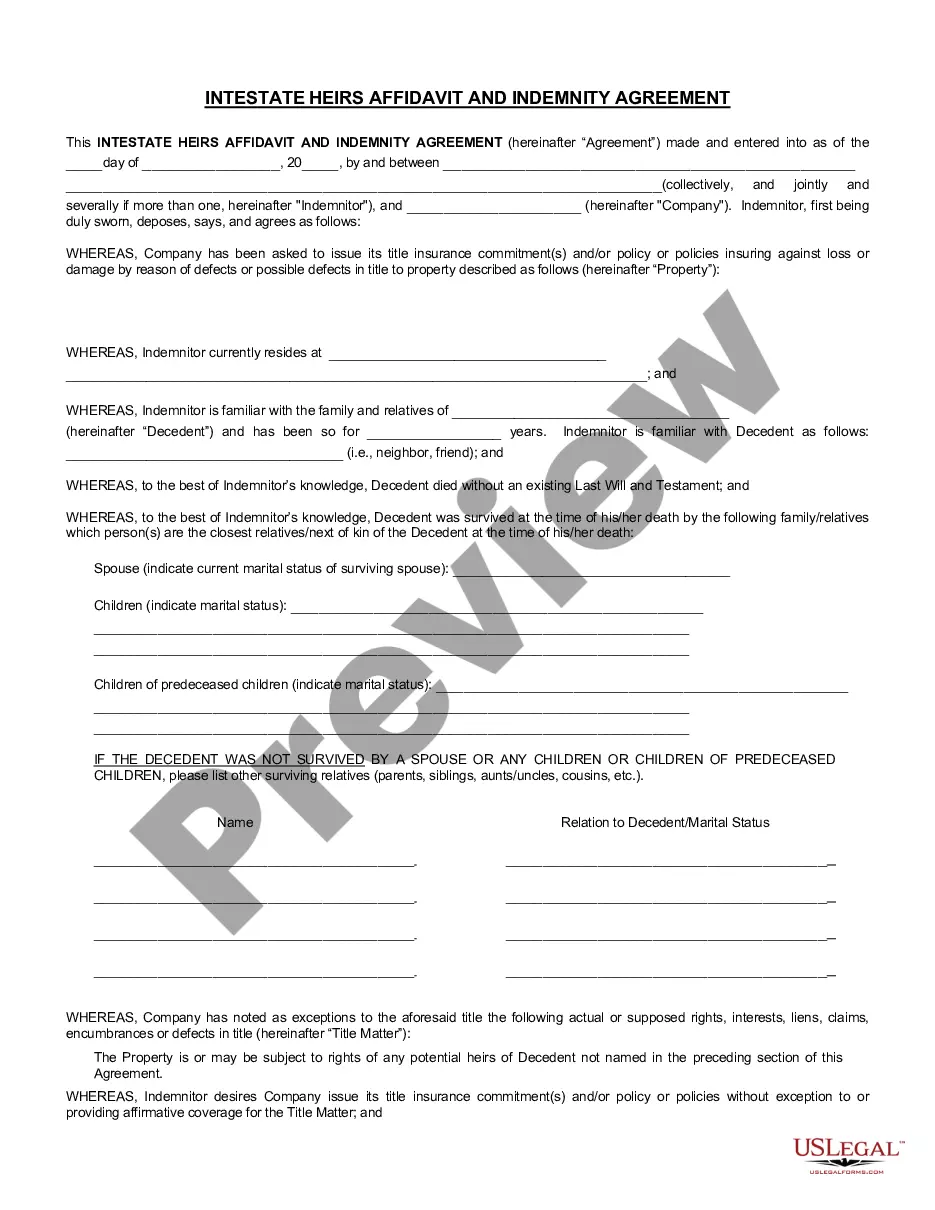

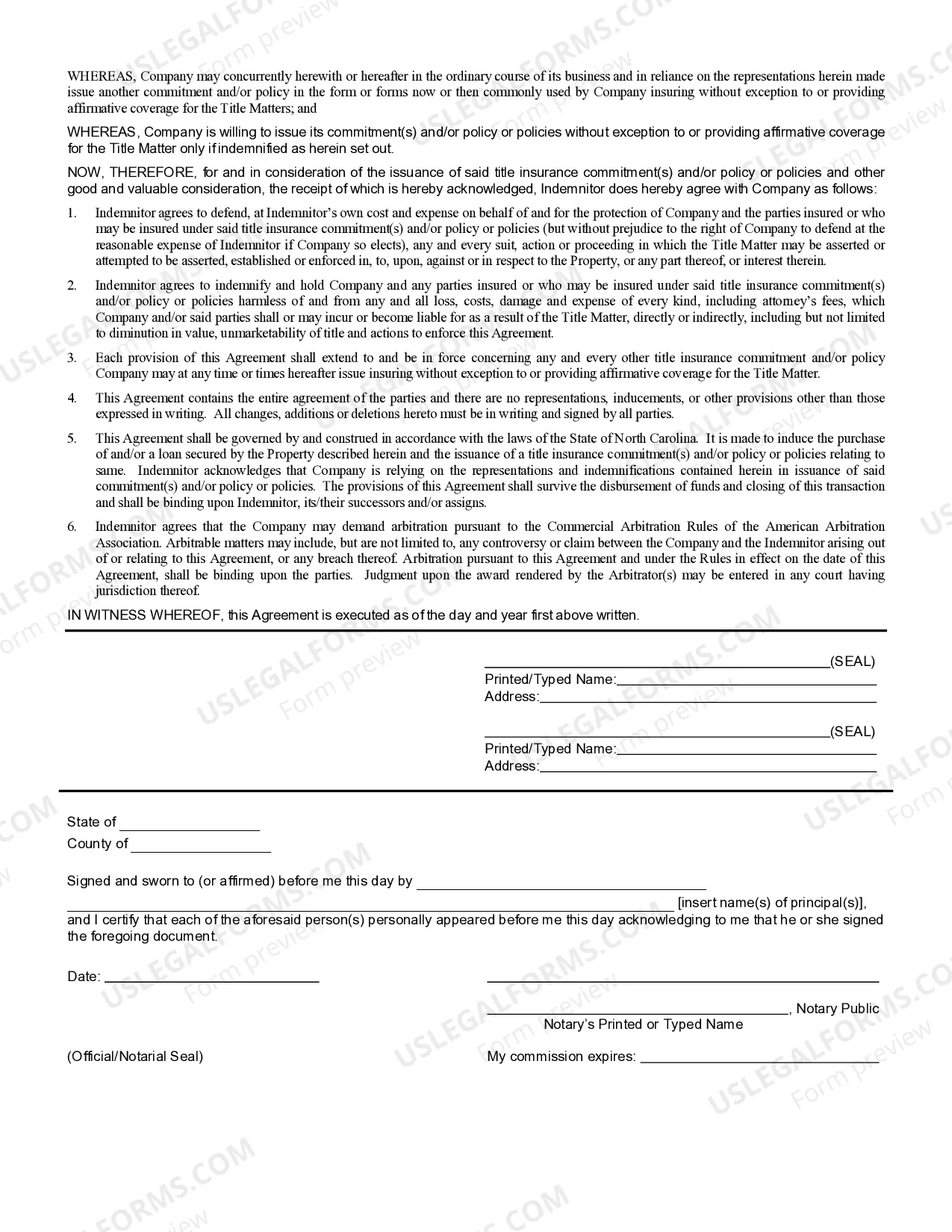

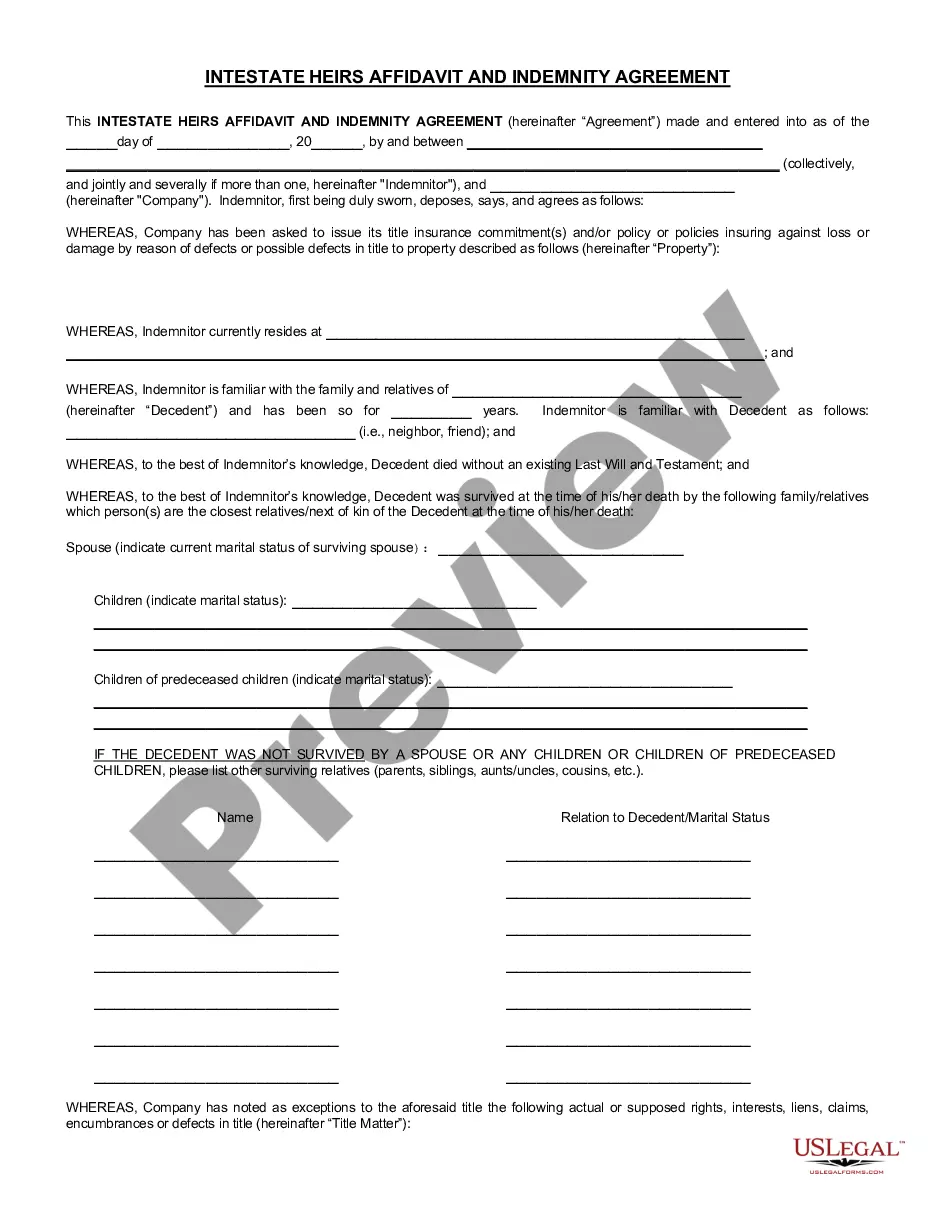

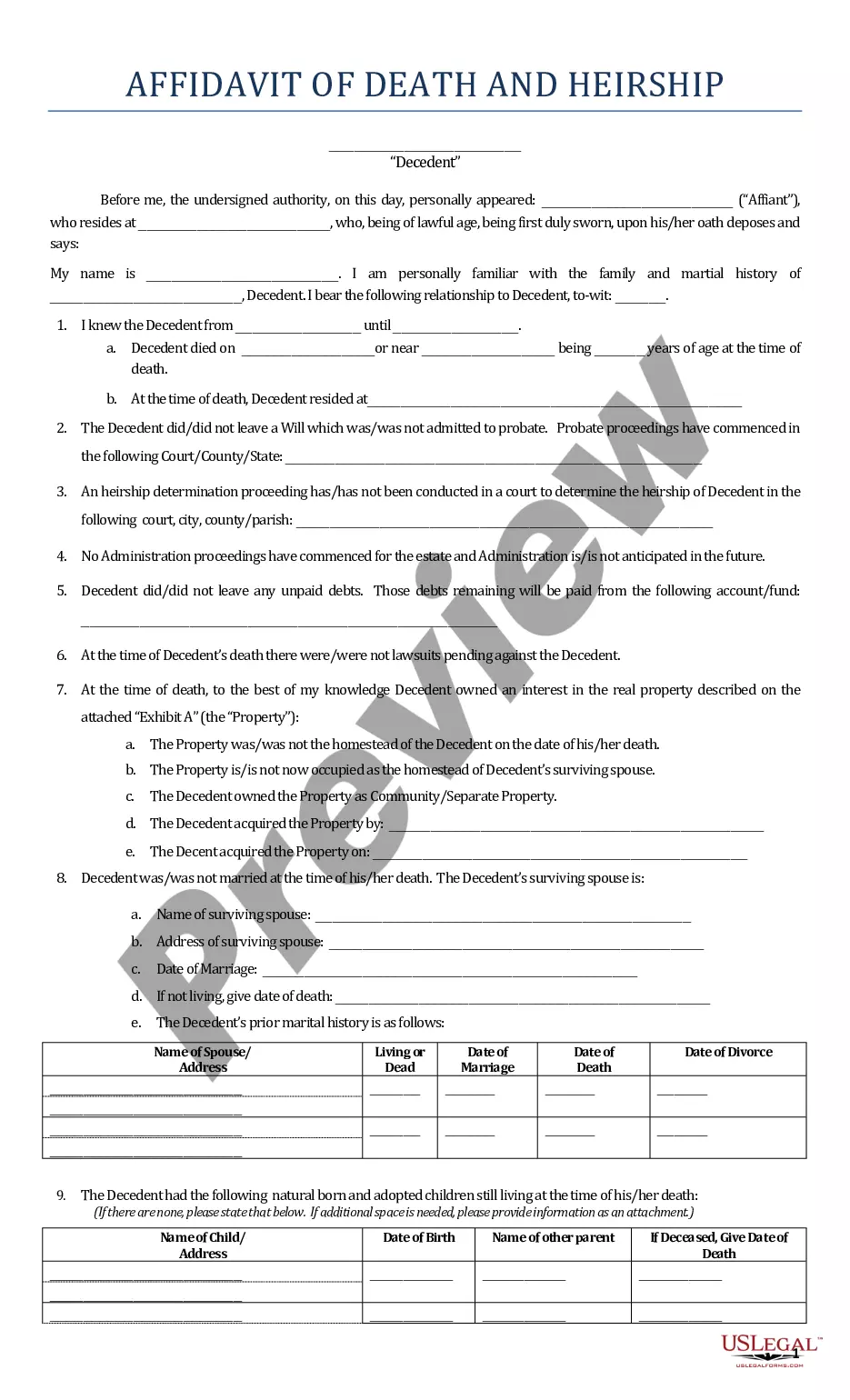

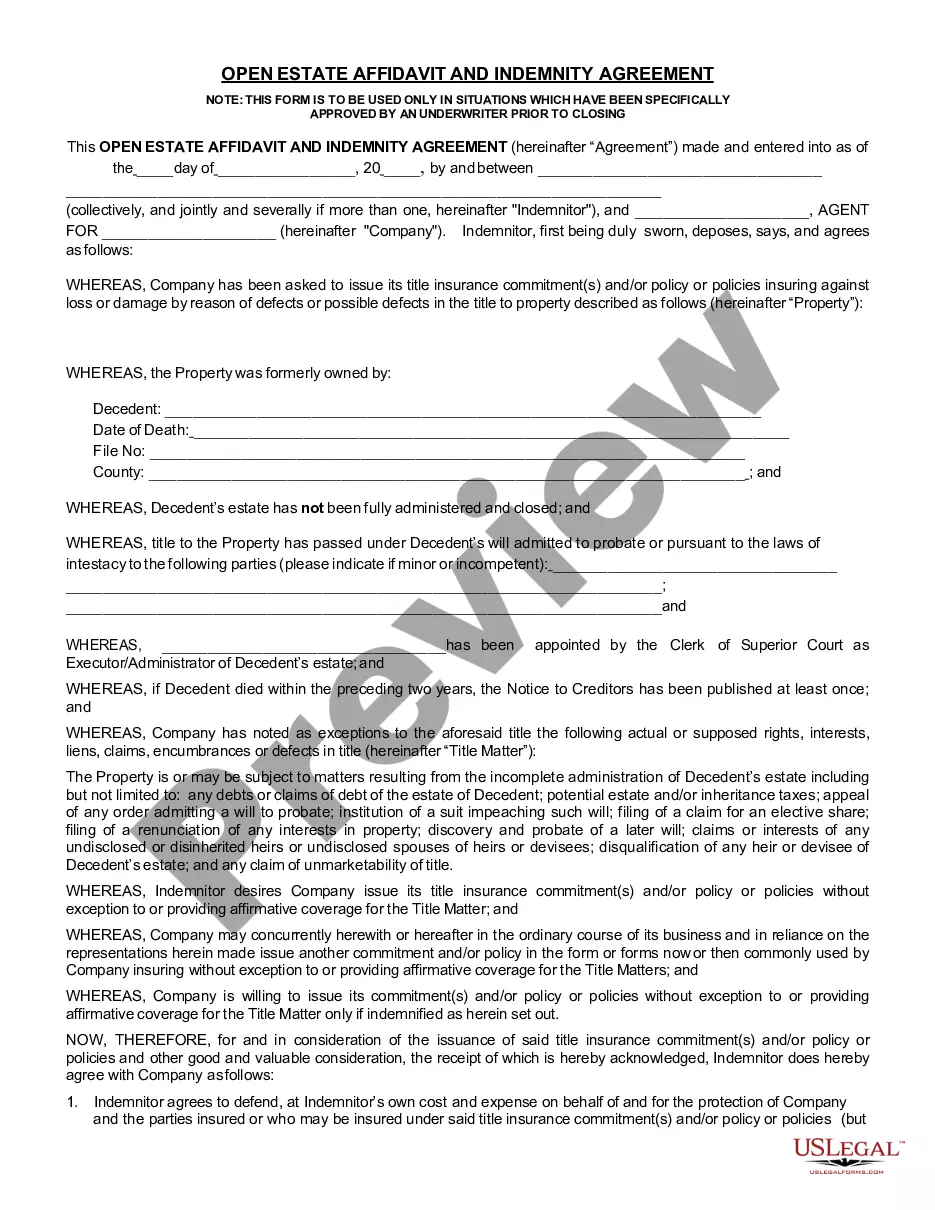

The North Carolina Intestate Heirs Affidavit and Indemnity Agreement is a legal document used in the state of North Carolina to document the transfer of property rights of a deceased person (decedent) to the decedent's heirs. This document