North Carolina Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc.

Description

How to fill out Sample Letter For Re-Request Of Execution Of Petition For Authority To Sell Property Of Estate Etc.?

Finding the right legal document format can be a battle. Naturally, there are plenty of templates available online, but how can you discover the legal kind you require? Take advantage of the US Legal Forms website. The service gives a huge number of templates, such as the North Carolina Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc., which you can use for business and private needs. All the kinds are inspected by experts and meet federal and state requirements.

If you are previously registered, log in in your bank account and click on the Acquire key to get the North Carolina Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc.. Make use of bank account to search from the legal kinds you may have ordered in the past. Check out the My Forms tab of your bank account and obtain another duplicate in the document you require.

If you are a whole new user of US Legal Forms, here are easy recommendations that you can adhere to:

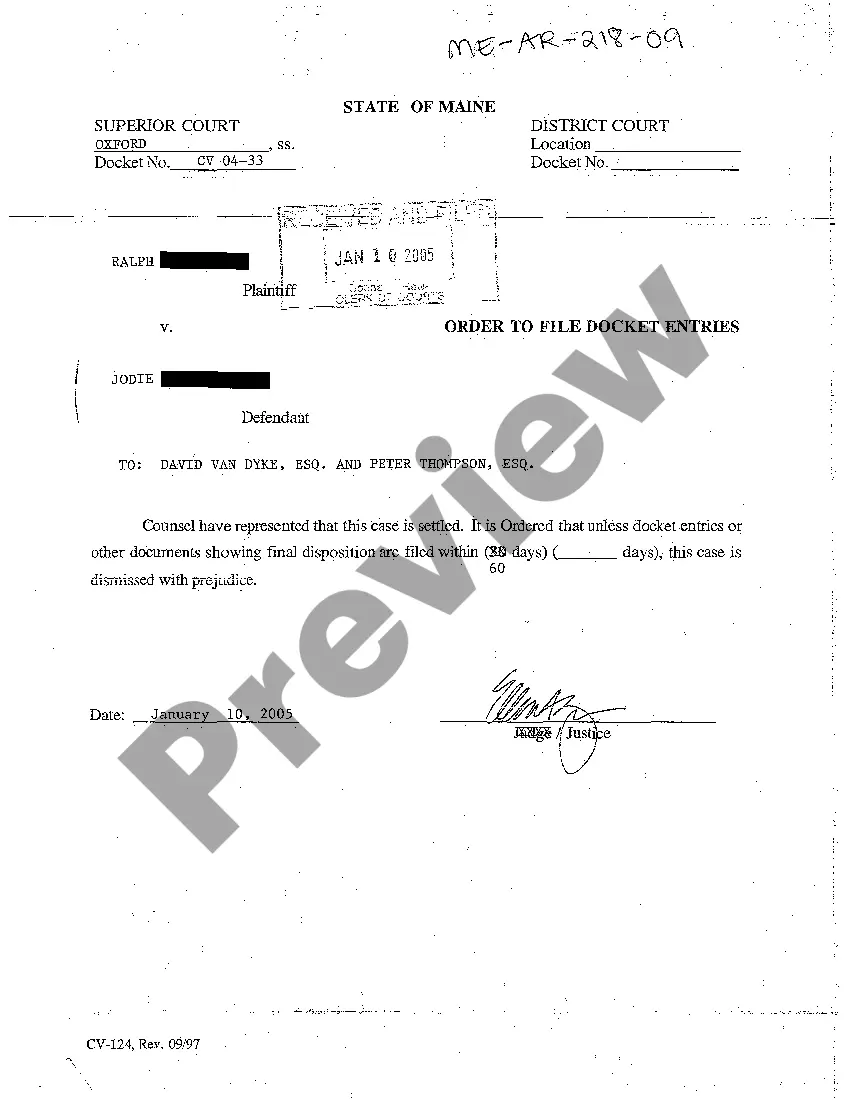

- Very first, ensure you have chosen the proper kind for your personal metropolis/region. You are able to examine the shape utilizing the Review key and read the shape outline to make certain it will be the right one for you.

- If the kind is not going to meet your needs, utilize the Seach field to find the appropriate kind.

- When you are certain the shape is acceptable, click the Buy now key to get the kind.

- Pick the pricing prepare you would like and type in the essential info. Build your bank account and pay money for an order making use of your PayPal bank account or charge card.

- Choose the document file format and down load the legal document format in your device.

- Comprehensive, modify and printing and signal the acquired North Carolina Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc..

US Legal Forms will be the largest library of legal kinds in which you can find different document templates. Take advantage of the service to down load skillfully-created files that adhere to condition requirements.

Form popularity

FAQ

The most useful tool we use to avoid probate is a revocable ?living? trust. A trust is an entity that holds property for the use of individuals known as beneficiaries. The property in the trust is managed by a trustee, but the trustee does not get to use the property for their own benefit.

Generally, North Carolina law expects the executor to settle the estate within a reasonable time frame, typically ranging from six to 18 months or longer for complex cases.

This Form (AOC-E-201) is used to start the process of settling a person's estate after they die (Probate). It's a request to make the Will and appointment of the Executor official and should be filled out by the Personal Representative.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

First, the court will review the person's will to determine if they named anyone executor of the estate. If there is a named executor, the court will contact that person and walk them through the paperwork they must file to assume that responsibility.

This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law. North Carolina also has a simplified probate process called summary administration which applies if the surviving spouse is the sole heir.

It depends on the nature of the Estate. Many assets pass outside of Probate and Estate Administration. For example, assets with Beneficiary designations such as retirement accounts and life insurance may pass outside of Probate. Many individuals opt to use Trusts to keep assets out of Probate.