North Carolina FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

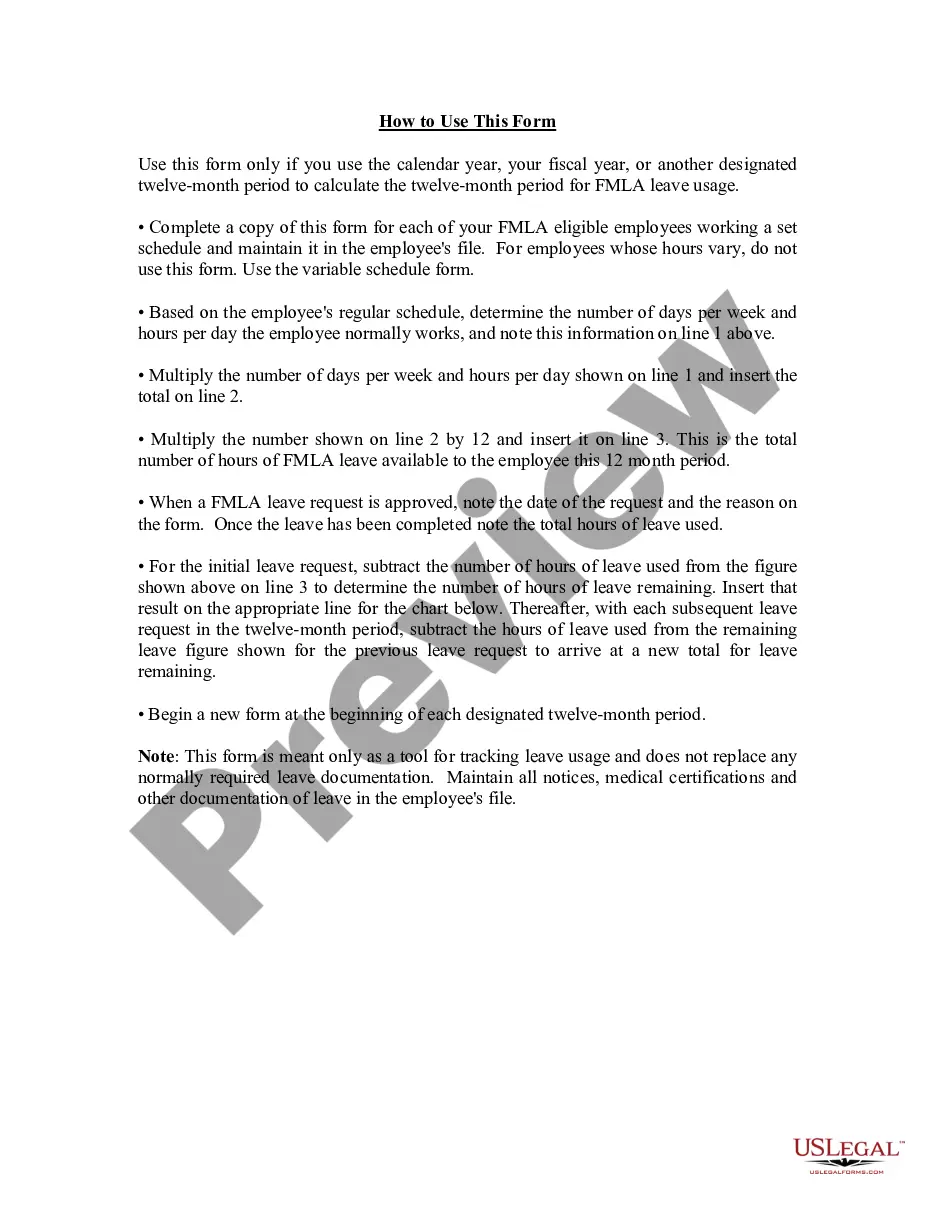

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the North Carolina FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule in mere moments.

If the form does not meet your needs, use the Search field at the top of the page to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Purchase Now button. Then, choose your preferred payment method and provide your details to create an account.

- If you already have a monthly subscription, Log In and download the North Carolina FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms under the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple instructions to get started.

- Make sure you have selected the correct form for your region/area.

- Select the Preview button to examine the form's details.

Form popularity

FAQ

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

Using this method, the employer will look back over the last 12 months from the date of the request, add all FMLA time the employee has used during the previous 12 months and subtract that total from the employee's 12-week leave allotment.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

Twelve (12) Month Period means the period of time from January 1st to December 31st of each year.

It refers to a period of time that "rolls" with whatever the current date is. A three-month rolling average refers to the three month immediately prior. Not "the first quarter" (Jan, Feb, March) but whatever three months came before.

Rolling year means the 12-month period measured backward from the date that leave is requested.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.