is typically used when the decedent has died without leaving a valid will, and the heirs must prove their legal right to inheritance. The North Carolina Intestate Heirs Affidavit and Indemnity Agreement outlines the details of the heirs' legal right to the decedent's property, and includes a signed indemnity agreement from the heirs to the estate. The North Carolina Intestate Heirs Affidavit and Indemnity Agreement comes in two forms: 1. The North Carolina Intestate Heir Affidavit: This document is used to identify the decedent's heirs and demonstrate their legal rights to the estate. It includes a signed statement by the heirs affirming their legal right to the estate, and is typically filed with the court. 2. The North Carolina Intestate Heirs Indemnity Agreement: This document serves as a contract between the heirs and the estate. It outlines the terms of the agreement and includes a signed indemnity agreement from the heirs to the estate. This agreement allows the heirs to take possession of the decedent's property without any legal liability.

North Carolina Intestate Heirs Affidavit and Indemnity Agreement

Description

Key Concepts & Definitions

Intestate:This term refers to the condition of the estate of a person who dies without a valid will, meaning the distribution of their assets will be handled by the states probate laws. Heirs:Individuals legally entitled to inherit a deceased person's assets under state law. Affidavit:A written statement made under oath. Indemnity Agreement:A contract where one party agrees to protect another from certain loss or damage.

Step-by-Step Guide on How to Use Intestate Heirs Affidavit and Indemnity Agreement

- Identify the Heirs:Determine who qualifies as an heir under state law, typically close family members.

