North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Overview of this form

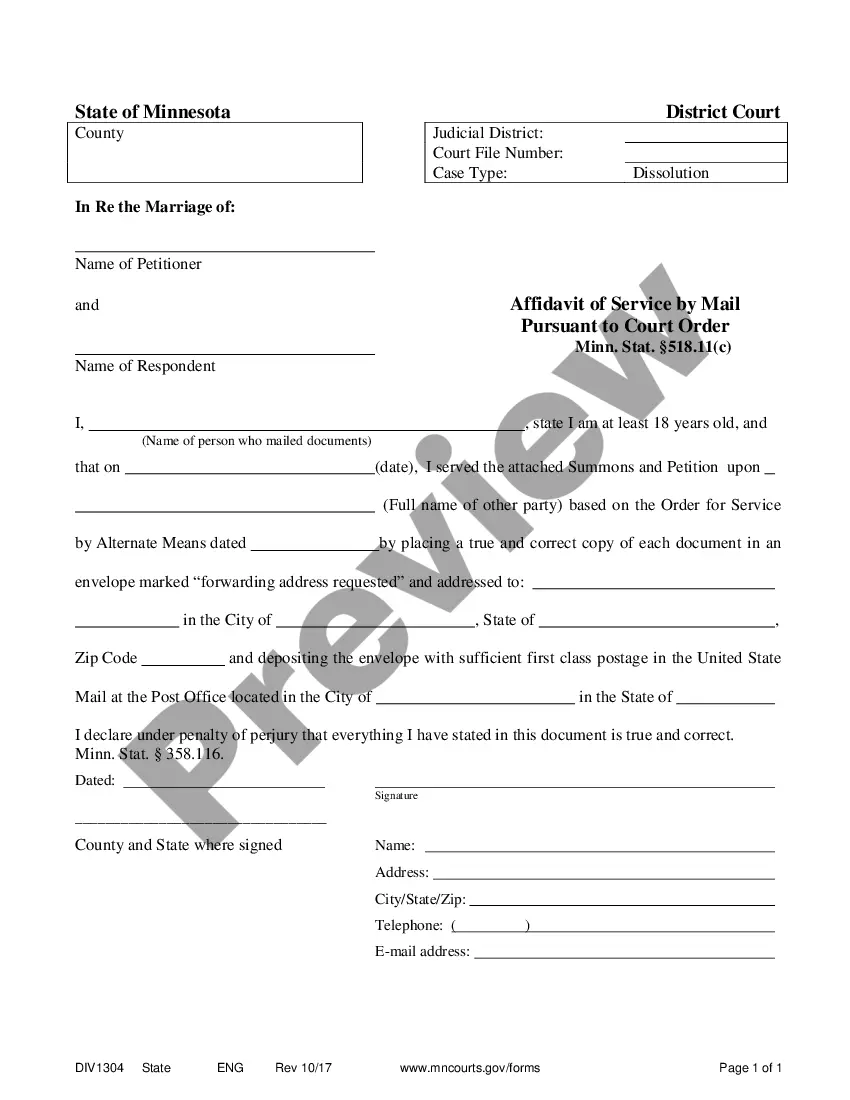

The North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines a borrowerâs obligation to repay a loan secured by real estate property. This form serves as a written promise to pay a specified sum of money to the lender, detailing the terms of the repayment including interest rates and payment schedules. Unlike unsecured notes, this form is secured by the borrower's property, providing additional protection for the lender in the event of default.

Form components explained

- Borrowerâs promise to pay: This section outlines the borrower's commitment to repay the principal and interest of the loan.

- Interest rate: Specifies the yearly interest rate applied to the outstanding principal amount.

- Payment schedule: Details the frequency and amount of payments due, along with the maturity date for final payment.

