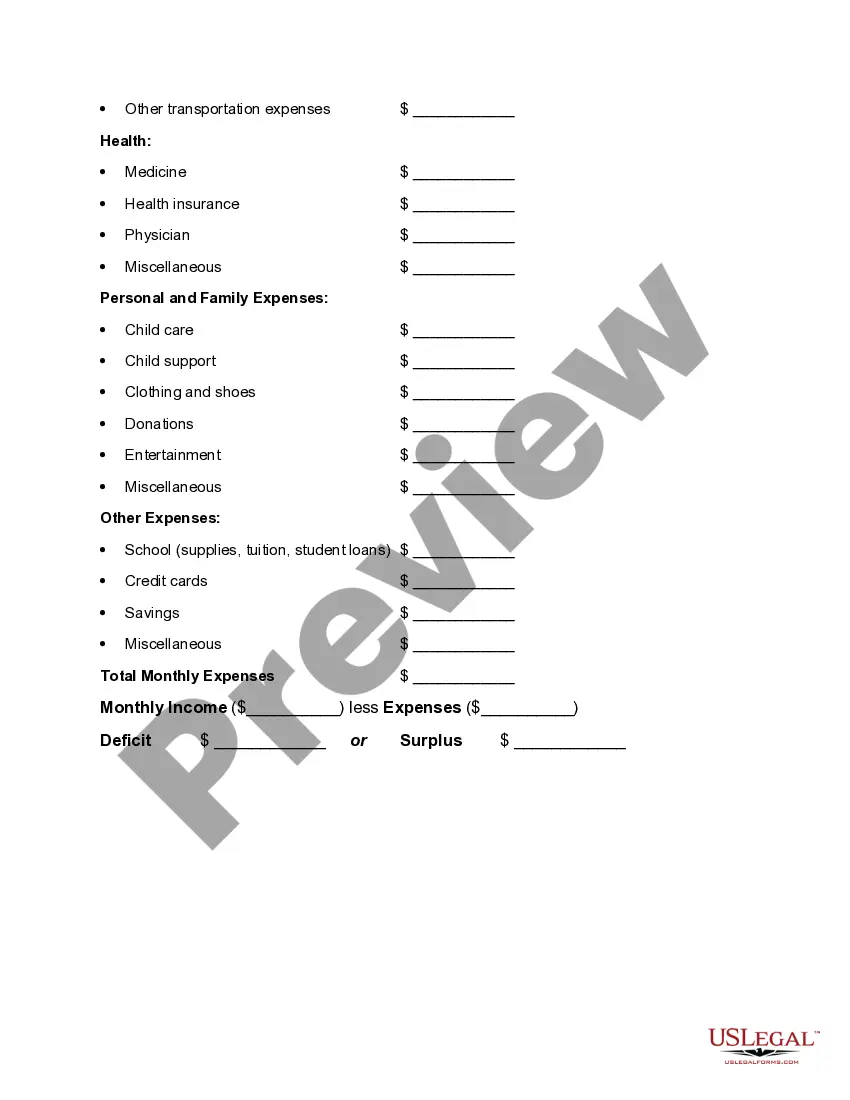

Indiana Worksheet for Making a Budget

Description

How to fill out Worksheet For Making A Budget?

US Legal Forms - one of the largest collections of legal documents in the country - provides a variety of legal form templates that you can download or create.

Through the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms such as the Indiana Worksheet for Creating a Budget in mere seconds.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

Once satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to create an account. After that, process the purchase using your credit card or PayPal account to complete the transaction.

- If you have a monthly subscription, Log In to obtain the Indiana Worksheet for Creating a Budget from your US Legal Forms library.

- The Download button will appear on every form you open.

- You can find all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to help you begin.

- Ensure you have selected the correct form for your locality.

- Click the Review button to examine the form's contents.

Form popularity

FAQ

A simple, step-by-step guide to creating a budget in Google SheetsStep 1: Open a Google Sheet.Step 2: Create Income and Expense Categories.Step 3: Decide What Budget Period to Use.Step 4: Use simple formulas to minimize your time commitment.Step 5: Input your budget numbers.Step 6: Update your budget.

10 Things to Include in Your Budget SpreadsheetItem #1- Housing Payment.Item #2- Costs Associated With Your Residence.Item #3- Emergency Fund.Item #4- General Savings Fund.Item #5- Gifts.Item #6- Debt Payments.Item #7- Entertainment Expenses.Item #8- Clothes and Accessories.More items...?

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

How to make a monthly budget: 5 stepsCalculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month.Spend a month or two tracking your spending.Think about your financial priorities.Design your budget.Track your spending and refine your budget as needed.

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.

How to Create a Monthly Budget in 6 StepsTOTAL YOUR MONTHLY TAKE-HOME PAY.ADD UP WHAT YOU SPEND ON FIXED EXPENSES.ADD UP WHAT YOU SPEND ON NON-MONTHLY COSTS.ADD UP CONTRIBUTIONS TO FINANCIAL GOALS.ADD UP YOUR DISCRETIONARY SPENDING.DO SOME SIMPLE MATH.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Follow the steps below as you set up your own, personalized budget:Make a list of your values. Write down what matters to you and then put your values in order.Set your goals.Determine your income.Determine your expenses.Create your budget.Pay yourself first!Be careful with credit cards.Check back periodically.

Spreadsheets help you to see how much income you have, as well as how your money is spent. That way, you can budget your money appropriately for your needs. While not a spreadsheet, the CFPB offers a budgeting worksheet to help you plan for your financial needs.

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.