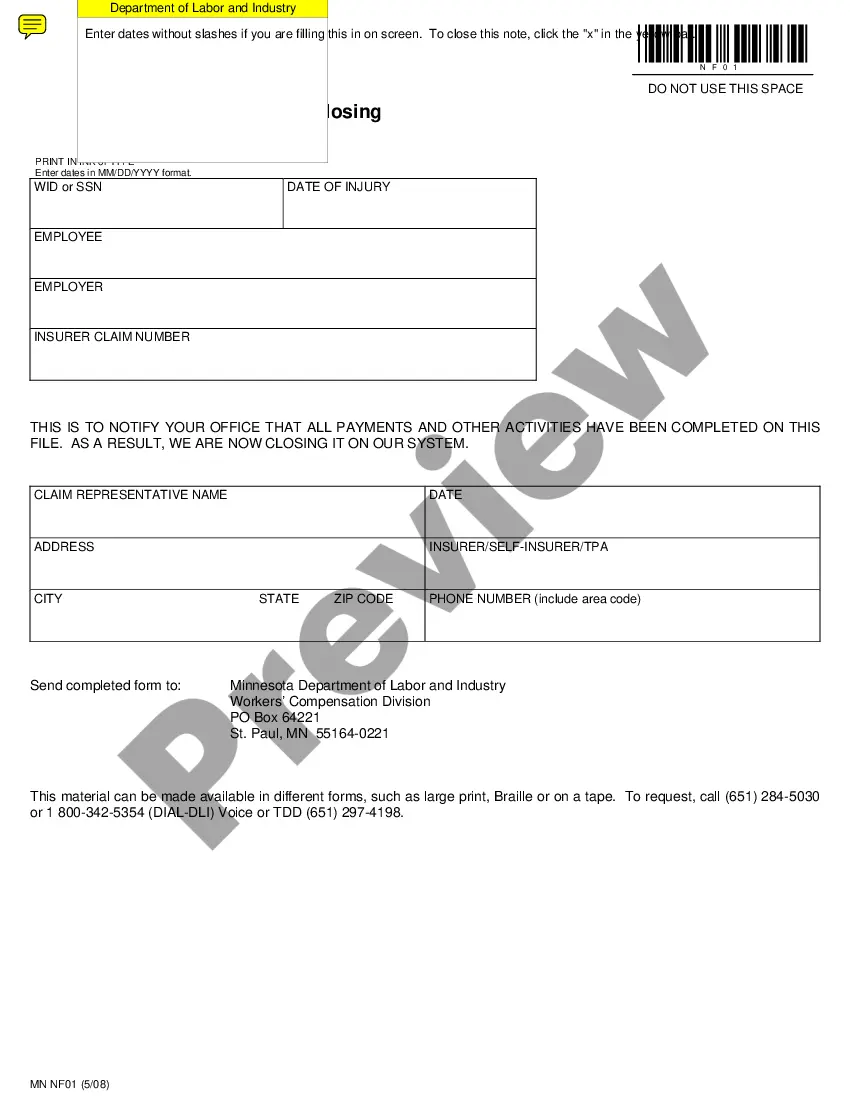

- Obtain an Affidavit:Heirs need to complete an intestate heirs affidavit, attesting to their relationship to the deceased and their rights to the estate.

- Prepare an Indemnity Agreement:Required if there is potential contention or claims arising from other parties. This agreement ensures that the party handling the estate is protected against possible lawsuits by the heirs.

- File the Documents:Submit the completed affidavit and indemnity agreement to the relevant state or local agency overseeing estate settlements.

- Disburse Assets:Once approved, assets can be distributed according to the affidavits and agreements.

Risk Analysis

Using an Intestate Heirs Affidavit and Indemnity Agreement involves certain risks such as:

- Potential disputes among family members about heirship rights.

- Legal challenges from omitted parties.

- Financial responsibility if the indemnity agreement is not comprehensive.

FAQ

- What happens if someone dies without a will?The estate is settled according to the intestacy laws of the state where the deceased resided.

- Who qualifies as an intestate heir?This typically includes the spouse, children, and potentially other close relatives depending on the state laws.

- Is an attorney necessary for preparing these documents?While not mandatory, it's highly advisable to consult an attorney to navigate the complexities of probate law and draft accurate legal documents.

How to fill out North Carolina Intestate Heirs Affidavit And Indemnity Agreement?

If you’re looking for a way to appropriately complete the North Carolina Intestate Heirs Affidavit and Indemnity Agreement without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple guidelines on how to get the ready-to-use North Carolina Intestate Heirs Affidavit and Indemnity Agreement:

