Iowa User Oriented Software and Equipment Maintenance Services Agreement

Description

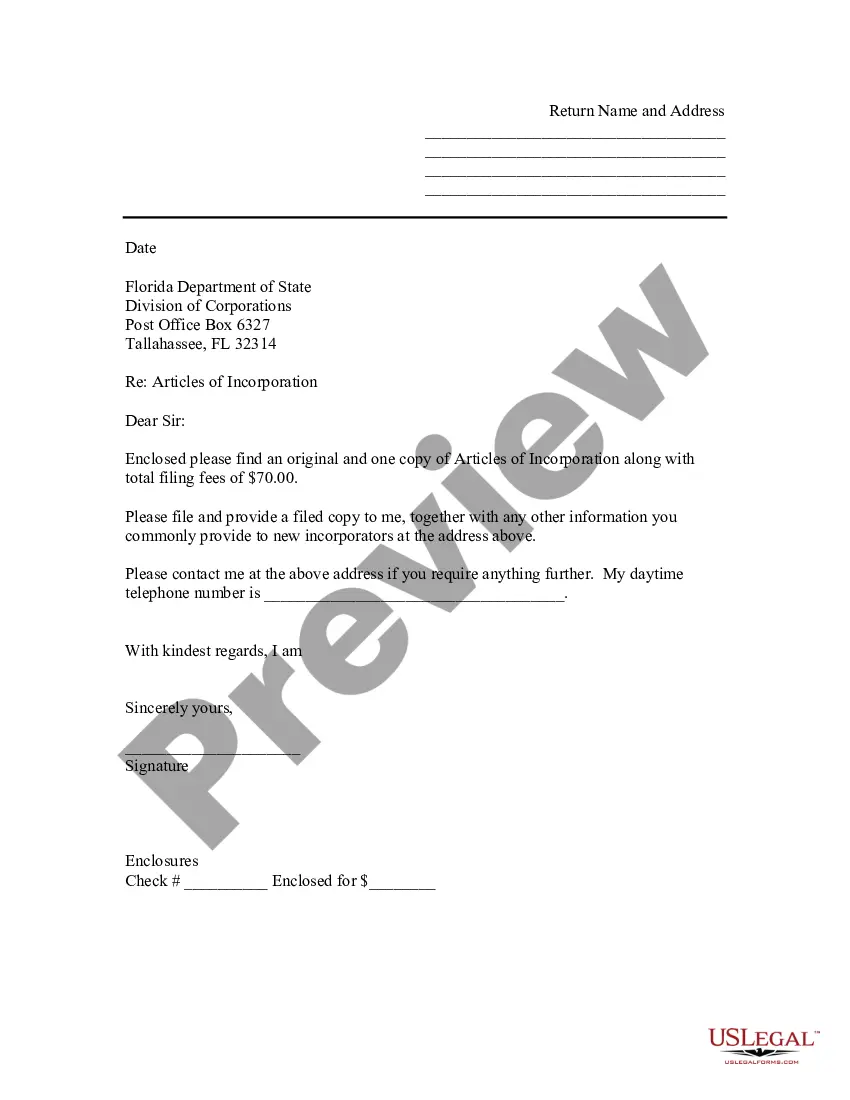

How to fill out User Oriented Software And Equipment Maintenance Services Agreement?

US Legal Forms - one of the largest archives of legal templates in the United States - offers a variety of legal document forms that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Iowa User Oriented Software and Equipment Maintenance Services Agreement within moments. If you possess a subscription, Log In and download the Iowa User Oriented Software and Equipment Maintenance Services Agreement from the US Legal Forms catalog. The Obtain button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

If you are new to using US Legal Forms, here are simple instructions to help you get started: Ensure you have chosen the correct form for your area/region. Click the Preview button to review the content of the form. Read the description of the form to confirm that you have selected the correct one. If the form does not meet your needs, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking on the Acquire now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use a Visa or Mastercard or PayPal account to finalize the transaction.

- Choose the format and download the form onto your device.

- Make modifications. Fill out, alter, and print/sign the downloaded Iowa User Oriented Software and Equipment Maintenance Services Agreement.

- Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Iowa User Oriented Software and Equipment Maintenance Services Agreement with US Legal Forms, the most extensive collection of legal document templates. Use thousands of professional and state-specific templates that address your business or personal requirements and specifications.

Form popularity

FAQ

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

Service fees for the installation of software are subject to sales tax. Moreover, charges for software maintenance services including delivery of updates for prewritten software are generally taxable. However, maintenance contracts that only provide support services for canned software are not taxable.

