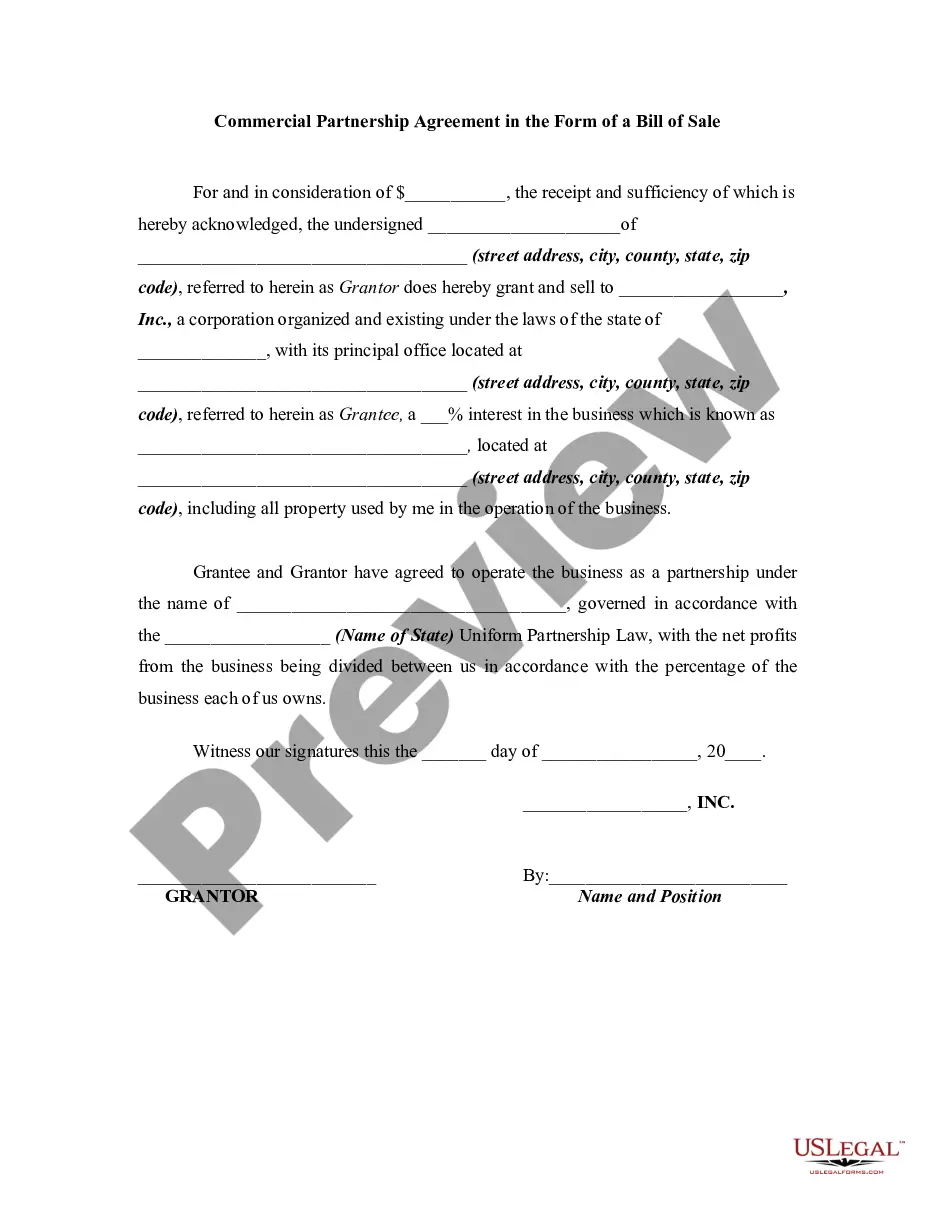

North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out Commercial Partnership Agreement In The Form Of A Bill Of Sale?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a range of legal document templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the most up-to-date versions of forms such as the North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale within moments.

If you already have a membership, Log In to retrieve the North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale from the US Legal Forms library. The Download option will be readily available for every form you review. You can also access all your previously acquired forms in the My documents section of your account.

Make edits. Complete, modify, print, and sign the downloaded North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale.

