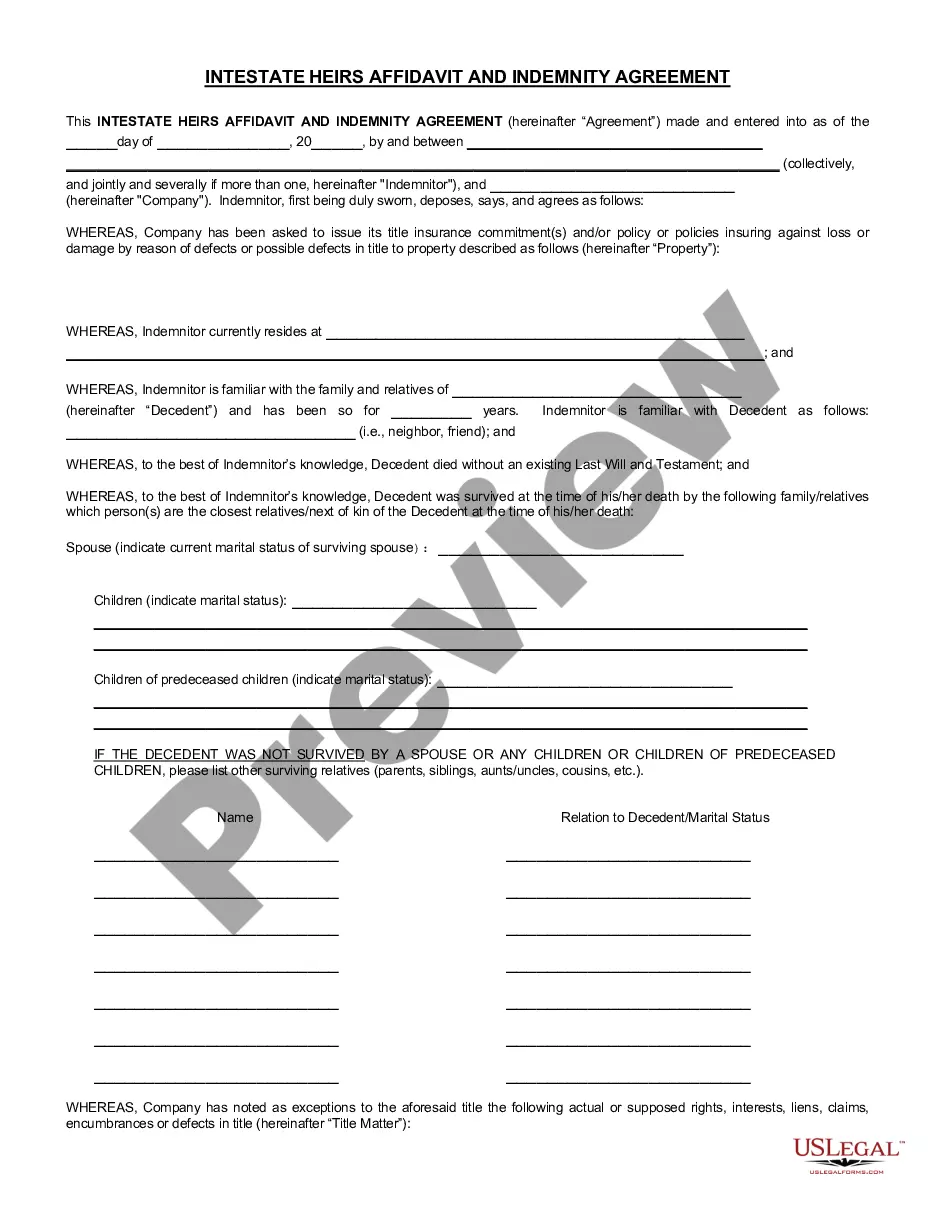

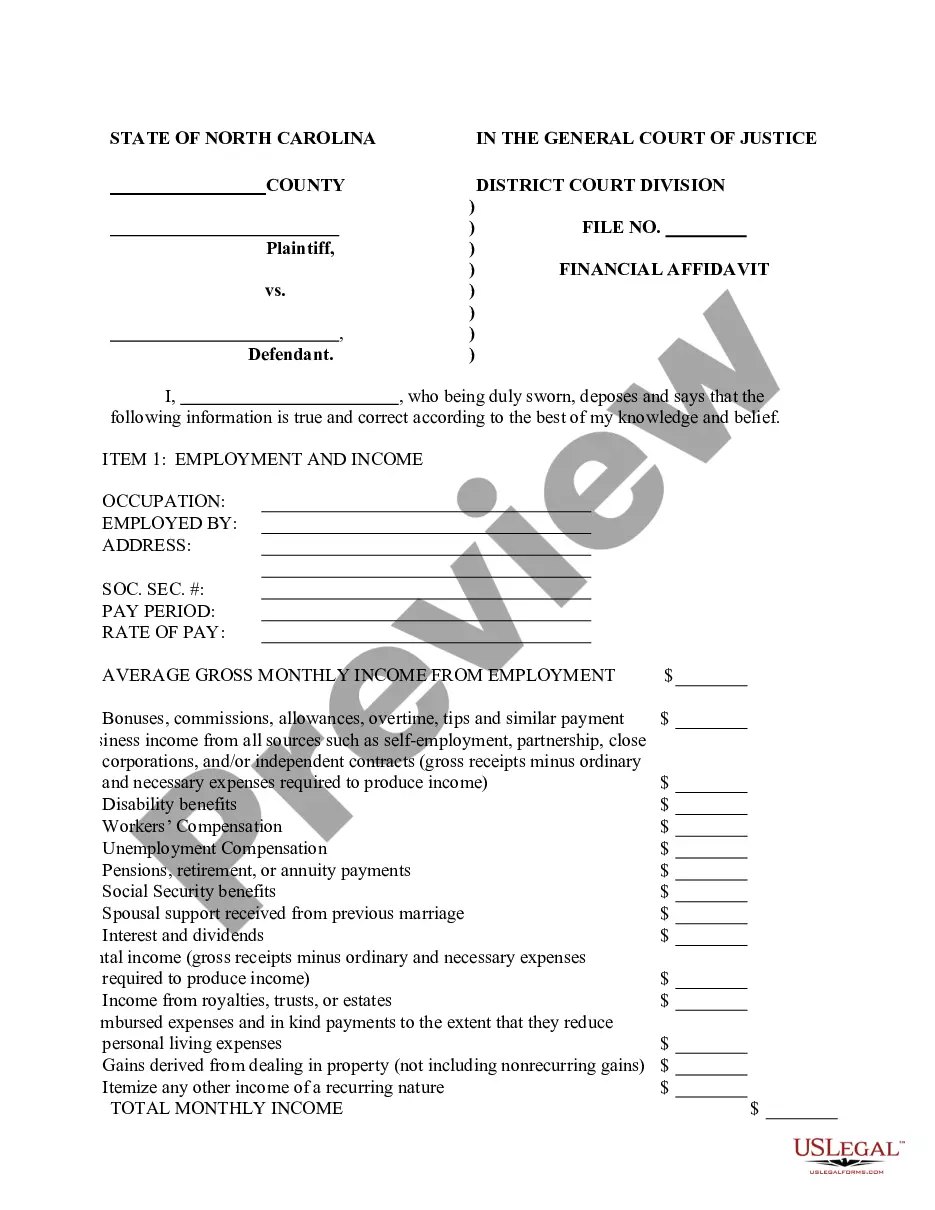

North Carolina Intestate Heirs Affidavit and Indemnity Agreement is a document used by individuals to provide evidence of their warship when an individual dies without a will. This document serves as a legal agreement between the deceased's heirs and the estate that outlines the rights and responsibilities of both parties when the estate is distributed. The agreement also protects the estate from any potential legal action by the heirs. There are three types of North Carolina Intestate Heirs Affidavit and Indemnity Agreement: Heirs Affidavit, Heirs Indemnity Agreement, and Heirs Affidavit and Indemnity Agreement. The Heirs Affidavit is used to provide evidence of warship when an individual dies without a will. The Heirs Indemnity Agreement is an agreement between the heirs and the estate that outlines the rights and responsibilities of both parties when the estate is distributed. Lastly, the Heirs Affidavit and Indemnity Agreement combines the two documents and serves as a legal agreement between the deceased's heirs and the estate.

North Carolina Intestate Heirs Affidavit and Indemnity Agreement

Description

How to fill out North Carolina Intestate Heirs Affidavit And Indemnity Agreement?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to complete North Carolina Intestate Heirs Affidavit and Indemnity Agreement, our service is the best place to download it.

