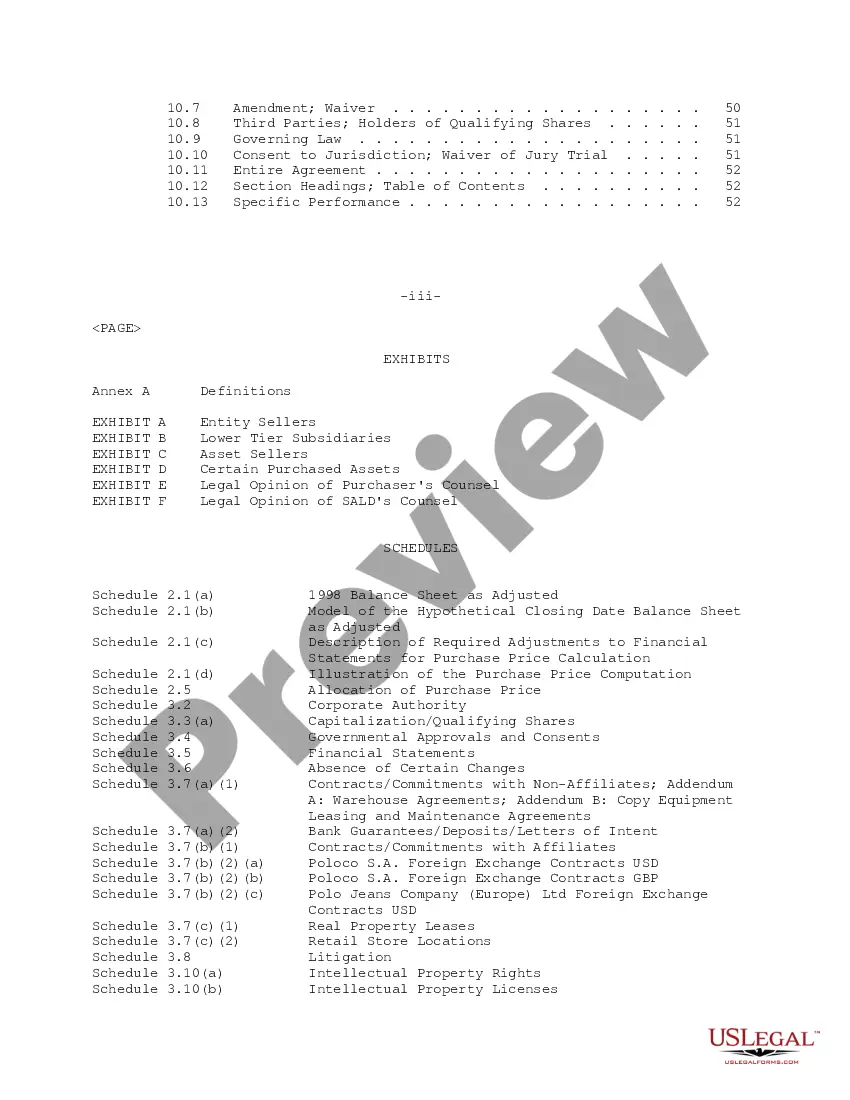

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

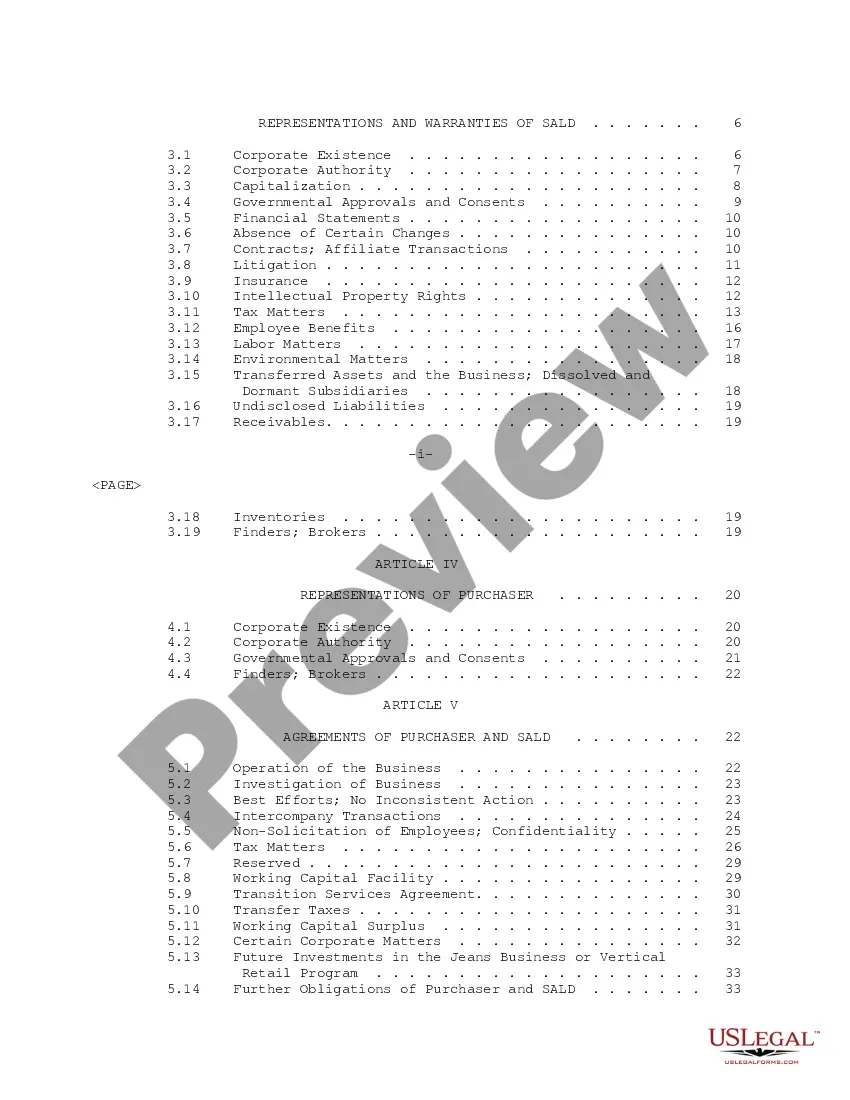

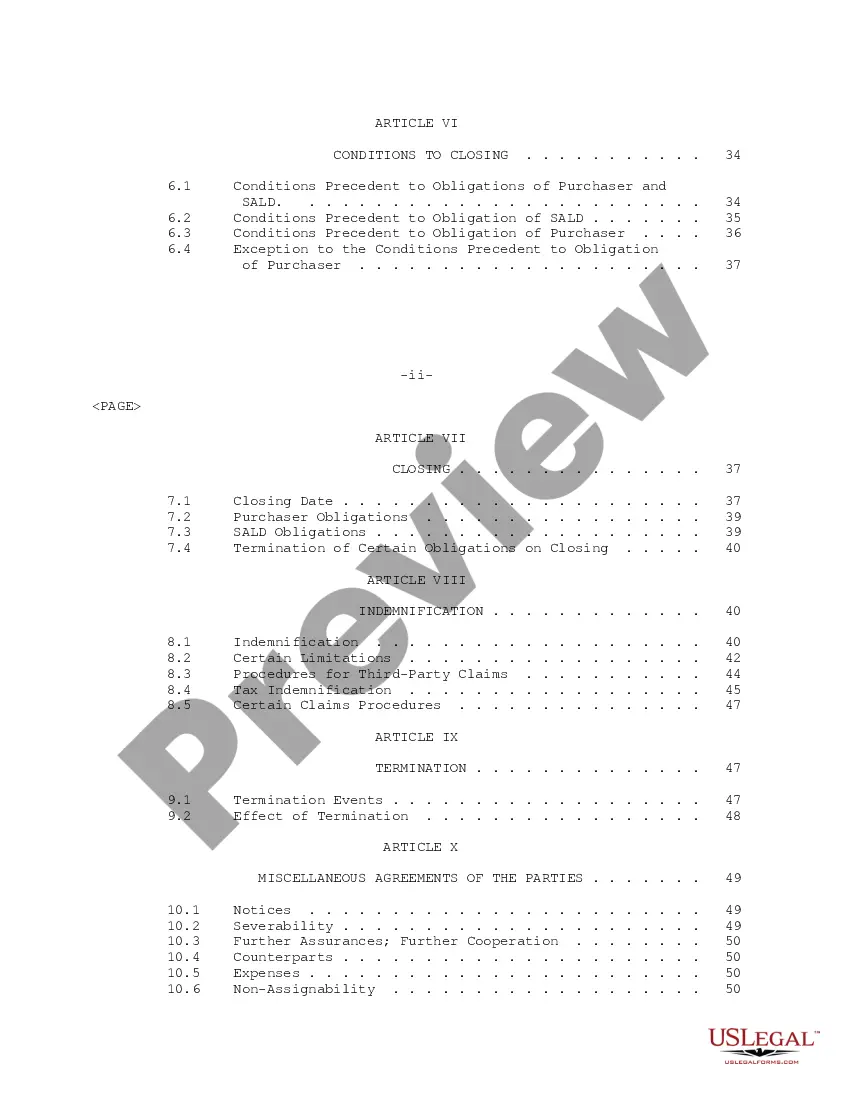

When reviewing a Share Purchase Agreement (SPA), some of the key clauses to examine include: The parties to the transaction. The number and type of shares being sold. The purchase price and any adjustments. Representations and warranties of both parties. Indemnities and liabilities. Restrictions post completion.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).