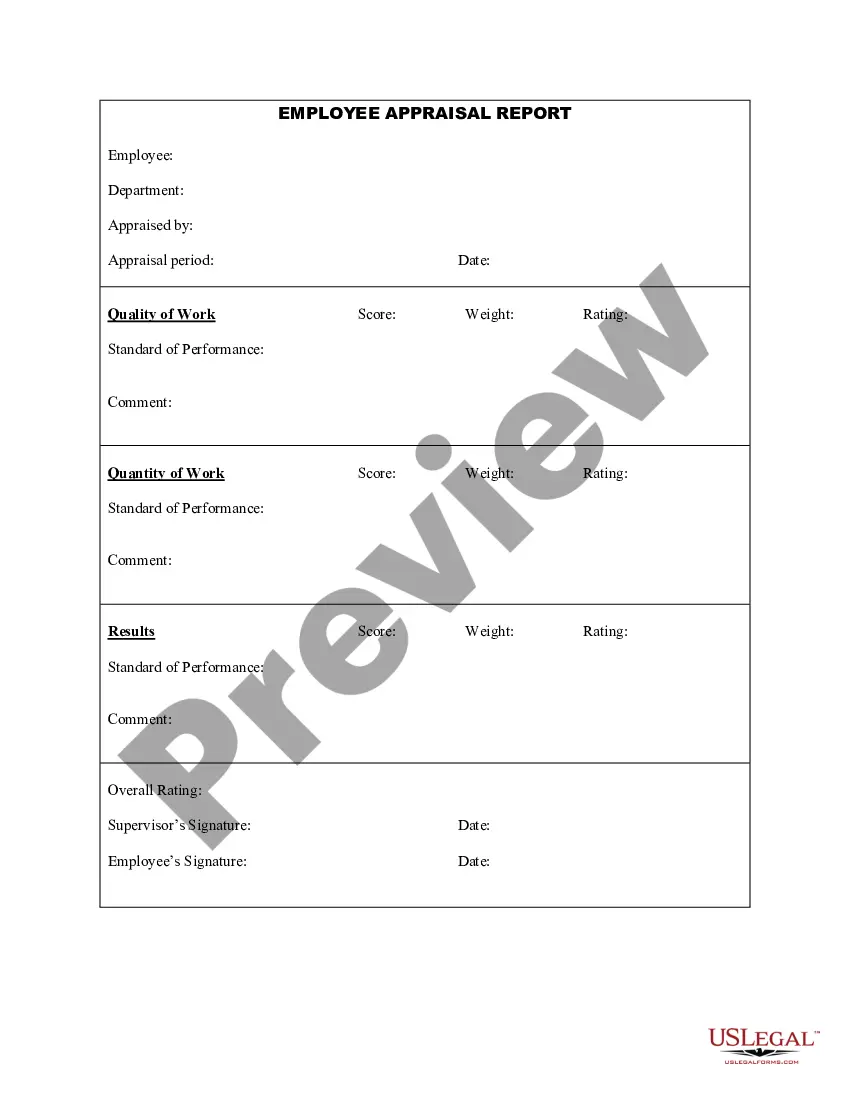

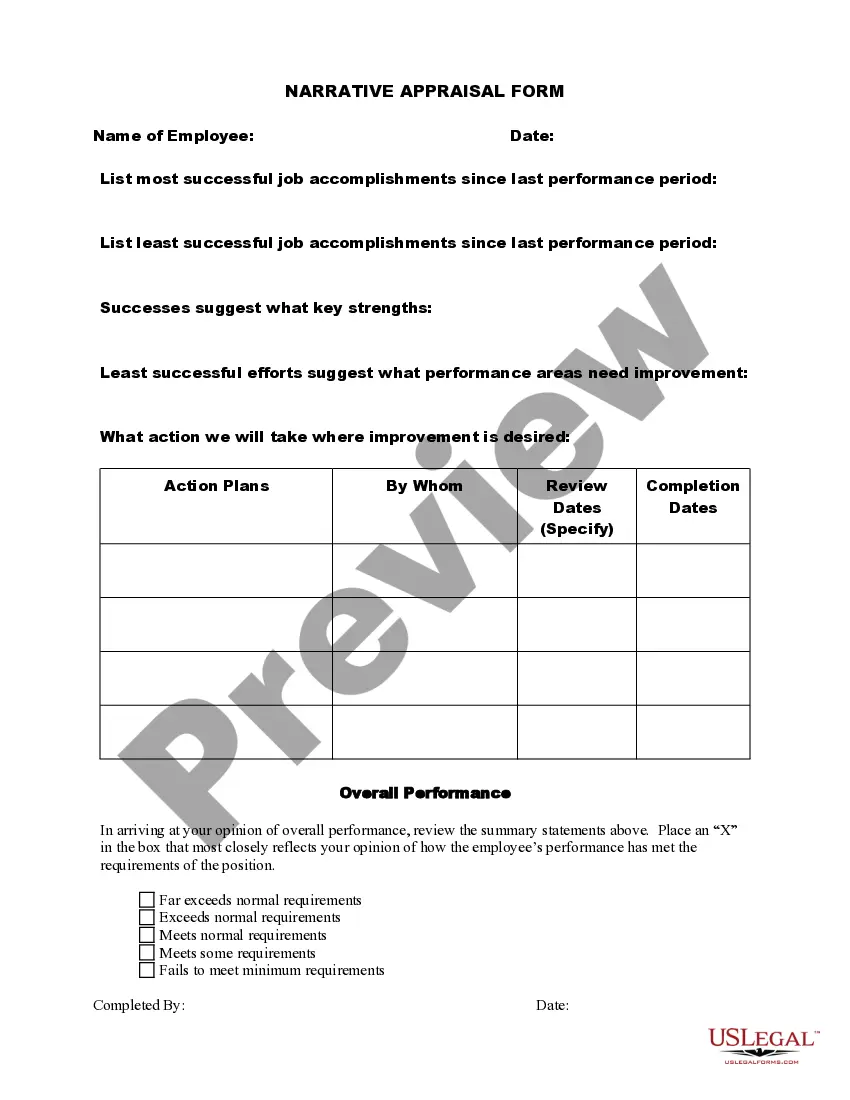

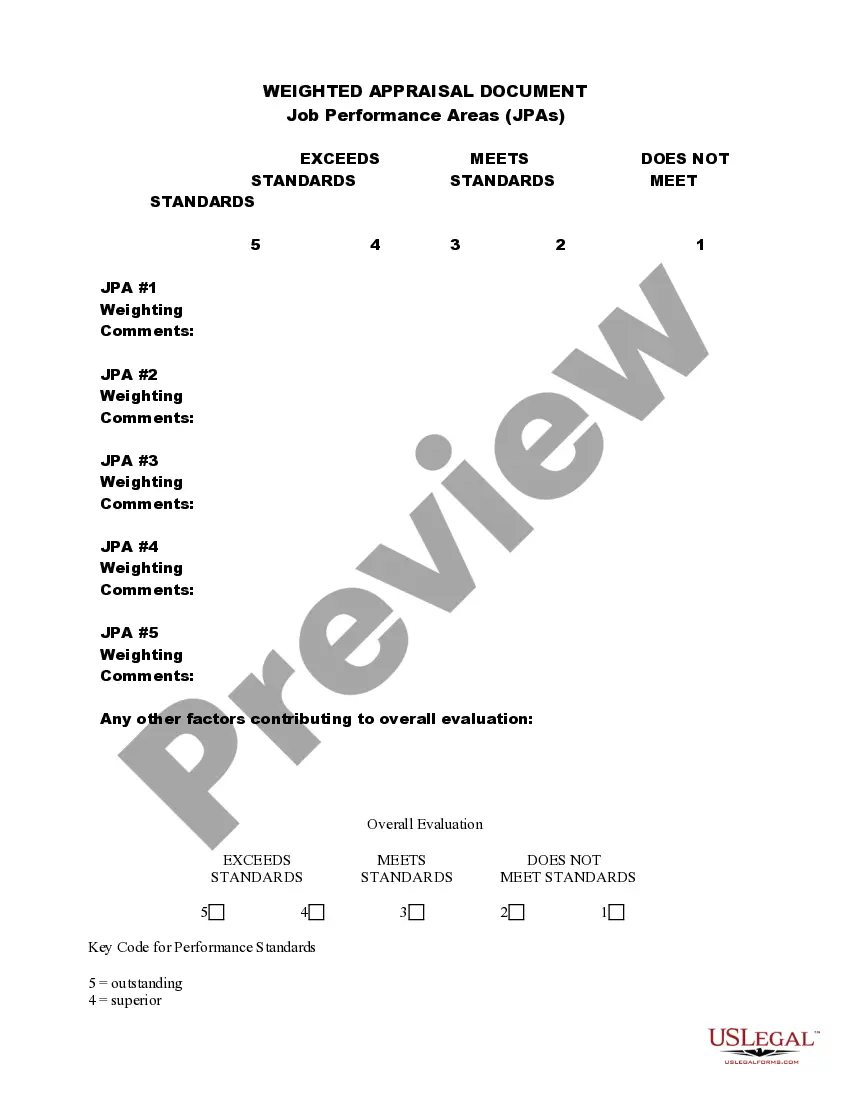

North Carolina Weighted Appraisal Document

Description

How to fill out Weighted Appraisal Document?

In case you need to gather, retrieve, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available on the internet.

Employ the site's user-friendly practical search to locate the paperwork you require. Various templates for business and individual purposes are organized by categories and claims, or keywords.

Use US Legal Forms to find the North Carolina Weighted Appraisal Document in just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete, download, and print the North Carolina Weighted Appraisal Document with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms member, Log In to your account and then click the Download button to retrieve the North Carolina Weighted Appraisal Document.

- You can also access forms you previously acquired in the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps provided below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the North Carolina Weighted Appraisal Document.

Form popularity

FAQ