Obtaining your North Carolina Intestate Heirs Affidavit and Indemnity Agreement from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the proper template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance check. You should carefully review the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your North Carolina Intestate Heirs Affidavit and Indemnity Agreement and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

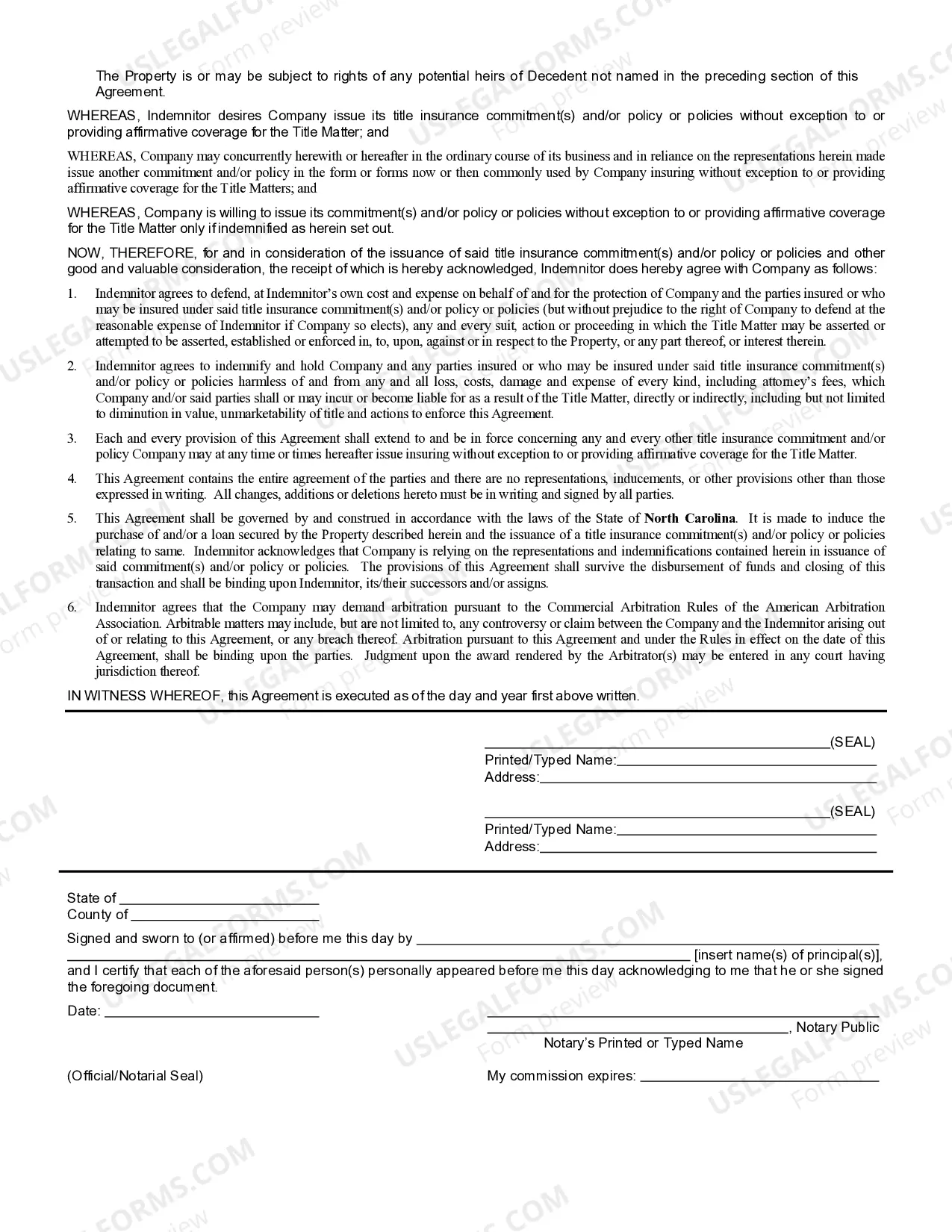

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Indemnity is defined by statute in California as ?a contract by which one engages to save another from a legal consequence of the conduct of one of the parties, or of some other person.?1 In other words, one party (known as the indemnitor) agrees to be responsible for certain liabilities of another party (known as

An affidavit and indemnity agreement is a legal contract that is created when someone, such as an individual or business owner, needs to use another person's documents for their own purposes.

A Collection by Affidavit is available for a small estate whether the decedent dies intestate (without a will) or testate (with a will). The affiant, or person who makes the affidavit, can be the public administrator or the decedent's heir, creditor, executor, or devisee.

Indemnity agreements, also known as indemnity clauses, play an integral role in contracts. That's because they are designed to punish the nonperforming party and reassure the damaged one they will be reimbursed for losses caused by the errant entity.

The best example of indemnity would be insurance indemnification. Let's say the commercial property owner has consistently paid insurance premiums for the property. The money is paid to an insurance company that promises to take full responsibility for repaying any losses if any loss or damages ever occurs.

Confidentiality agreements: an indemnity for breach of contract in a confidentiality agreement should be resisted as it will potentially increase the liability of the party who's receiving confidential information, allowing the disclosing party to recover for all liabilities, costs, claims and expenses incurred in

Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.