Sales of custom software - downloaded are exempt from the sales tax in Iowa.

The retail sale of software sold as tangible personal property is generally taxable in Iowa unless considered an exempt commercial enterprise.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Sales of custom software - downloaded are exempt from the sales tax in Iowa.

The gross receipts from the sale of a preventive maintenance contract is not subject to tax.

Services provided to the following entities are exempt from sales and use tax: Iowa private nonprofit educational institutions, the federal government, Iowa governmental subdivisions, Iowa government agencies, certain nonprofit care facilities, nonprofit museums, and nonprofit legal aid organizations.

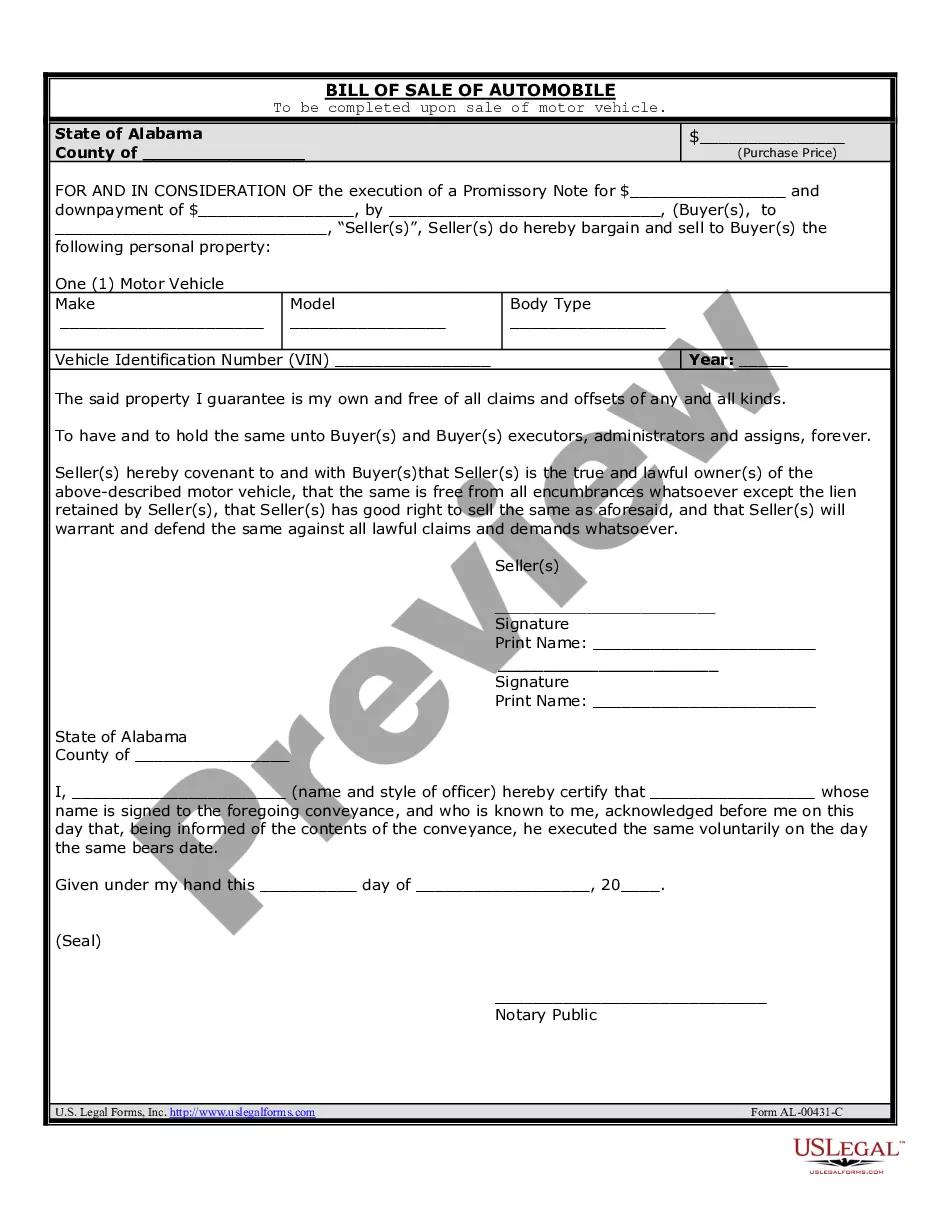

A maintenance agreement outlines the steps one party will undertake to insure the upkeep, repair, serviceability of another party's property. Maintenance contracts are commonly used by companies that take care of vehicle fleets, industrial equipment, office and apartment buildings, computer networks, etc.