North Carolina Sample Letter for Ad Valorem Tax Exemption

Description

How to fill out Sample Letter For Ad Valorem Tax Exemption?

Finding the right legal record format can be quite a have difficulties. Of course, there are a lot of layouts available on the net, but how can you obtain the legal kind you want? Use the US Legal Forms web site. The assistance provides a large number of layouts, like the North Carolina Sample Letter for Ad Valorem Tax Exemption, that you can use for enterprise and personal needs. Each of the kinds are examined by pros and meet federal and state requirements.

Should you be previously registered, log in to your accounts and click on the Down load button to get the North Carolina Sample Letter for Ad Valorem Tax Exemption. Make use of accounts to search from the legal kinds you may have purchased previously. Visit the My Forms tab of your own accounts and get another backup in the record you want.

Should you be a brand new customer of US Legal Forms, allow me to share straightforward guidelines so that you can comply with:

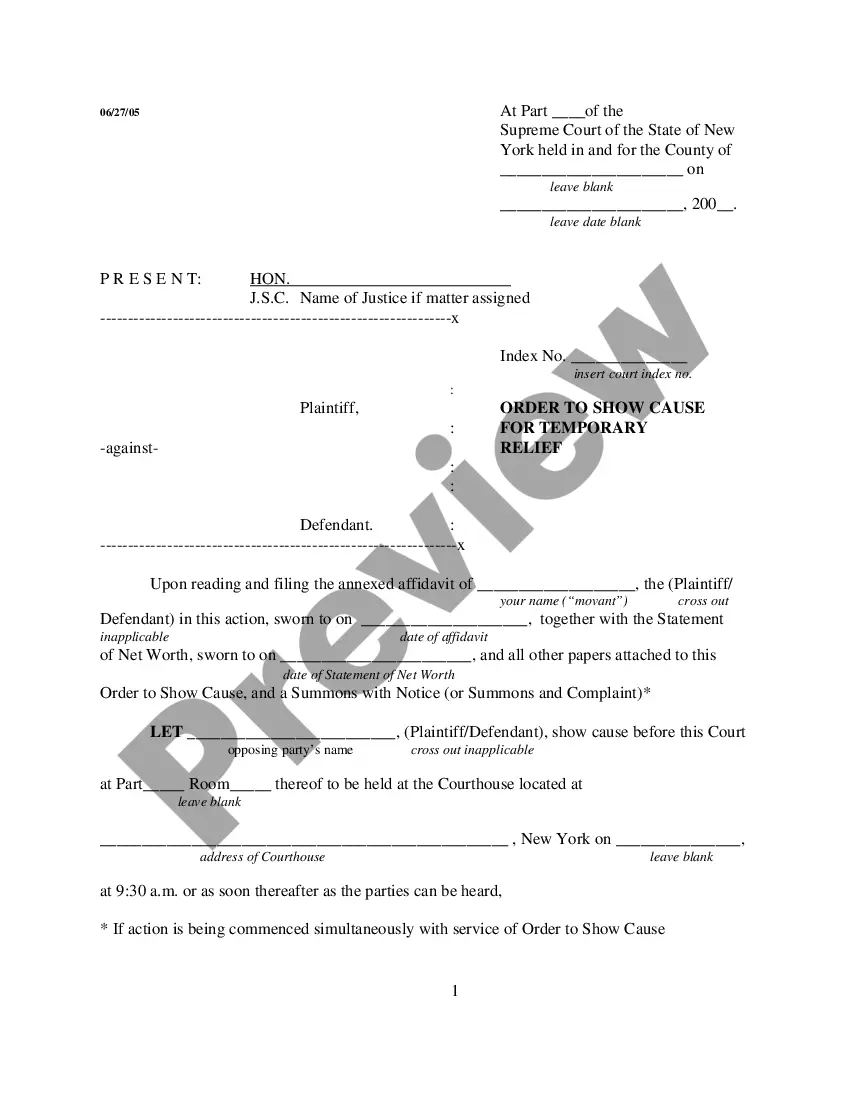

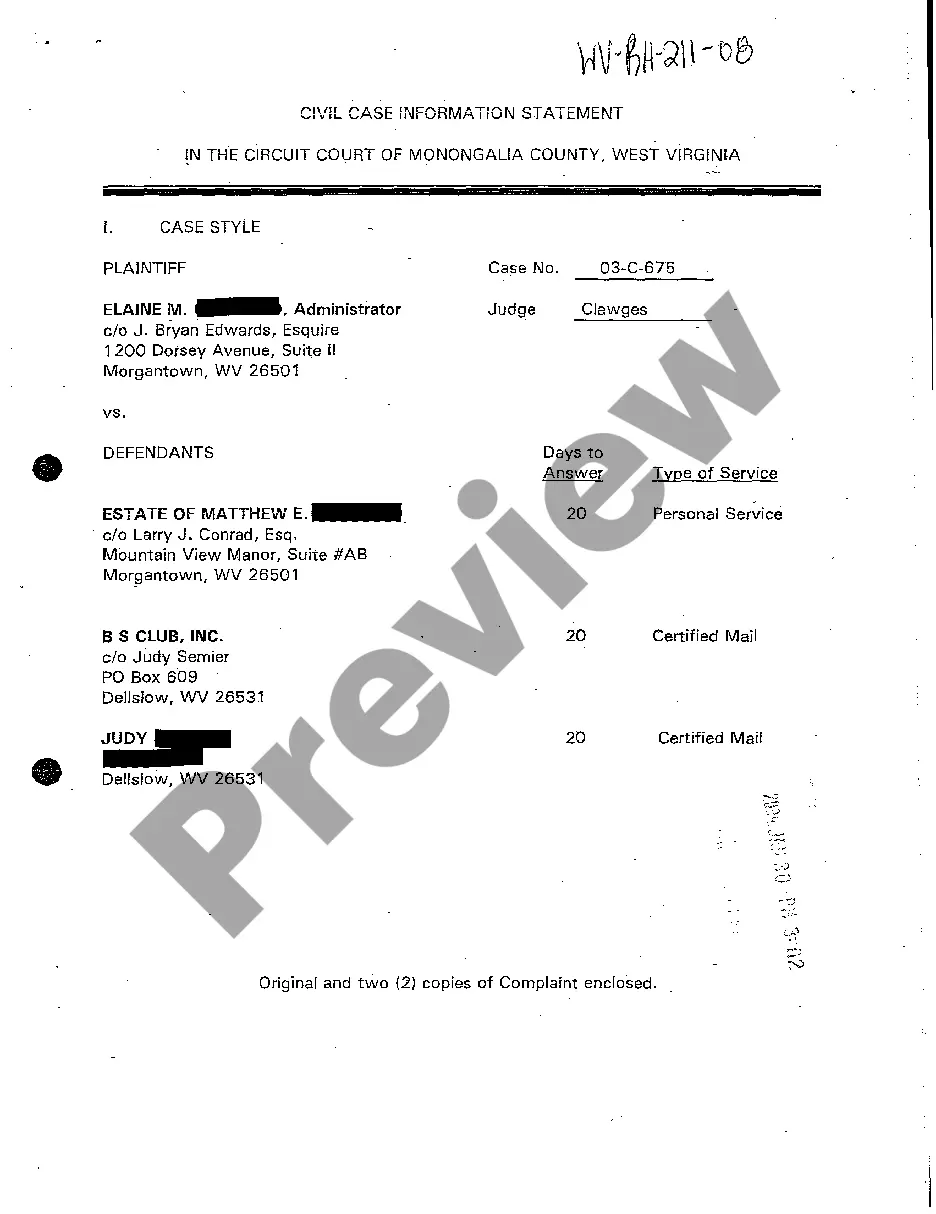

- Initially, be sure you have chosen the proper kind for your personal metropolis/state. You can examine the form making use of the Preview button and read the form explanation to guarantee it is the best for you.

- In case the kind will not meet your preferences, make use of the Seach discipline to find the appropriate kind.

- Once you are certain that the form is suitable, click the Acquire now button to get the kind.

- Opt for the prices plan you would like and enter in the required details. Make your accounts and pay money for your order with your PayPal accounts or bank card.

- Opt for the submit format and acquire the legal record format to your system.

- Complete, revise and print and signal the obtained North Carolina Sample Letter for Ad Valorem Tax Exemption.

