District of Columbia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

Discovering the right authorized record design can be quite a have a problem. Of course, there are tons of web templates available on the net, but how can you find the authorized form you want? Utilize the US Legal Forms internet site. The assistance delivers 1000s of web templates, including the District of Columbia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name, that you can use for enterprise and private demands. Every one of the varieties are checked by pros and satisfy federal and state specifications.

If you are currently authorized, log in to your accounts and click on the Down load button to get the District of Columbia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Make use of accounts to look with the authorized varieties you might have acquired formerly. Visit the My Forms tab of your accounts and obtain an additional copy of the record you want.

If you are a fresh customer of US Legal Forms, here are straightforward directions that you should comply with:

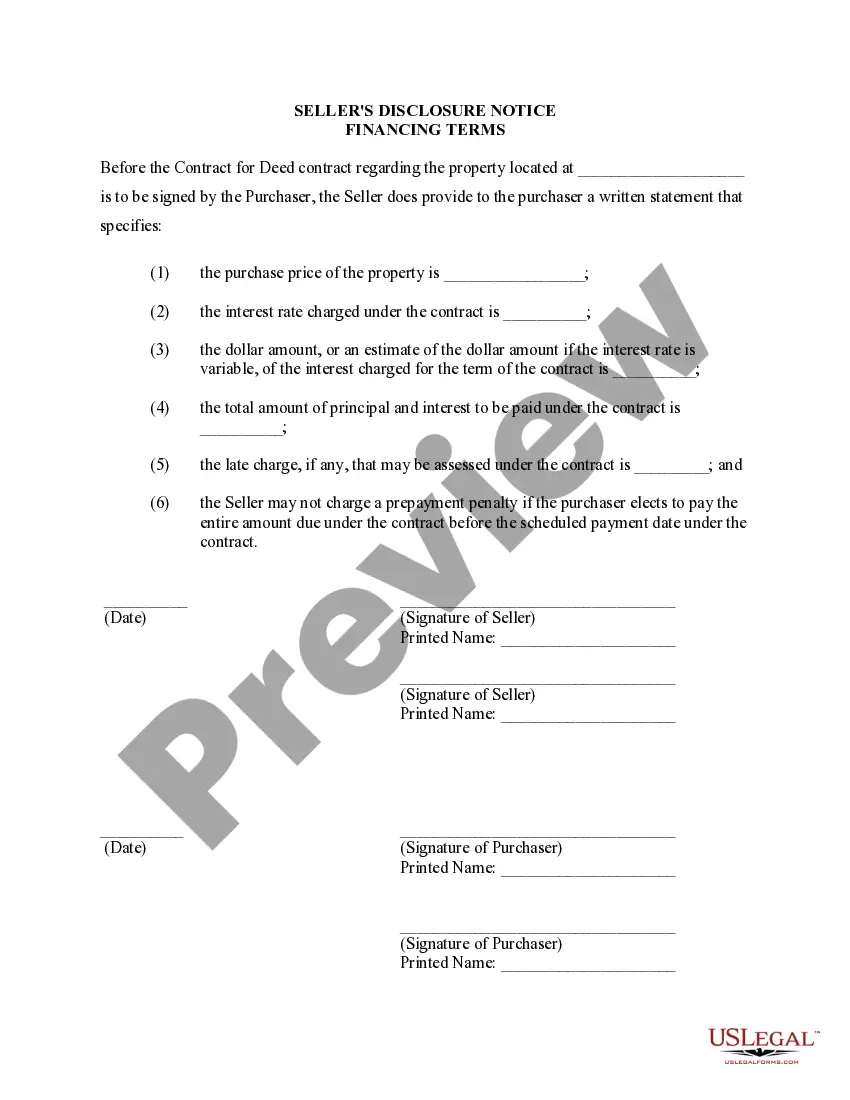

- Initially, ensure you have selected the right form to your town/county. It is possible to examine the shape making use of the Preview button and read the shape explanation to ensure this is basically the best for you.

- When the form will not satisfy your preferences, utilize the Seach industry to get the correct form.

- Once you are certain that the shape is acceptable, go through the Get now button to get the form.

- Select the prices program you want and type in the required details. Build your accounts and buy the order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the submit format and acquire the authorized record design to your gadget.

- Comprehensive, edit and printing and sign the acquired District of Columbia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

US Legal Forms will be the greatest catalogue of authorized varieties for which you will find a variety of record web templates. Utilize the service to acquire professionally-manufactured paperwork that comply with state specifications.

Form popularity

FAQ

One of the most common benefits of a waiver of subrogation is the avoidance of lengthy litigation and negotiation, as well as the costs to pursue them. These provisions can also prevent conflict between parties to a contract, such as between a landlord and tenant.

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

Business owners often agree to waivers of subrogation clauses if they see that to do otherwise would result in lengthy litigation that would cause even greater financial losses due to the need to halt projects until any lawsuit is settled.

Disadvantages of Subrogation On the downside, subrogation claims can sometimes result in delays. Recovering costs from the at-fault party can take time, especially if the case goes to court.

Benefits of Subrogation This means that both you and your insurer can recoup the costs of damage or harm caused by somebody else. It also means improved loss ratios and profits for your insurer.

If you've been in an accident and filed a claim with your insurance company, you may have received a subrogation letter. This document allows the insurance company to pursue a claim against a third party that caused damage to their insured, after the insurance company has paid out a claim to the insured.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.