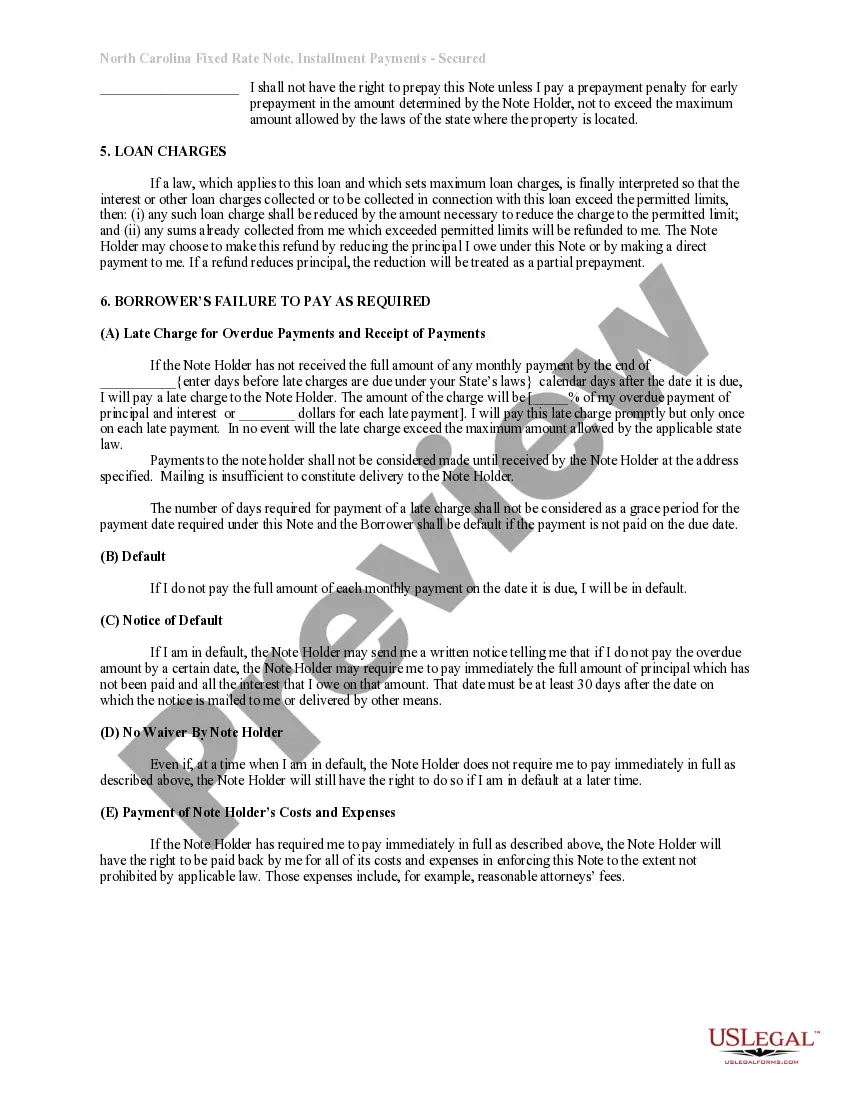

- Prepayment rights: Outlines the borrower's ability to make principal payments before they are due, along with any penalties that may apply.

- Late payment terms: Details what constitutes a default and the penalties or charges incurred for late payments.