US Legal Forms is the largest library of legal kinds for which you will find a variety of record layouts. Use the service to acquire expertly-created papers that comply with status requirements.

Form popularity

FAQ

There are many programs and regulations in North Carolina which provide for a reduced rate, exclusion, or deferment of ad valorem tax. These various regulations and programs are found in Chapter 105 of the North Carolina General Statutes.

Homestead Property Exclusion / Exemption The State of North Carolina excludes from property taxes a portion of the appraised value of permanent residents owned and occupied by North Carolina residents aged 65 or older or totally and permanently disabled whose 2022 income does not exceed $33,800 annually.

For information on exemption certificate procedures and exemption number requirements in North Carolina, see Section 52 of the Sales and Use Tax Technical Bulletins which can be found on the Department's website at .dornc.com, or you may contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll ...

Details on North Carolina Retirement Taxes Social Security income in North Carolina is not taxed. However, withdrawals from retirement accounts are fully taxed. Additionally, pension incomes are fully taxed.

The Tax Credit for the Elderly and Disabled is a credit for persons over 65 years of age, as well as persons under 65 and disabled. But, to receive the tax credit as a disabled individual, one must be retired on permanent and total disability (preventing an individual from being employable).

Homestead Property Exclusion / Exemption The State of North Carolina excludes from property taxes a portion of the appraised value of permanent residents owned and occupied by North Carolina residents aged 65 or older or totally and permanently disabled whose 2022 income does not exceed $33,800 annually.

North Carolina General Statute 105-277.1 excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or older, or totally and permanently disabled person, whose income does not exceed the income eligibility limit set on or before July 1 ...