Every template you add to your account does not expire and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

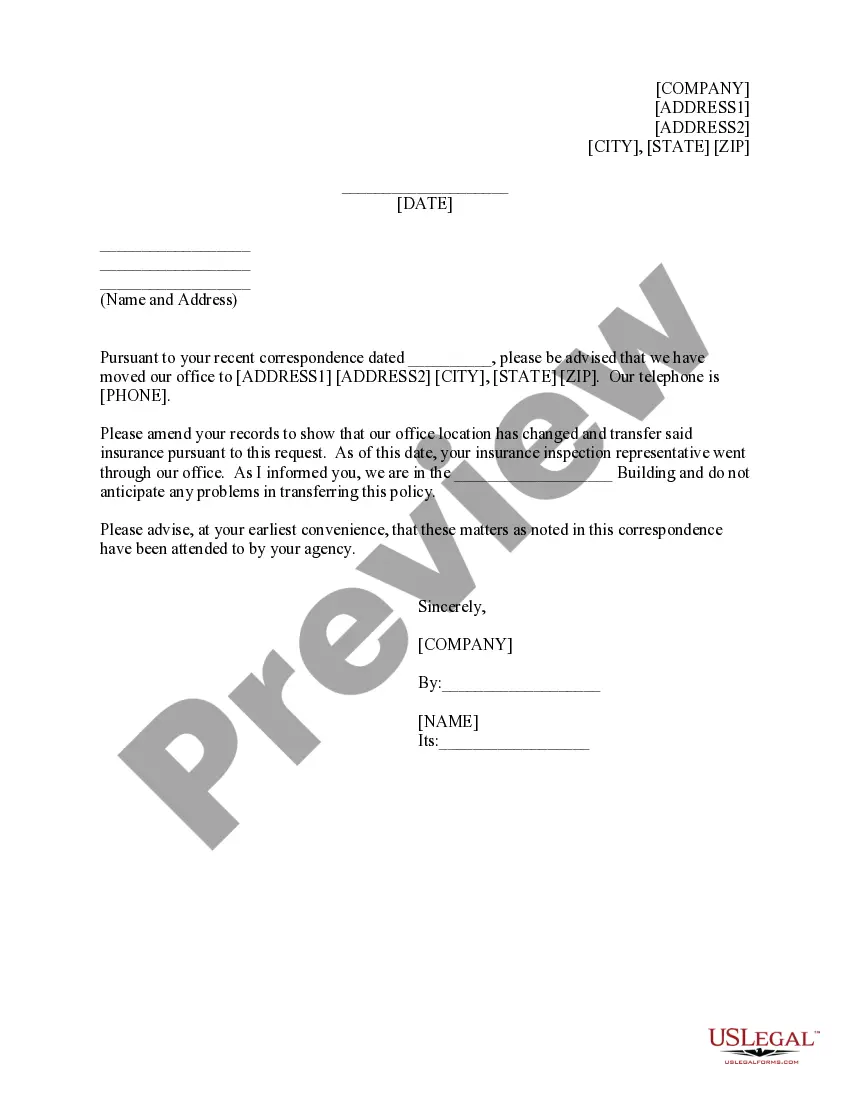

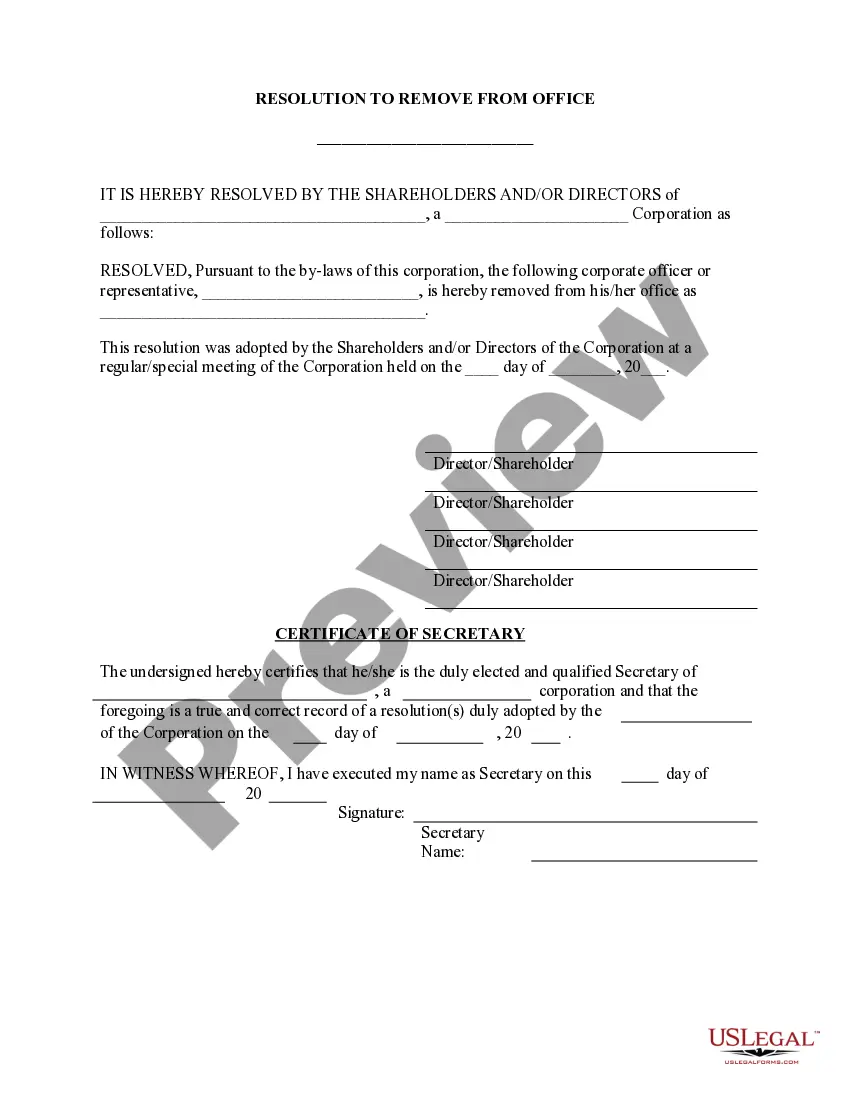

- Ensure you have selected the correct form for your city/state. Use the Preview feature to examine the form’s content. Review the form description to confirm you have selected the right one.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking on the Get now button. Then, choose the payment plan you wish and provide your details to set up an account.

- Process the purchase. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Yes, North Carolina requires partnerships to file a tax return using Form D-403. This form is essential for reporting partnership income and ensuring that all tax obligations are met. Filing your partnership tax return accurately protects your North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale status, keeping your business compliant with state regulations.

The partnership return form for North Carolina is Form D-403, which is specifically designed for reporting income earned by partnerships. It is important for partners to complete this form accurately to ensure compliance with state tax laws. This includes income from your North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale, helping maintain transparent financial records.

The NC BR form refers to the North Carolina Business Registration form, which is crucial for establishing a partnership in the state. Completing this form correctly lays the foundation for your North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale. Once filed, it provides the necessary legal recognition you need to operate your business.

To register a partnership in North Carolina, you must file your partnership registration with the Secretary of State. You will need to complete the necessary forms and provide relevant information about your business. This step ensures your North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale is recognized legally, allowing you to operate your business legally in the state.