To ensure that balance and equity are maintained, the State of North Carolina requires real property be reappraised on a cycle that maintains and acceptable Assessed Value to Sales Price Ratio (90% to 110%), (Assessed Value divided by Sales Price) and that the cycle not does not exceed eight years.

The Machinery Act (General Statute 105, Subchapter II) provides the framework for the listing, assessing, and appraising of both real and personal property in North Carolina. Under G. S. 105-286, all counties are required to conduct a reappraisal at least every eight (8) years.

Title Transfers in North Carolina: Step-by-Step A title transfer is simple with both parties are present, and paperwork ready. The transfer should happen within 28-days of the sale else you'll pay a late fee.

In North Carolina, real estate reappraisals are required to be conducted at least once every eight years.

How are property taxes calculated? A homeowners' property tax bill is calculated by multiplying the assessed value of a property by the combined city and county tax rate. In North Carolina, there is no state property tax. Counties collect the largest share of property tax revenue.

Mill machinery, a term that generally includes manufacturing machinery, is exempt from sales and use tax. For a list of items that are classified as mill machinery, please see the North Carolina Department of Revenue's Sales and Use Tax Technical guides..

A: According to North Carolina General Statute 105-283, Market Value is defined as "the price estimated in terms of money at which the property would change hands between a willing and financially able buyer and a willing seller, neither being under any compulsion to buy or sell." The Mecklenburg County Assessor's

How to Fill Out an Application for Title or Registration FormVehicle Information.The Owner's Information.Title Holder's Information.Fill in the Cost and Operation Information.The Owner's Signature.The Owner's Second Signature.Recheck the Vehicle Information.Verify Proper Assignation of the title.More items...?

Assessed Value = Market Value x (Assessment Rate / 100) The first calculation is based on the market value of the property and the determined assessment rate. The market value is multiplied by the assessment rate, in decimal form, to get the assessed value.

For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25% (0.0525). For Tax Years 2017 and 2018, the North Carolina individual income tax rate is 5.499% (0.05499). For Tax Years 2015 and 2016, the North Carolina individual income tax rate is 5.75% (0.0575).