North Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Discovering the right legitimate document design can be a battle. Naturally, there are a lot of templates available on the net, but how do you discover the legitimate form you need? Take advantage of the US Legal Forms website. The services offers a large number of templates, such as the North Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, which you can use for company and private requirements. All the types are checked out by experts and satisfy federal and state requirements.

If you are already signed up, log in to the bank account and then click the Download key to have the North Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. Make use of your bank account to check throughout the legitimate types you may have acquired formerly. Proceed to the My Forms tab of the bank account and get an additional backup from the document you need.

If you are a new user of US Legal Forms, here are basic guidelines so that you can follow:

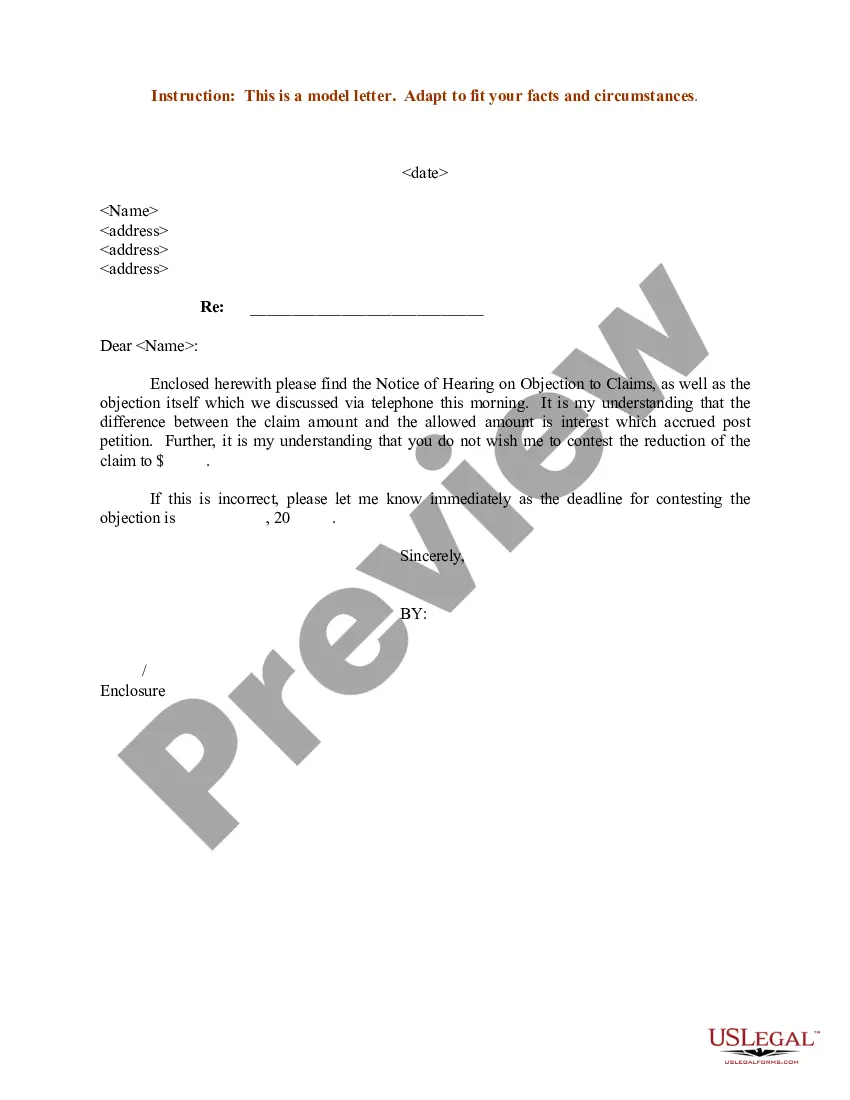

- Initially, make certain you have chosen the proper form to your city/region. It is possible to look over the form utilizing the Review key and study the form outline to ensure it will be the right one for you.

- In case the form fails to satisfy your needs, make use of the Seach field to obtain the proper form.

- When you are sure that the form would work, select the Get now key to have the form.

- Choose the prices prepare you need and type in the required details. Make your bank account and pay for the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Select the document formatting and acquire the legitimate document design to the gadget.

- Full, modify and print and sign the received North Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

US Legal Forms is definitely the most significant library of legitimate types where you can discover numerous document templates. Take advantage of the company to acquire skillfully-made files that follow express requirements.

Form popularity

FAQ

In a Nutshell The court sends this document to the creditors you listed on your bankruptcy paperwork when you file. It gives each creditor important information about your case and tells them what they need to do if they have a reasonable objection to your bankruptcy.

Not only will filing Chapter 7 close the business, but corporations and LLCs don't receive a debt discharge. It isn't needed. A creditor can't collect from the company once it's no longer operational. Nothing of value will be left to take.

In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations. 11 U.S.C. § 727(a)(1). Although an individual chapter 7 case usually results in a discharge of debts, the right to a discharge is not absolute, and some types of debts are not discharged.

A Chapter 7 bankruptcy will generally discharge unsecured debts, including credit card debt, unsecured personal loans, medical bills and payday loans. The court discharges all of these remaining eligible debts at the end of the bankruptcy process, generally about four to six months after you start.

A Chapter 7 bankruptcy wipes out mortgages, car loans, and other secured debts. But if you don't continue to pay as agreed, the lender will take back the home, car, or other collateralized property using the lender's lien rights.