Yes, North Carolina offers e-filing options for several tax forms, including those related to partnership taxes. E-filing can simplify the process, making it easier for you to submit your North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale documents electronically. Utilizing e-filing helps you save time and reduces the likelihood of errors.

Form D-400 is the individual income tax form used in North Carolina. This form is essential for reporting personal income, and it plays a key role for partners involved in a North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale. Understanding this form is crucial for ensuring proper tax compliance and avoiding penalties.

Yes, you can file the North Carolina Business Registration (NC BR) online. This process allows you to efficiently submit your documents without the need for physical visits. By using the online service, you can also track the status of your North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale applications. This convenience helps streamline your business registration experience.

In North Carolina, various documents benefit from notarization, including property deeds, powers of attorney, and certain contracts. Notarization helps confirm the identity of parties and the authenticity of their signatures. While not all documents must be notarized, having a notarized North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale can significantly enhance its legal standing and reliability in transactions.

To obtain a bill of sale in North Carolina, you can create one yourself using templates available online or seek assistance from legal service platforms such as US Legal Forms. These platforms provide ready-made forms that meet North Carolina’s legal standards. If you are including it in a North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale, it’s beneficial to ensure that all required details are accurately captured to avoid future complications.

A bill of sale does not have to be notarized in North Carolina, but notarization can enhance its validity and acceptance. For many buyers and sellers, having a notarized document provides confidence and security, especially in complex deals. This is particularly true when dealing with major assets under agreements like the North Carolina Commercial Partnership Agreement in the Form of a Bill of Sale.