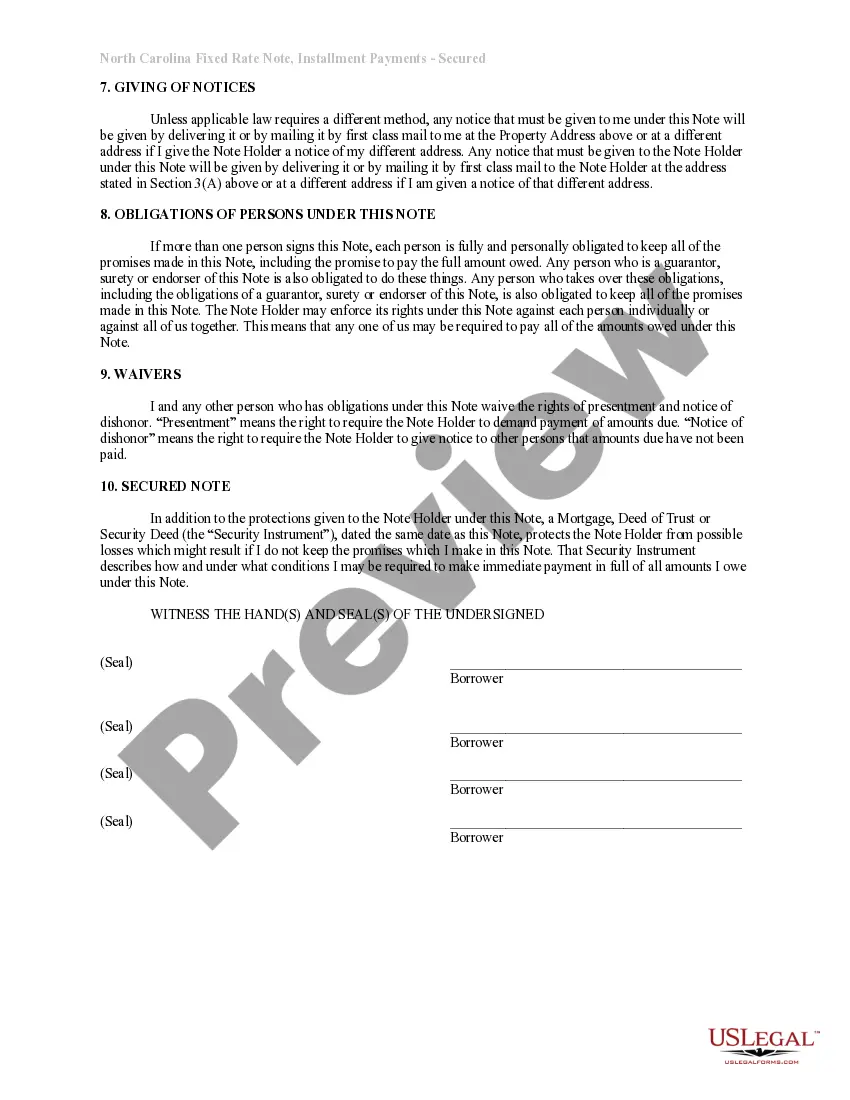

- Secured loan conditions: Clarifies how the promissory note is secured by a mortgage or deed of trust on the property.

Common use cases

This form should be used when an individual or entity is borrowing money and wishes to secure the loan with residential real estate. It is particularly useful in situations where the borrower needs to finance home renovations, purchase a home, or consolidate debt, providing security to the lender in case of non-repayment.

Who this form is for

This form is intended for:

- Borrowers seeking to obtain loans secured by residential property.

- Lenders who require a legally binding promise to ensure repayment of the loan.

- Individuals or entities involved in real estate transactions requiring formal loan documentation.

Steps to complete this form

- Identify the parties involved by entering the names of the borrower(s) and lender.

- Specify the amount of the loan (principal) and the annual interest rate.

- Fill in the payment schedule, including the start date and the amount of each monthly payment.

- Describe the property being used as collateral in the provided section.

- Sign and date the form where indicated, ensuring all parties acknowledge their obligations.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include accurate property details, which can affect the security interest.

- Not specifying the correct interest rate or payment schedule, leading to confusion and potential disputes.

- Overlooking the need for all borrower signatures, which can invalidate the note.

- Missing notation regarding prepayment rights or penalties which could lead to misunderstandings.

Benefits of using this form online

- Convenience of completing the form at any time from any location.

- Editability allows you to customize terms before finalizing.

- Access to professionally drafted templates ensures legal compliance.

- Quick download for immediate use, saving time compared to traditional methods.

Legal use & context

- This form is legally binding when properly completed and signed by all parties.

- Enforcement of the terms relies on compliance with North Carolina laws regarding promissory notes and secured interests.

- Failure to uphold the terms can lead to default and legal actions to recover the loan amount.

Main things to remember

- This promissory note is essential for securing a loan with residential real estate.

- Clear terms regarding payments, interest, and obligations protect both parties.

- Ensure all details are accurate and comprehensive to avoid future disputes.

Looking for another form?

Form popularity

FAQ

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.