North Carolina Determining Self-Employed Independent Contractor Status

Description

How to fill out Determining Self-Employed Independent Contractor Status?

Finding the appropriate legal document template can be a challenge. Indeed, there are numerous templates available online, but how can you obtain the legal form you need.

Utilize the US Legal Forms website. This platform provides an extensive array of templates, such as the North Carolina Determining Self-Employed Independent Contractor Status, suitable for both business and personal uses. All forms are reviewed by experts and comply with federal and state regulations.

If you are already a registered user, Log In to your account and select the Download button to obtain the North Carolina Determining Self-Employed Independent Contractor Status. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired North Carolina Determining Self-Employed Independent Contractor Status. US Legal Forms offers the largest repository of legal documents where you can find a variety of document templates. Use the service to obtain properly crafted paperwork that meets state requirements.

- First, ensure you have selected the correct form for your city/state.

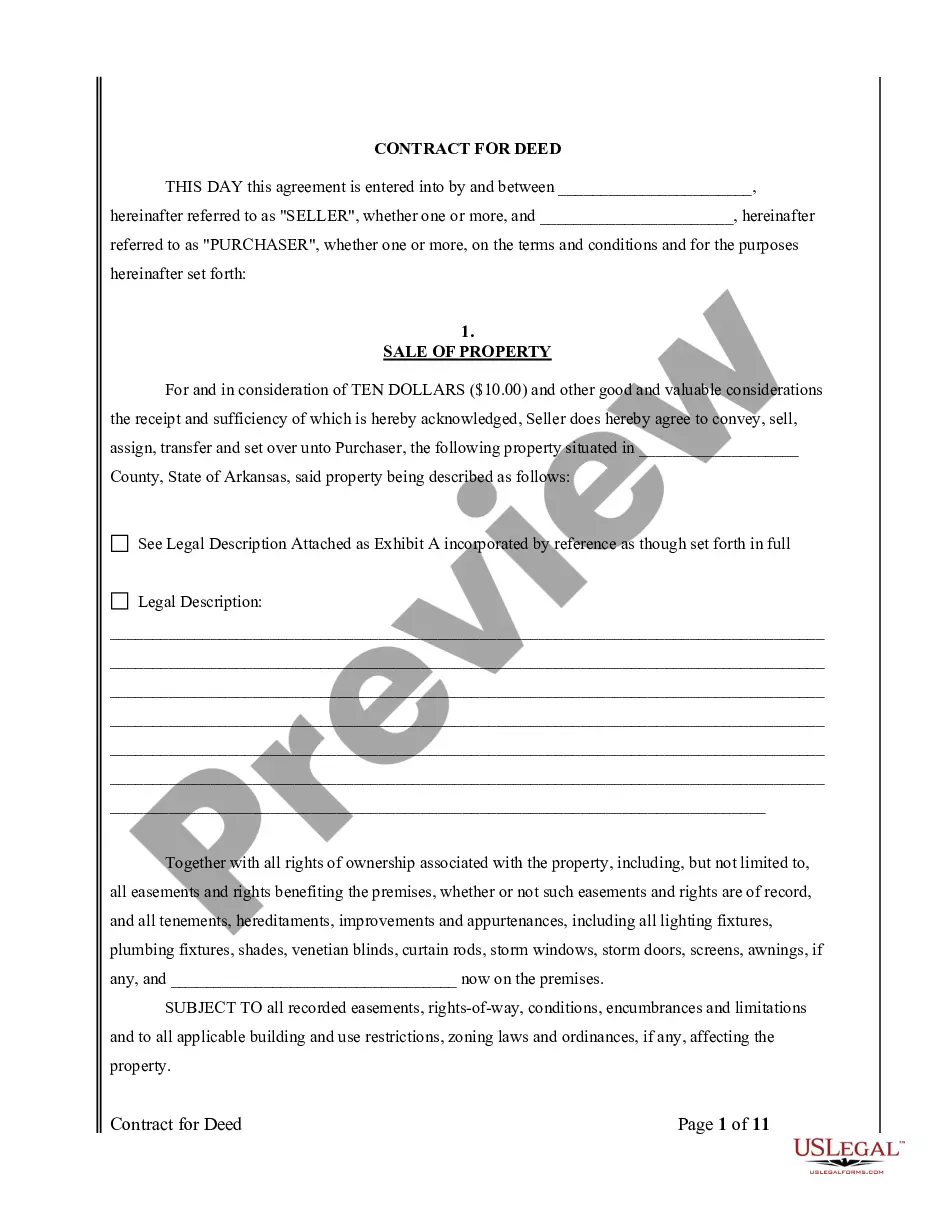

- You can preview the document using the Preview option and review the form summary to confirm it is appropriate for your needs.

- If the document doesn't satisfy your requirements, utilize the Search bar to find the correct form.

- Once you are confident that the form is suitable, choose the Purchase now button to obtain the document.

- Select the pricing plan you prefer and input the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

There are three easy steps to take when beginning an independent contractor business:Pick a name for your business. The name of your business should shed a little light on what it is you do and who your target clients may be.Get yourself a contracting license.Make sure you figure out your recordkeeping and taxes.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Independent contractors are essentially self-employed people who perform services that an employer does not control. Employers typically hire independent contractors for short-term projects and do not have supervision over the way they complete their work.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors. To determine whether a person is an employee or an independent contractor, the company weighs factors to identify the degree of control it has in the relationship with the person.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.