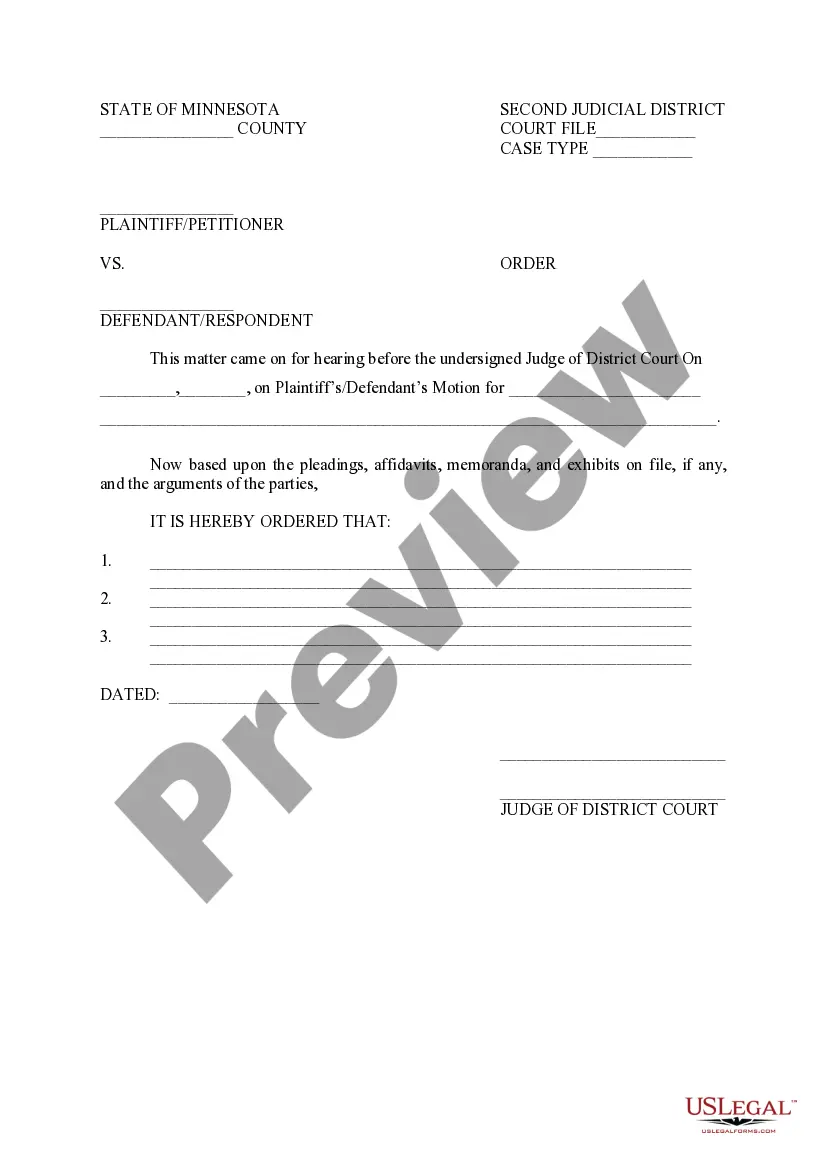

- Make sure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your North Carolina Intestate Heirs Affidavit and Indemnity Agreement and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

If you die without a surviving spouse, your assets will generally pass to your children. If you have no children, your parents will receive the estate. This pattern continues through siblings, grandparents, aunts and uncles, and their descendants.

If the decedent has none of these relatives, assets generally are distributed to family members in the following order of priority: 1) parents; 2) siblings and the children, grandchildren, etc., of deceased siblings; 3) grandparents; 4) aunts and uncles and, if deceased, their descendants.

North Carolina's Intestate Succession Laws If the decedent had two children, the surviving spouse will only receive a one-third interest in the real property. If you die without a surviving spouse, your assets will generally pass to your children. If you have no children, your parents will receive the estate.

If you die without a will in North Carolina, your assets and estate will be handled by North Carolina probate law administrators. This is commonly referred to as ?dying intestate.? North Carolina intestacy laws help ensure your final wishes are carried out upon your death.

All the estate of a person who was born out of wedlock and dies intestate shall descend and be distributed, subject to the payment of costs of administration and other lawful claims against the estate, and subject to the payment of State inheritance or estate taxes, as provided in this Article.

Do All Estates Have to Go Through Probate in North Carolina? Smaller estates with probate-qualified assets valued at less than $20,000 can avoid the formal probate proceeding. If the surviving spouse inherits the whole estate, however, the estate's value can't exceed $30,000 if probate is to be avoided.

If you die with two or more children, or descendants of those children, your spouse will inherit a third of intestate real estate and the first $100,000 of personal property. If there is more than $100,000 worth of personal property, your spouse then inherits a third of the remaining personal property.

Unlike South Carolina and many other states, real property in North Carolina does not typically pass through probate. When a decedent dies intestate (without a Will), title to the decedent's non-survivorship real property is vested in his or heir heirs as of the time of death G.S. 28A-15-2(b).