North Carolina Sample Letter for Execution of Petition to Close Estate and For Other Relief

Description

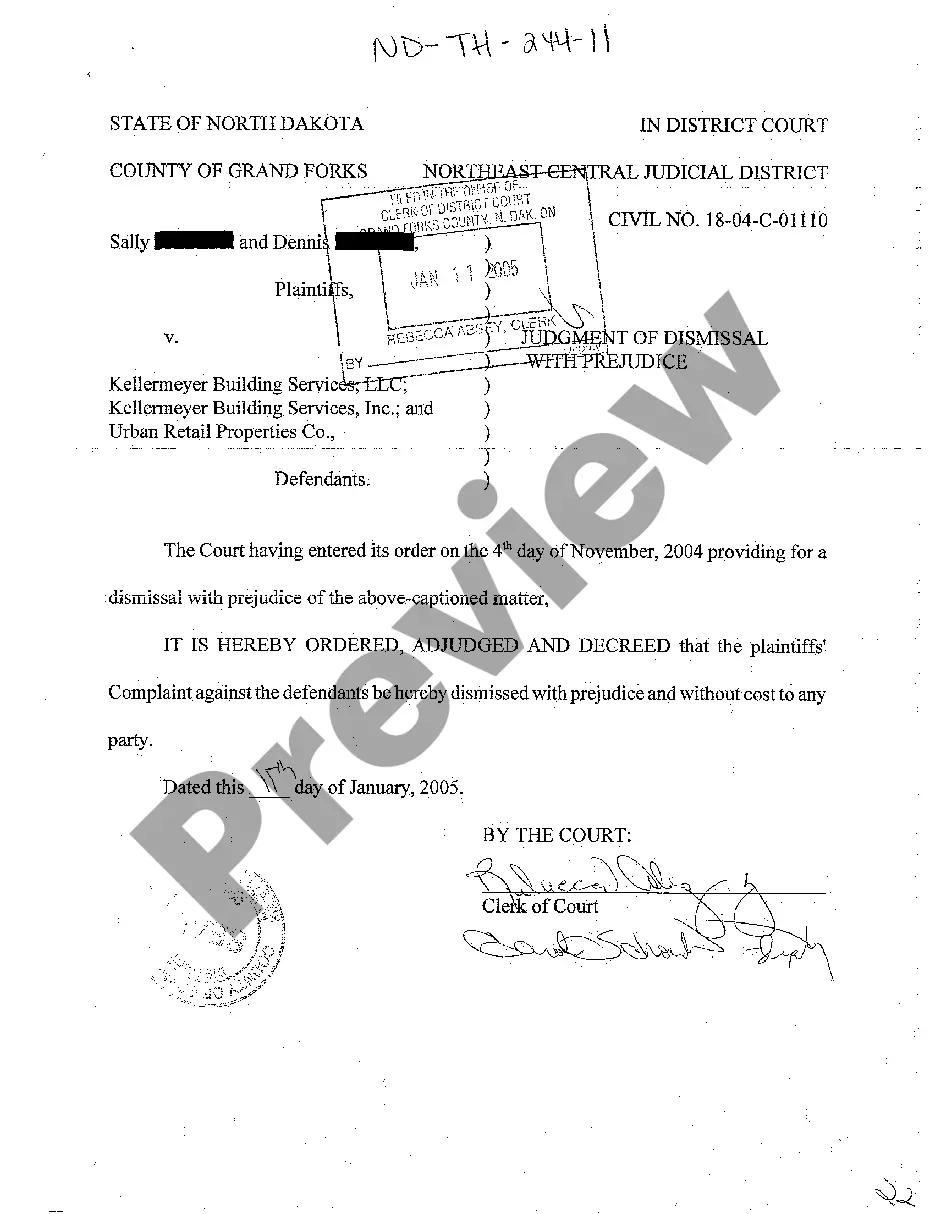

How to fill out Sample Letter For Execution Of Petition To Close Estate And For Other Relief?

If you need to full, down load, or print out legitimate file web templates, use US Legal Forms, the largest variety of legitimate forms, that can be found online. Utilize the site`s easy and handy search to obtain the documents you need. Various web templates for organization and personal functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the North Carolina Sample Letter for Execution of Petition to Close Estate and For Other Relief in just a handful of mouse clicks.

When you are previously a US Legal Forms client, log in to your account and click the Acquire switch to obtain the North Carolina Sample Letter for Execution of Petition to Close Estate and For Other Relief. You may also entry forms you previously acquired from the My Forms tab of your account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for the correct town/region.

- Step 2. Make use of the Review option to check out the form`s information. Never forget to see the outline.

- Step 3. When you are not satisfied using the form, utilize the Research field at the top of the monitor to locate other models in the legitimate form format.

- Step 4. Upon having found the shape you need, go through the Buy now switch. Select the prices strategy you prefer and add your references to sign up for an account.

- Step 5. Method the deal. You can use your charge card or PayPal account to finish the deal.

- Step 6. Choose the format in the legitimate form and down load it on your own device.

- Step 7. Full, change and print out or indication the North Carolina Sample Letter for Execution of Petition to Close Estate and For Other Relief.

Each and every legitimate file format you purchase is your own property permanently. You have acces to each and every form you acquired in your acccount. Go through the My Forms segment and pick a form to print out or down load once again.

Compete and down load, and print out the North Carolina Sample Letter for Execution of Petition to Close Estate and For Other Relief with US Legal Forms. There are millions of professional and condition-distinct forms you may use for your organization or personal needs.

Form popularity

FAQ

Unless the Will provides otherwise, under North Carolina law, Executors or Administrators may claim a commission of up to 5% of the Estate assets and receipts, as approved by the Clerk of Court. Trusts should provide specific guidance regarding compensation.

In North Carolina, executor removal involves filing a petition with the appropriate court. If you have good cause, then you can get an executor removed. That being said, our state's courts will not remove an executor simply because you disagree with their decisions or because you are unhappy with their performance.

?If the executor owns the home, there is no timeline for them to sell it,? Millane says. If you're tasked with selling the home per the terms of the will, you must obtain approval from the probate court to sell the home.

Generally, North Carolina law expects the executor to settle the estate within a reasonable time frame, typically ranging from six to 18 months or longer for complex cases.

North Carolina has no separate state estate tax, inheritance tax nor gift tax. Close the estate. Close the estate bank account after all debts are paid and assets are distributed. Once all claims against the estate have been satisfied, file a final accounting with the probate court and ask that the estate be closed.

Every estate is different and can take a different length of time to administer depending on its complexity. There is a general expectation that an executor or administrator should try to complete the estate administration within a year of the death, and this is referred to as the executor's year.

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.

This is a common and reasonable question, but it can also be a difficult one to answer without a more detailed look at the situation. A common rule of thumb is that total probate and estate administration costs tend to end up in the range of 2-8% of the estate.