North Carolina Sample Letter for Exemption of Ad Valorem Taxes

Description

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

Are you inside a situation the place you will need paperwork for either company or personal reasons virtually every working day? There are plenty of authorized file web templates available on the Internet, but getting kinds you can depend on is not effortless. US Legal Forms provides 1000s of type web templates, just like the North Carolina Sample Letter for Exemption of Ad Valorem Taxes, that happen to be published to satisfy federal and state demands.

When you are previously knowledgeable about US Legal Forms internet site and get an account, just log in. Afterward, you may obtain the North Carolina Sample Letter for Exemption of Ad Valorem Taxes design.

If you do not have an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and ensure it is for the appropriate metropolis/area.

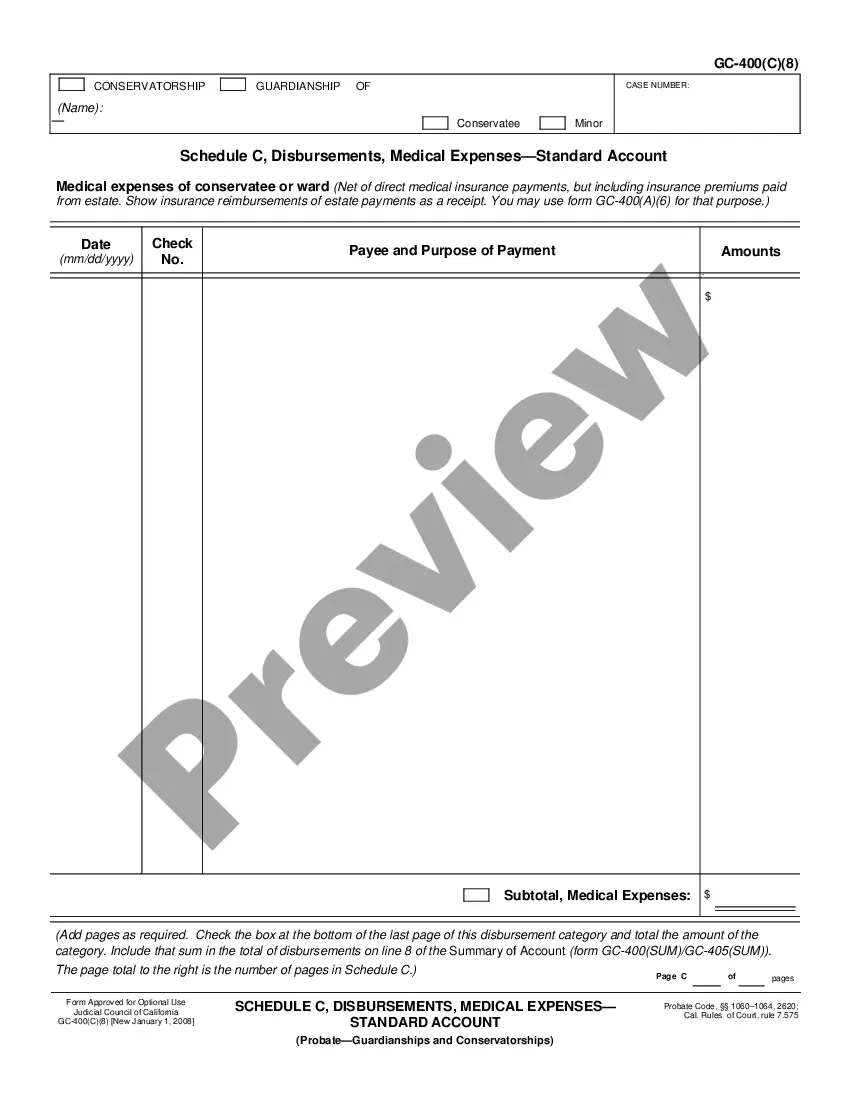

- Take advantage of the Preview option to analyze the shape.

- Look at the outline to ensure that you have selected the correct type.

- If the type is not what you`re searching for, utilize the Research area to find the type that fits your needs and demands.

- When you obtain the appropriate type, just click Acquire now.

- Pick the prices strategy you want, complete the necessary information to create your money, and pay money for your order with your PayPal or credit card.

- Choose a hassle-free file formatting and obtain your version.

Find each of the file web templates you might have bought in the My Forms food list. You can aquire a further version of North Carolina Sample Letter for Exemption of Ad Valorem Taxes at any time, if possible. Just select the necessary type to obtain or printing the file design.

Use US Legal Forms, by far the most comprehensive collection of authorized forms, to conserve efforts and steer clear of faults. The services provides appropriately made authorized file web templates that can be used for a variety of reasons. Make an account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

Some goods are exempt from sales tax under North Carolina law. Examples include most non-prepared food items, food stamps, and medical supplies. We recommend businesses review the laws and rules put forth by the NCDOR to stay up to date on which goods are taxable and which are exempt, and under what conditions.

North Carolina transfer tax exemptions There are circumstances where there is no transfer tax needed. Some of these are deeds of gift, foreclosure deeds, deeds from local, state, or federal government, and certain leases with a term of fewer than 10 years.

For information on exemption certificate procedures and exemption number requirements in North Carolina, see Section 52 of the Sales and Use Tax Technical Bulletins which can be found on the Department's website at .dornc.com, or you may contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll ...

There are many programs and regulations in North Carolina which provide for a reduced rate, exclusion, or deferment of ad valorem tax. These various regulations and programs are found in Chapter 105 of the North Carolina General Statutes.

North Carolina General Statute 105-277.1 excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or older, or totally and permanently disabled person, whose income does not exceed the income eligibility limit set on or before July 1 ...

The sales tax exempt number assigned to NC State from the NC Department of Revenue is 400021. The NCSU Controller's Office Vendor Sales Tax Exemption Letter should be provided to the supplier.

Homestead Property Exclusion / Exemption The State of North Carolina excludes from property taxes a portion of the appraised value of permanent residents owned and occupied by North Carolina residents aged 65 or older or totally and permanently disabled whose 2022 income does not exceed $33,800 annually.

Contractors Exempt from 4% Withholding: A partnership that has a permanent place of business in N.C. Any entity that is exempt from N.C. corporate income tax. An individual who is an ordained or licensed member of the clergy. Resident of North Carolina.