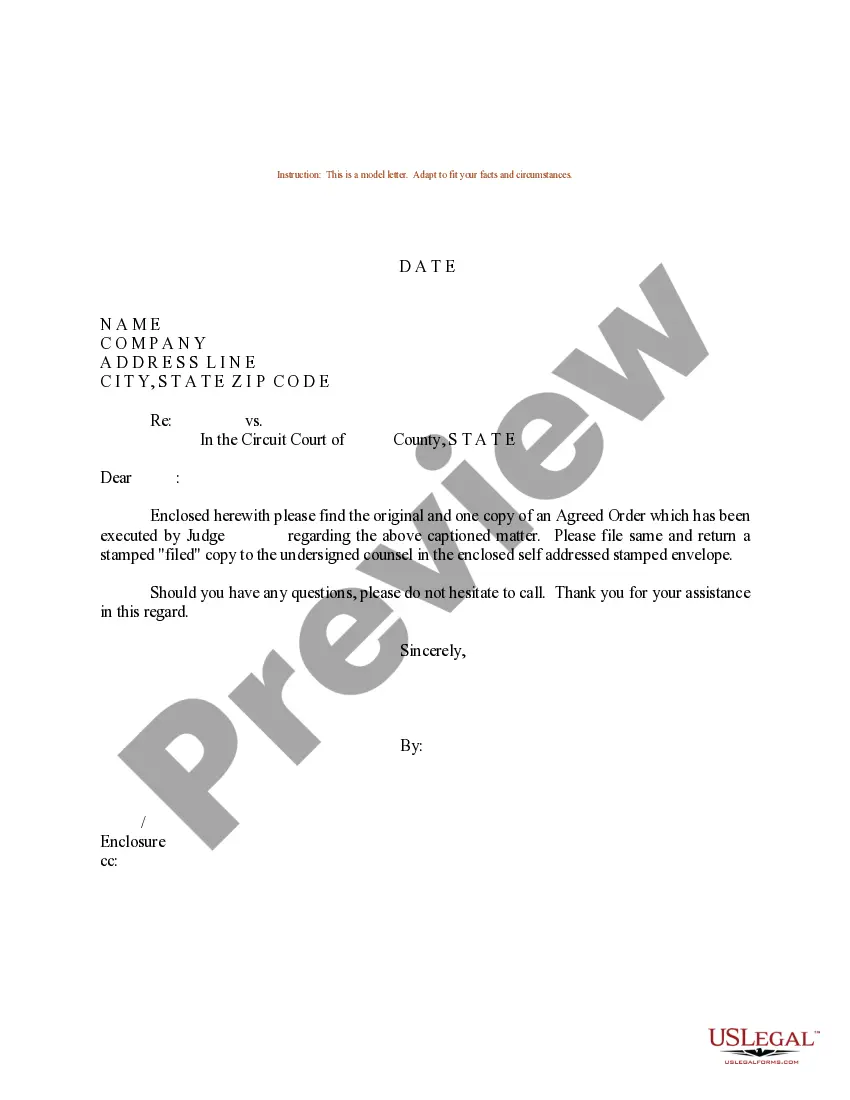

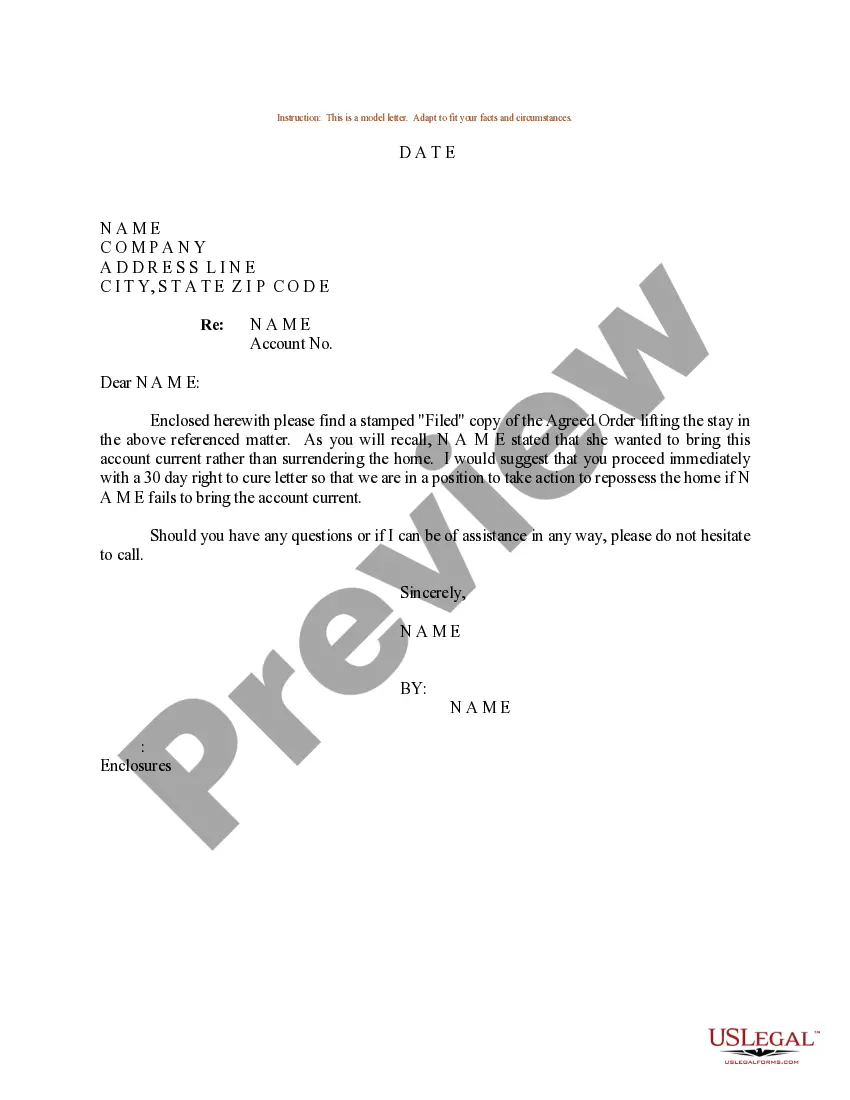

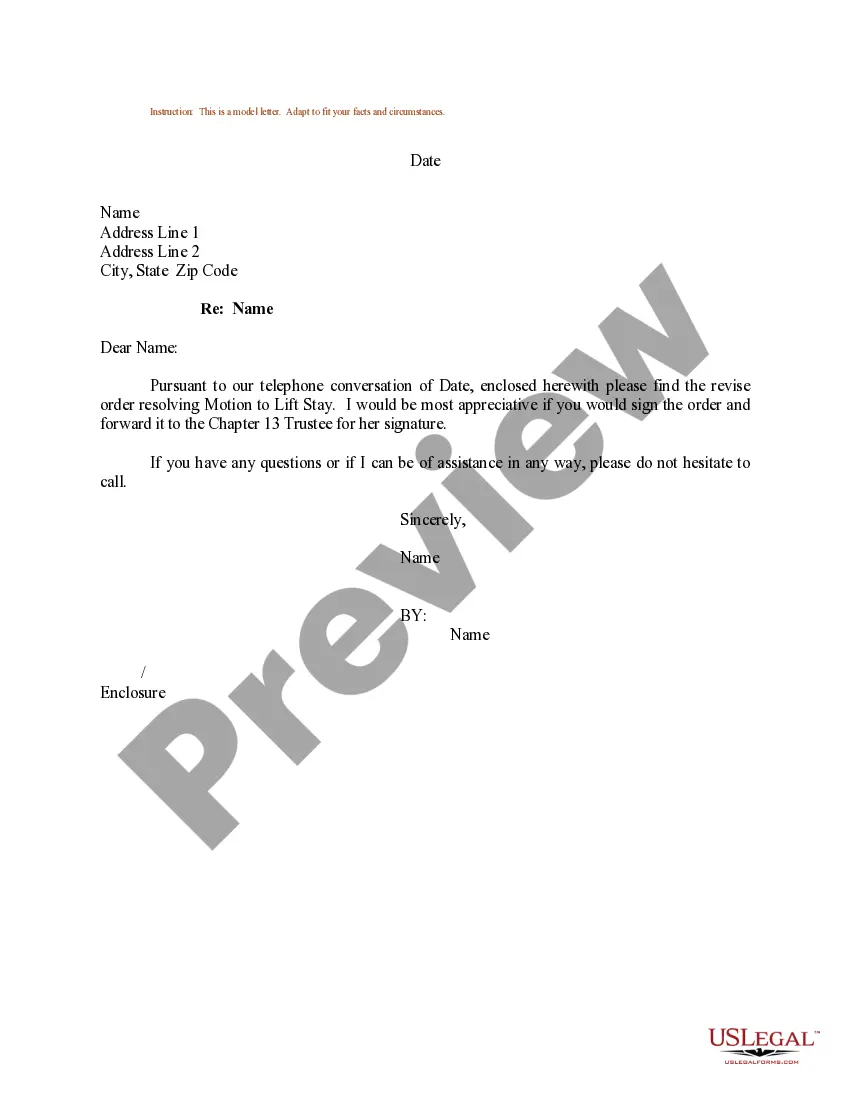

North Carolina Sample Letter for Revised Proposed Agreed Order

Description

How to fill out Sample Letter For Revised Proposed Agreed Order?

You may spend several hours on the Internet attempting to find the lawful record template which fits the federal and state specifications you require. US Legal Forms provides a huge number of lawful varieties that happen to be examined by specialists. It is simple to acquire or print out the North Carolina Sample Letter for Revised Proposed Agreed Order from my support.

If you have a US Legal Forms accounts, you are able to log in and click on the Down load key. Next, you are able to total, revise, print out, or signal the North Carolina Sample Letter for Revised Proposed Agreed Order. Every lawful record template you buy is your own permanently. To get another duplicate for any bought kind, check out the My Forms tab and click on the related key.

If you work with the US Legal Forms web site the first time, keep to the basic directions under:

- Initial, make certain you have chosen the right record template for the region/area of your choosing. See the kind description to make sure you have picked out the appropriate kind. If available, make use of the Review key to search with the record template as well.

