North Carolina Worksheet Analyzing a Self-Employed Independent Contractor

Description

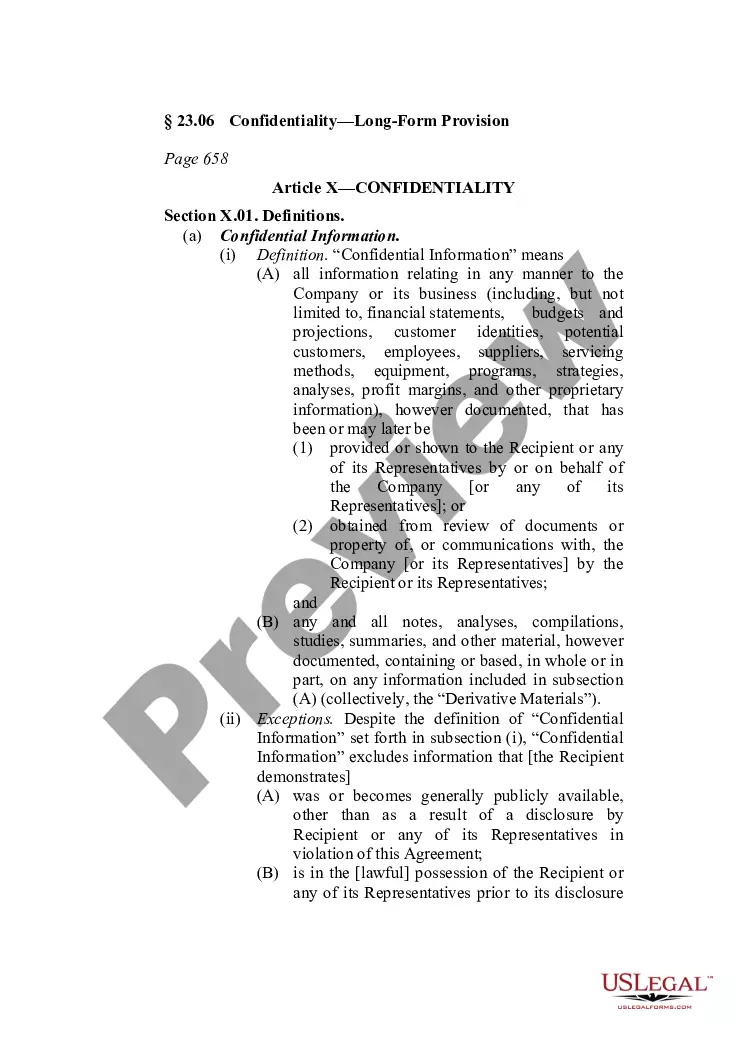

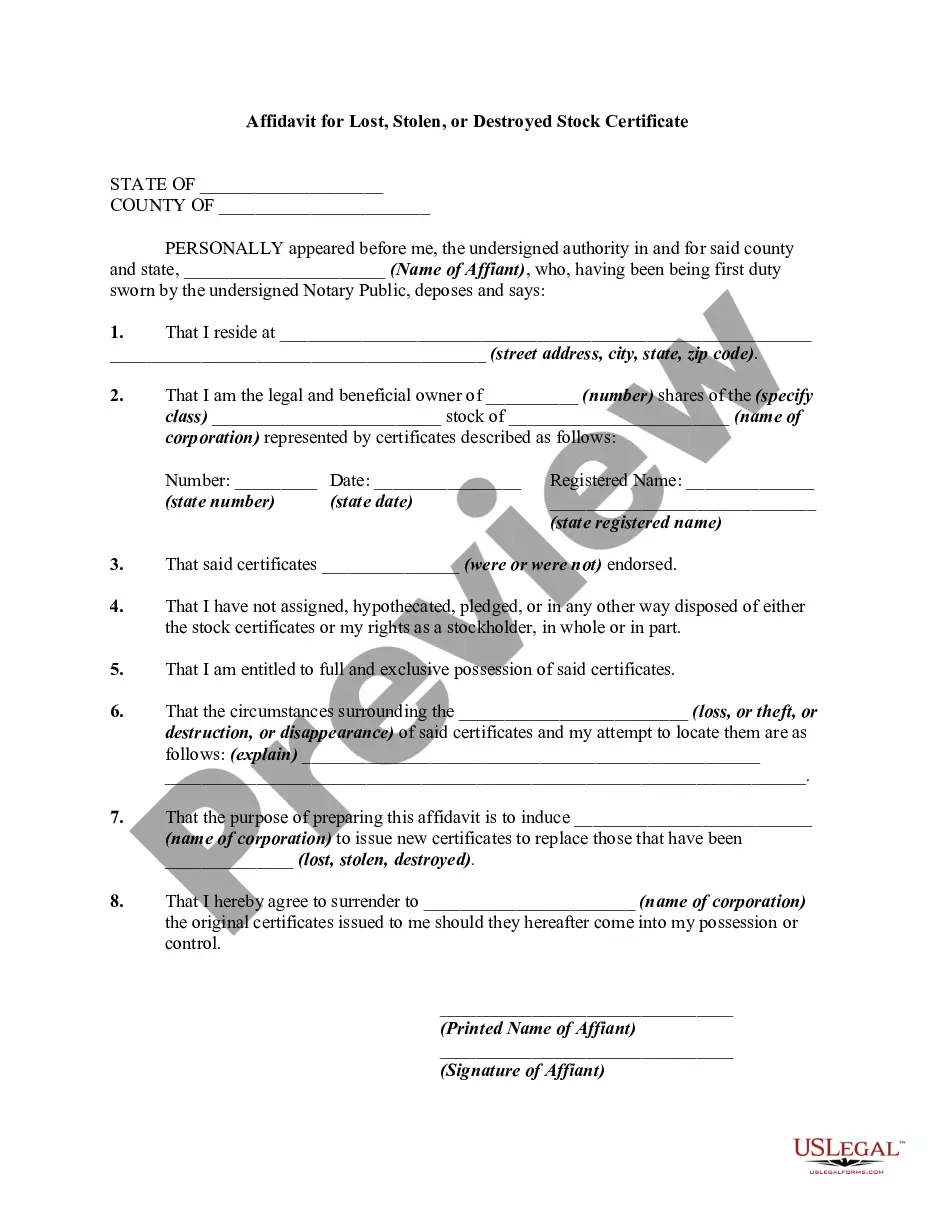

How to fill out Worksheet Analyzing A Self-Employed Independent Contractor?

Finding the correct legal document template can be a challenge.

Certainly, there are numerous layouts available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the North Carolina Worksheet Analyzing a Self-Employed Independent Contractor, which can be used for both business and personal purposes.

You can browse the form using the Preview button and read the form description to confirm this is the right one for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the North Carolina Worksheet Analyzing a Self-Employed Independent Contractor.

- Use your account to search through the legal forms you have obtained previously.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

To calculate income for self-employed borrowers, gather the last two years of personal tax returns and any business tax returns if applicable. Lenders typically average your net income from these returns over the relevant period. Using a North Carolina Worksheet Analyzing a Self-Employed Independent Contractor helps you compile this data efficiently, ensuring you present a robust financial profile to lenders.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Self-employment income is earned from carrying on a "trade or business" as a sole proprietor, an independent contractor, or some form of partnership. To be considered a trade or business, an activity does not necessarily have to be profitable, and you do not have to work at it full time, but profit must be your motive.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

To calculate gross income, add up your total sales revenue, then subtract any refunds and the cost of goods sold. Add in any extra income such as interest on loans, and you have your gross income for the business year.

To calculate income for a self-employed borrower, mortgage lenders will typically add the adjusted gross income as shown on the two most recent years' federal tax returns, then add certain claimed depreciation to that bottom-line figure. Next, the sum will be divided by 24 months to find your monthly household income.