- If you want to discover another model of the kind, make use of the Look for industry to find the template that meets your requirements and specifications.

- Upon having identified the template you need, just click Get now to carry on.

- Select the costs prepare you need, type in your qualifications, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your Visa or Mastercard or PayPal accounts to cover the lawful kind.

- Select the formatting of the record and acquire it to your system.

- Make changes to your record if required. You may total, revise and signal and print out North Carolina Sample Letter for Revised Proposed Agreed Order.

Down load and print out a huge number of record templates making use of the US Legal Forms site, which offers the largest selection of lawful varieties. Use professional and express-certain templates to deal with your small business or individual requirements.

Form popularity

FAQ

§ 105-241.24. The Department may collect a tax for a period of 10 years from the date it becomes collectible under G.S. 105-241.22. The 10-year period may be tolled for the same reasons the enforcement period for a certificate of tax liability may be tolled under G.S. 105-242(c).

A copy of the tax return you filed in another state or country if you claimed a tax credit for tax paid to another state or country on Form D-400TC, Line 7a. A copy of your federal tax return unless your federal return reflects a North Carolina address. Other required North Carolina forms or supporting schedules.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

You can file your tax return electronically or by mail. Before you file, determine your filing status.

Instead, many states require you to submit a copy of your entire federal tax return, including any schedules you attach such as a Schedule C for self-employment earnings or Schedule A for your itemized deductions. In certain circumstances, you may have to attach an additional state schedule to your state tax return.

A copy of the tax return you filed in another state or country if you claimed a tax credit for tax paid to another state or country on Form D-400TC, Line 7a. A copy of your federal tax return unless your federal return reflects a North Carolina address or you filed electronically.

Why did I receive a Notice to File a Return? The Department has many different programs and initiatives to identify taxpayers who have failed to file tax returns, failed to pay taxes owed, underpaid their taxes and other situations in which taxes are owed.

All personal service income earned in South Carolina must be reported to this state. You may choose the way that is most beneficial to you. This option is only available for the year you are a part- year resident. You must also attach a copy of your federal return.